Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 1 July 2016 00:00 - - {{hitsCtrl.values.hits}}

Background

The United Kingdom European Union membership referendum, known within the United Kingdom as the EU referendum was held on 23June to decide whether the UK is going to remain within the European Union (EU) or leave the EU. The proposed British withdrawal from the EU was termed as Brexit (created in combination of the two words “British” and “exit”). A majority (17.4 million of the UK voters / 51.9%) voted in favour of leaving the EU against 16.1 million voters (48.1%) who wanted to remain as a member of the EU.

Six founding member states in Western Europe formed the European Economic Community (EEC) in 1957 via the Treaty of Rome to create economic integration among its members. The United Kingdom joined the EEC in 1973. Soon after joiningthe EEC, a referendum was held in 1975 and a majority of (67%) the UK voters approved the country’s continued membership. The EEC, which was renamed later as the European Community (EC) was absorbed into the EU on its formation in 1993 via the Maastricht Treaty.

The EU has established an internal single market through a standardised system of laws that apply in all member states comprising of an estimated population of 508 million. The right to withdraw from the EU was offered to its member countries in 2007 under Article 50 of the Treaty on the European Union. If a member state has chooses to leave, there is a still two-year period for the orderly exit from the membership of the Union.

Market reaction

The outcome of the referendum surprised markets that were expecting a “Remain” vote, was severe enough to create a mini-storm in the financial markets around the world. The message carried by such anadverse market reaction is the uncertainly it brings to the world economy.

The GBP (British Pound) lost approximately 10% of its value against USD (United States Dollar) on the first trading day while it lost nearly 8% vis-à-vis JPY (Japanese Yen). Main stock indices in the UK (FTSE) also reacted in a similar manner falling by almost 10%. Economists warned the UK might fall into a recession. The Bank of England (BoE) indicated that they are ready to cut its main interest rate from its present level, of 0.5% and may even consider reviving its quantitative-easing programme (buying bonds with created money) to support ailing economy.

Though the UK economy generates only 3.9 % of world output, the repercussion of the Brexit are far reaching. This paper attempts to identify the impact of the Brexit on Sri Lanka.

Assessment by the main political parties in Sri Lanka

The main political parties in the unity Government were of the view that it would be beneficial for Sri Lanka if the UK remained in the EU as it has a strong economy. Both parties participated in educating the Sri Lankan diaspora living in the UK on the implications of Brexit on the Sri Lankan economy and requested them to support for remaining in the EU. Several ministers including the Deputy Minister of Foreign Affairs travelled to London for taking part in the awareness campaign. The motivation for such involvement could be understandable given UK’s importance to Sri Lankan economy as a major trading partner.

Contribution to exports

and tourism

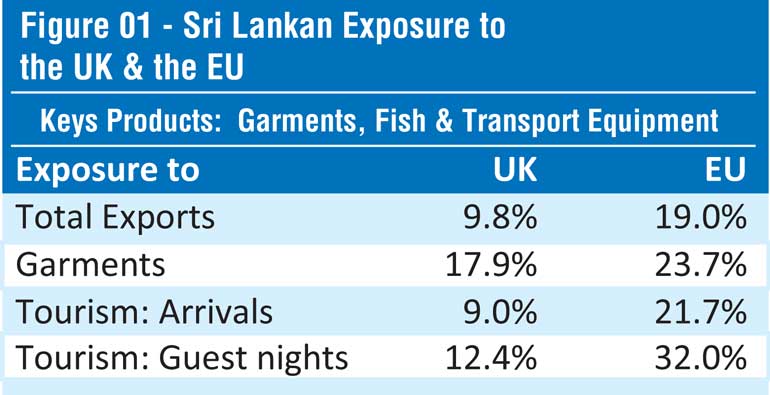

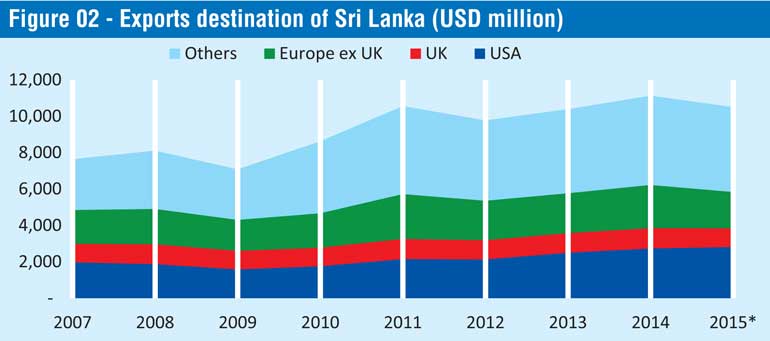

The UK and the EU are important trading partners of the country. Overall, the EU including the UK purchased nearly 29% of our exports in 2015. Due to the prevailing soft economic condition in the Europe, the share of our exports to the EU has declined from 34% in 2011. Sri Lanka had shipped 9.8% of its exports to the UK in 2015 while the European Union ex UK had purchased 19%. As a single block, the EU remains behind only to the United States in terms of merchandising exports.

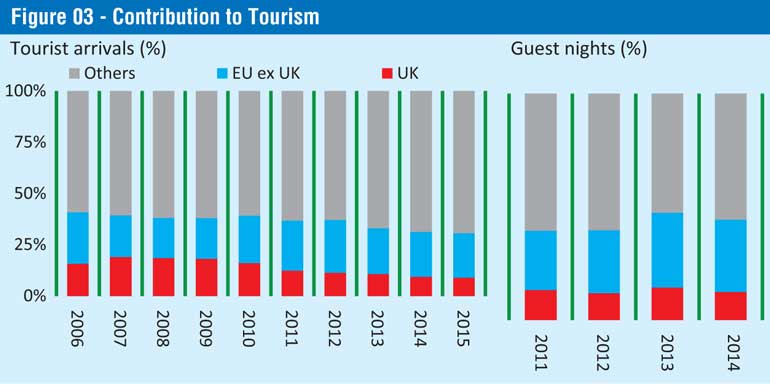

Western Europe and the UK have been traditional markets for inbound tourists to Sri Lanka. Even during the civil conflict period, Sri Lanka received tourists from the above markets. The UK has sent 161,845 travellers to Sri Lanka in 2015 contributing to 9% of total tourist arrivals. Though thenumber of tourist arriving from the UK is less than India and China, the UK is the number one market in term of guest nights, contributing 1.9 million guest nights or 12% of total guest nights in Sri Lanka. In this sense, the UK’s contribution to the tourism industry is very significant. Western Europe including the UK contributes 45% of the total nights in Sri Lanka.

Possible impact in Sri Lanka

It is too early to predict how the European Union and the UK will handle a smooth exit from the Union. Financial markets may have overreacted initially, however, the outlook of both the EU and the UK are negative. If the GBP depreciated substantially, being the largest contributor to the tourism sector (guest nights) in Sri Lanka, it would have a negative effect for thetourism sector. Lower income and the decline in the currency can cause imported goods and foreign travels more expensive for locals. The slowdown may negatively affect the next tourist season. Similarly, the UK may purchase less from Sri Lanka if the economic slowdown could lower purchasing power of the UK citizens.

The UK will not be part of the EU single market and no trade concession, such as GSP plus, will be offered as a part of the EU policy. Sri Lanka is looking to revive the GSP plus concessionary access to EU region. No longer will Sri Lanka be able to claim benefits from the UK in the event of successful renegotiation of the GSP Plus. This will lower the significance of the benefits of regaining GSP Plus access.

However, the indirect impact is difficult to assess. The world economy is integratedthrough a complex web of interrelated economic variables. The impact of Brexit may vary depending on the circumstances and the interaction of those economic variables. Immediate impact is the increased risk aversion. This will result in flight to quality, increasing safe haven assets like gold, USD, and US Treasuries, while pressuring oil and commodities. The likelihood of US rate hikesare lower given the heightened risk of the global economy, however local risk spreads of emerging nations vis-à-vis the US may still widen.

Brexit has taken place when the US is just trying to raise its benchmark rates and rest of the world economy is still struggling. Direct impact of the Brexit on Sri Lankan economy will be negative since both the UK and the EU are large trading partners of the nation.