Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 9 August 2016 00:01 - - {{hitsCtrl.values.hits}}

Compared to when Interbrand first pioneered brand valuation in 1988 business leaders now widely accept the importance and value of strong brands – and the significant role they can play in enhancing business performance.

Interbrand’s globally respected brand valuation methodology brings together market, brand, competitor, and financial data into a single framework within which the performance of the brand can be assessed, areas for improvement identified, and the financial impact of investment in the brand quantified.

Interbrand was also the first company to have its methodology certified as compliant with the requirements of ISO 10668 (requirements for monetary brand valuation) and has played a key role in the development of the standard itself.

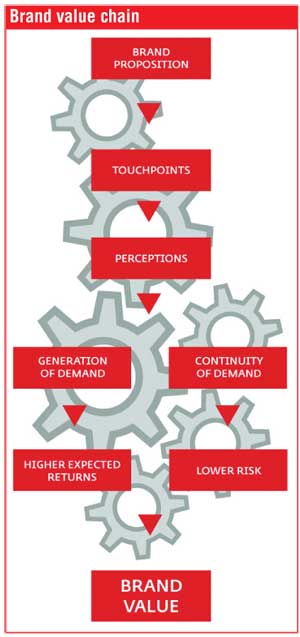

Strong brands enhance business performance primarily through their influence on three key stakeholder groups: (current and prospective) customers, employees, and investors. They influence customer choice and create loyalty; attract, retain, and motivate talent; and lower the cost of financing.

The influence of brands on current and prospective customers is a particularly significant driver of economic value. By expressing their proposition consistently across all touchpoints, brands help shape perceptions and, therefore, purchase behavior, making products and services less substitutable. In this way, brands create demand, allowing their owners to enjoy higher returns. Strong brands also create continuity of demand into the future, thus making expected returns more likely – or less risky. Brands, therefore, create economic value by generating higher returns and growth, and by mitigating risk.

Interbrand’s brand valuation methodology has been specifically designed to take all of these stakeholders and value-creation levers into account. Role of Brand analysis is about understanding purchase behavior: the brand’s influence on the generation of demand through choice. Brand Strength measures the ability of the brand to create continuity of demand into the future through loyalty and, therefore, to reduce risk. In doing this it considers ‘internal’ (management and employee) and ‘external’ (customer) factors. Finally, these inputs are combined with a financial model of the business to measure the brand’s ability to create economic value for its owner.

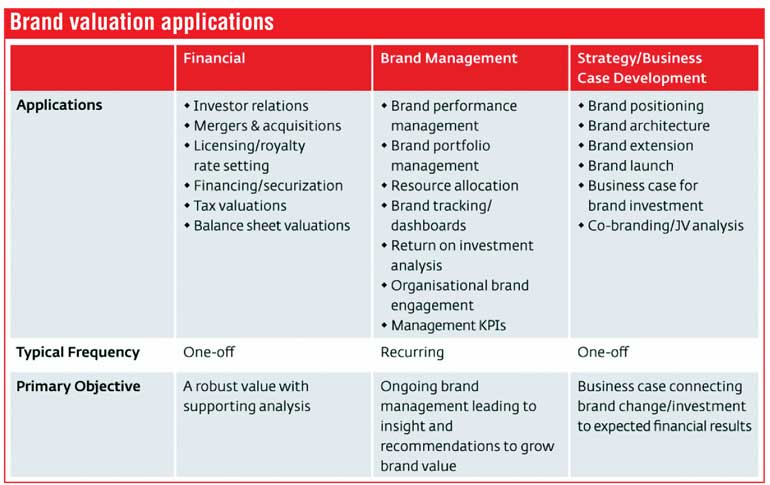

It is quite possible that you believe that your brand could be (or is) a significant source of competitive advantage for your business, but you are unsure of how a brand valuation exercise could help you.

case development

Increasingly, CEOs are placing more emphasis on their companies’ brands in investor communications. Many more annual report column inches are now dedicated to discussing an organisation’s commitment to its brand, from the CEO down. Numerous  companies take their brands seriously enough to report on their value over time to investors.

companies take their brands seriously enough to report on their value over time to investors.

Brand also continues to be a key driver of acquisition premiums in M&A. Often, it is the latent potential of the brand that is driving this premium through its ability to enter new markets and extend into adjacent categories. A broad skill set, combining market research, brand, and business strategy, together with business case modelling, is required to quantify the latent financial potential of the target brand.

Interbrand’s brand valuation methodology can also be used to complement other more traditional techniques for setting royalty rates for brands. By identifying the value created by a brand for its business, combined with an evaluation of the relative bargaining power of the parties involved, we are able to advise on the proportion of brand value that should be paid out as a royalty rate in return for the right to exploit the brand.

Ultimately, everything we do as brand managers should be considered through a value creation lens. Considerable investments are made in brands and, ultimately, it is important to determine if these actions are creating value for your customers and, in turn, your shareholders. Interbrand’s brand valuation methodology seeks to determine, in both customer and financial terms, the contribution of the brand to business results.

A strategic tool for ongoing brand management, it brings together market, brand, competitor, and financial data into a single, value-based framework within which the performance of the brand can be assessed, areas for improvement identified, and the financial impact of investing in the brand quantified. It also provides a common language around which a company can be galvanised and organised.

Role of Brand analysis lets us know where investment in (and focus on) brand improvements will have the biggest impact. It can be thought of as a measure of ‘brand leverage’.

Brand Strength is the key diagnostic tool with which we can measure brand performance and better understand the reasons behind a brand’s strengths and weaknesses, both internally and externally. It supports strategic brand management by prioritising areas of highest impact for managers.

Finally, when the Role of Brand and Brand Strength analyses are connected to the financial model, they provide a framework for resource allocation and prioritisation based on the opportunities to enhance brand performance that are expected to have the greatest impact on brand and business value.

From time to time, businesses need to evaluate significant changes in brand strategy, whether it be repositioning, brand architecture, brand extension, or even a complete rebrand. These kinds of changes typically involve significant financial outlay upfront, along with a high degree of uncertainty over when, or whether, a positive return will be made on that investment.

Some CEOs are willing to make these critical brand strategy decisions based on qualitative strategic analysis and intuition. The majority, however, are looking for a business case that goes further. They want to understand the likely overall financial impact on the business over time, covering a range of alternative scenarios. In addition to a detailed breakdown of the expected costs to deliver, a rounded business case will also quantify the expected impact on the top line through the modelling of key revenue drivers (these will vary based on the business, but could include customer acquisition, churn, price premiums, share of wallet, frequency of purchase/visit, average basket size, and so on) and on profit margins from any operational changes required to deliver the new strategy. Finally, sophisticated techniques such as Monte Carlo simulation may be employed, running thousands of possible permutations in order to estimate the most likely outcome.

By bringing together market, brand, competitor, and financial data, the brand valuation model is the ideal framework within which such business case modelling can be conducted.

As global competition becomes tougher and many competitive advantages, such as technology, become more short-lived, the brand’s contribution to shareholder value will only increase. Brands are one of the few business assets that can provide long-term competitive advantage.

Companies as diverse as Samsung, Philips, Hyundai, and AXA, among many others, have used brand valuation to help them refocus their businesses on their brands, motivate management, create an economic rationale for branding decisions and investments, and make the business case for change.

Although many brand metrics are available, few can link the brand to long-term financial value creation and this, along with its many other applications, makes brand valuation a versatile strategic tool for your business.

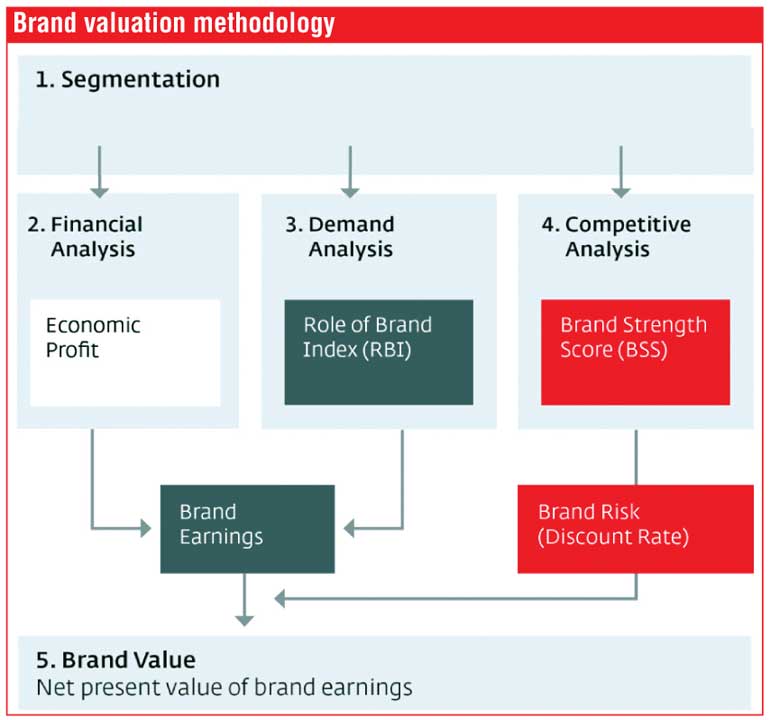

There are three key components in all of our valuations: an analysis of the financial performance of the branded products or services, of the role the brand plays in the purchase decision, and of the competitive strength of the brand. These are preceded by a decision on segmentation and at the end of the process are brought together to enable the financial value of the brand to be calculated.

Segments are typically defined by geography, business unit, product, service or customer group. Why is segmentation important? A robust valuation requires a separate analysis of the individual parts (or segments) of a business to ensure that differences between those segments in terms of the three key components of the brand valuation (financial performance, Role of Brand and Brand Strength) can be taken into consideration. From a brand management perspective, the insights and recommendations that result from the brand valuation exercise will be at the segment level, so it is also important that they are at an actionable level for the client’s brand teams.

This measures the overall financial return to an organisation’s investors, or its ‘economic profit.’ Economic profit is the after-tax operating profit of the brand minus a charge for the capital used to generate the brand’s revenues and margins. A brand can only exist and, therefore, create value, if it has a platform on which to do so. Depending on the brand, this platform may include, for example, manufacturing facilities, distribution channels, and working capital. Interbrand, therefore, allows for a fair return on this capital before determining that the brand itself is creating value for its owner.

We build a set of financial forecasts over five years for the business, starting with revenues and ending with economic profit, which then forms the foundation of the brand valuation model. A terminal value is also created, based on the brand’s expected financial performance beyond the explicit forecast period. The capital charge rate is determined by reference to the company’s weighted average cost of capital.

Role of Brand measures the portion of the purchase decision that is attributable to the brand, relative to other factors (for example, purchase drivers like price, convenience, or product features). The Role of Brand Index (‘RBI’) quantifies this as a percentage. Customers rely more on brands to guide their choice when competing products or services cannot be easily compared or contrasted, and trust is deferred to the brand (e.g. computer chips), or where their needs are emotional, such as making a statement about their personality (e.g. luxury brands). RBI tends to fall within a category-driven range, but there remain significant opportunities for brands to increase their influence on choice within those boundaries, or even extend the category range where the brand can change consumer behaviour.

RBI determinations can be derived in three ways (and are described in order of preference below):

Primary research. Specifically designed research, such as choice modelling (although other techniques are available), where RBI is statistically derived.

Existing research plus Interbrand opinion. Existing research addressing the relative importance of purchase drivers is combined with Interbrand’s opinion on the extent to which the brand influences perception of how the product or service will perform against each driver.

Qualitative assessment. Based on management discussions and past experience. This is used where no market research is available.

RBI findings are cross-checked against historical roles of brand for companies in the same industry. Finally, RBI is multiplied by the economic profit of the branded products or services to determine the earnings attributable to the brand (‘brand earnings’) that contribute to the valuation total.

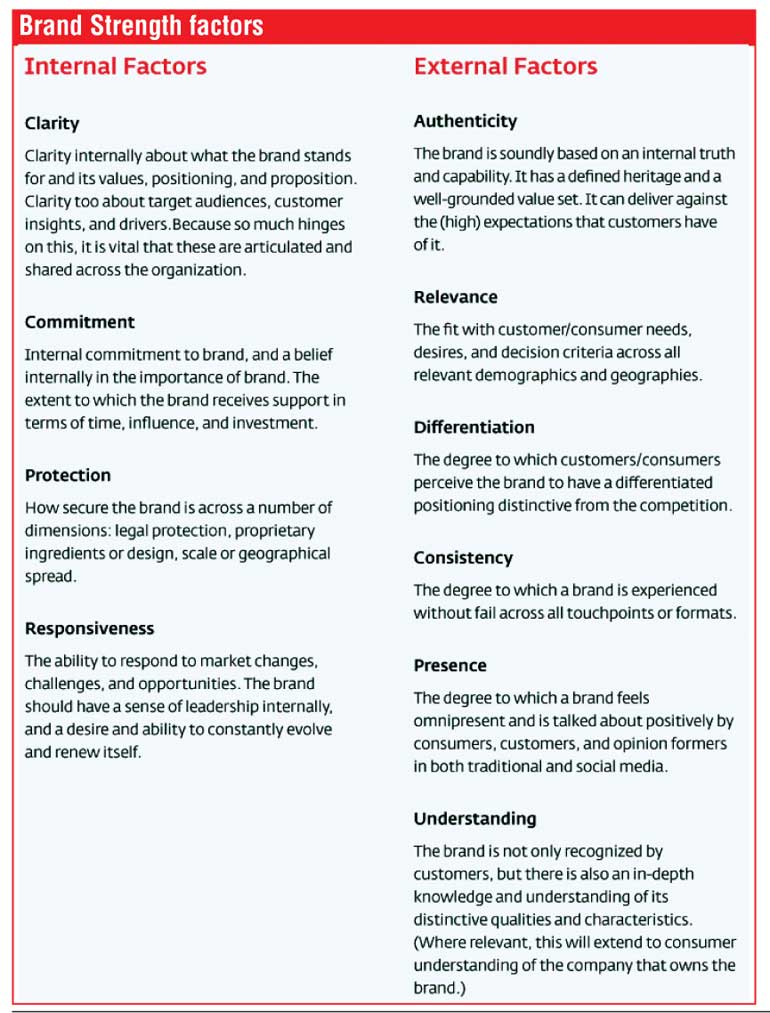

Brand Strength measures the ability of the brand to create loyalty and, therefore, to keep generating demand and profit into the future. Brand Strength is scored on a 0-100 scale, based on an evaluation across ten key factors that Interbrand believes make a strong brand. Performance on these factors is judged relative to other brands in the industry and relative to other world-class brands. The strength of the brand is inversely related to the level of risk associated with the brand’s financial forecasts (a strong brand creates loyal customers and lowers risk, and vice versa). A proprietary formula is used to connect the Brand Strength Score to a brand-specific discount rate. (See below for more information on Interbrand’s ten factors of Brand Strength).

The brand-specific discount rate is used to discount brand earnings back to a present value, reflecting the likelihood that the brand will be able to withstand challenges and deliver the expected earnings into the future. This is equal to brand value.

Our experience shows that brands that are best placed to keep generating demand and profit into the future are those performing strongly (relative to competition) across a set of ten factors, shown below.

Four of these factors are internally driven, and reflect the fact that great brands start from within. The remaining six factors are more visible externally, acknowledging the fact that great brands change their world.