Saturday Mar 07, 2026

Saturday Mar 07, 2026

Monday, 15 June 2015 00:00 - - {{hitsCtrl.values.hits}}

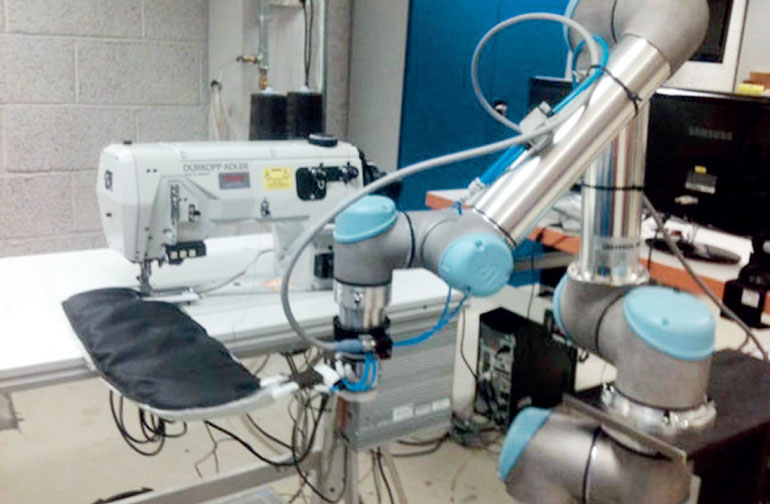

As referred to in ‘The Economist’ recently a robotic sewing machine could throw garment workers in low cost countries out of a job. While many manufacturing processes have been automated, stitching together garments remains a job for millions of people around the world. As nations develop and wages rise, the trade moves on to the next cheapest location: from China, to Bangladesh and, now that it is opening up, Myanmar.

There have been many attempts to automate sewing. The particularly tricky bit is stitching two pieces of material together. The distortion of the fabric is no longer an issue. That is what prevented automatic sewing in the past says Steve Dickerson, the founder of Soft-Wear Automation. The company is developing machines which tackle the problem of automated sewing in a number of ways. They use cameras linked to a computer to track the stitching. Dr. Dickerson patented the idea in 2013 and won a $ 1.3 million research contract from DARPA, a US Department of Defence Research and Development Agency.

The company has developed a materials handling system which it calls LOWRY. Although the first LOWRY will be delivered to an American factory later this year, commercial versions of the firm’s robotic sewing machines capable of automating the more difficult tasks in making garments will not be ready until next year. Frank Henderson, the boss of Henderson Sewing, an Alabama based textile equipment firm and an investor in Soft-Wear Automation, reckons that robotic sewing will be attractive to American fashion brands wanting to bring production closer to home and produce garments rapidly to catch new trends.

Inditex a fast fashion Spanish company, whose brands include Zara, famously does this by making many of its garments manually in Europe to speed up its time to market. But it is not only the production of garments which could be increasingly automated. Nike is now using a technology called Flyknit to make some of its trainers. Shoemakers are already using 3D printers, which build up material additively to make prototypes of shoes. Exotic clothing and shoes made with 3D printers are becoming regulars on the catwalks at many of the world’s leading fashion shows, although the materials they are printed from tend to be various sorts of plastic which can make the garments somewhat clunky and shoes a bit clog like.

However, researchers are working on ways to print more flexible materials. One such project involves a collaboration between Disney, Cornell University and Carnegie Mellon University. Their 3D printer uses layers of off the shelf fabric to make soft objects, such as cuddly toys. All these developments are a serious threat to shipping and logistics out of Asia, which relies on production being outsourced for manufacturing in Asia.

Limits in new container vessel sizes

In its new mega-ship order for eleven 19,630 TEU ships announced, Maersk Line took a conservative road, achieving a 7% capacity increase in ships of almost identical hull dimensions to its Triple-E class. In the process, it is showing how carriers are not automatically opting to build ever-larger ships to push the boundaries of economies of scale. The announcement came on the same day that a Korean shipbuilder, Hyundai Heavy Industries, received classification society approval for an innovation that slightly  increases the cargo capacity of large container vessels, a similar message that incremental capacity is achievable without increasing overall ship sizes.

increases the cargo capacity of large container vessels, a similar message that incremental capacity is achievable without increasing overall ship sizes.

The squeezing out of further efficiencies in a similar design to its 18,270 TEU Triple-E class vessels, a likely result of increasing the deck stowage and enhancing hold and hatch arrangements, shows how the world’s largest container line is achieving greater economies of scale to further distance itself from competitors. The design for the eleven 19,630 TEU vessels ordered from South Korea’s Daewoo Shipbuilding and Marine Engineering will also allow Maersk to better reposition empty containers when weighed down by Asia exports headed to Europe, said Robert Willmington, an Analyst at IHS Maritime and Trade.

Maersk’s call for very high specifications comes with a higher bill, though, he said. Each new vessel will cost about $ 163 million, a roughly 4% higher price tag than the six 20,000 TEU vessels OOCL ordered from Samsung Heavy Industries in March, Willmington said. The Hyundai Heavy Industries design, approved by the classification society DNV GL calls for bridge and upper three decks of a ‘twin island’ design container to be constructed as a separate sliding block, mounted on rails and a resizing and relocation of fuel tanks and the utilisation of the void spaces beneath the accommodation block in a traditional design, which allows the addition of two extra 20 foot container bays.

Asia-Europe rates tumble to $ 342

The spot rate for shipping a 20 foot container from Shanghai to North Europe fell 23% to $ 342 in the week ending 29 May and is down 23% since the week prior, according to the Shanghai Containerised Freight Index. Spot rates on the lane haven’t been above $ 1,000 per TEU since mid February and rates are down by $ 633 compared to the first week in February. Equally troubling for the carriers is that the low rates, along with a failed GRI in May, bode poorly for the 1 June GRI sticking.

On Monday, CMA CGM, Hyundai Merchant Marine and OOCL levied a $ 1,000 per TEU GRI, with OOCL, implementing a $ 2,000 per FEU at the same time. Maersk Line raised its rates by $ 800 per TEU from 1 June and on 5 June, Hamburg Sud will charge $ 900 more per TEU and $ 1,800 extra per FEU. It will be highly unlikely that these rate hikes will hold.

G6 curtail sailings on Asia-Europe trade

In the latest sign of the challenge facing Asia-Europe carriers to generate profits in the busiest global shipping lane, the G6 Alliance said it would cancel two sailings, citing low demand. Yet cancelling individual sailings will likely do little to quell analysts’ view that significantly more capacity, such as entire services, would need to be suspended in order to meaningfully impact supply and demand in the Asia-Europe market.

The cancellation of the two sailings connecting Asia to North Europe further highlights how overcapacity and weak demand is pulling spot rates to record lows and dashing hopes carriers had of implementing aggressive general rate increases that took effect. Volume from the Far East to Northern Europe fell 15% in March compared to April, according to Container Trade Statistics. The cancellation of the sailings also strengthens maritime analyst Drewry’s argument that the alliances’ weaker port coverage and transit times and smaller vessels than those of rival alliances’ 2M and Ocean Three are squeezing their ability to cut slot costs.

The G6 alliance is made up of Hapag-Lloyd, NYK, OOCL, APL, Hyundai Merchant Marine and MOL, while Maersk Line and Mediterranean Shipping Co., form the 2M and the O3 consists of CMA CGM, United Arab Shipping Co., and China Container Shipping Line. The sailing utilising APL Raffles and connecting Qingdao, Shanghai, Hong Kong, Yantian, Singapore, Port Said and Rotterdam, will make its last call at Qingdao on 8 June, according to an OOCL customer notice issued. The sailing utilising APL Qingdao will make its last call at Kaohsiung on 19 June.

The sailing calls at Kaohsiung, Xiamen, Shekou, Hong Kong, Singapore, Colombo Southampton, Antwerp, Hamburg, Rotterdam, Jebel Ali, Singapore, Shekou and Xiamen before returning to Kaohsiung.

Direct rail for deep-sea Krishnapatnam port

Privately operated Krishnapatnam Port Container Terminal, riding high on significant traffic gains last fiscal year, has received a further boost with state-owned rail operator Container Corporation of India launching a new hinterland link to the East Coast harbour. Concor would begin operating a weekly intermodal service between Krishnapatnam and Bangalore, effective 19 June. The container trains from Bangalore would depart every Friday and leave the port every Sunday evening, according to a trade announcement from KPCT.

Bangalore is a key inland destination in the country’s Southern region. The private port operator said the train schedule would be attractive for shippers and freight forwarders as they could make use of the weekends for loading and unloading at the port. The service will reduce transportation time from an average of 24 to 48 hours taken by road to just 18 hours through the rail route. In addition, it will help customers save between $ 100 to $ 150 on each container and also eliminate the chances of pilferage, which has been a major issue for the trade.

Krishnapatnam is about 112 miles North of Chennai. It is an all-weather, deep-water, multi-purpose facility with modern infrastructure, including dedicated rail and highway connectivity. The container terminal there has about 2,150 feet of quay, an 89 acre back-up area, nearly 5,000 ground slots and an annual capacity of 1.2 million 20 foot equivalent units.

(The writer a Maritime Economist is a Chartered Fellow (Logistics Transport), Chartered Shipbroker (UK), Chartered Marketer (UK) and a University of Oxford Business Alumni. He is also a Fellow of NORAD/JICA and Harvard Business School (EEP).)