Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 24 August 2016 00:01 - - {{hitsCtrl.values.hits}}

Financial indicators in the commercial office market are considered as the mirror of the demand and supply situation. Currently, as  the Colombo office market witnesses occupancy levels as high as 95%, occupiers intending to expand are likely to face a scarcity of options as the supply of Grade A office space remains minimal.

the Colombo office market witnesses occupancy levels as high as 95%, occupiers intending to expand are likely to face a scarcity of options as the supply of Grade A office space remains minimal.

Select occupiers had no other option but to consider strategically located Grade B developments to execute expansion plans. Along with the conventional industries, such as the banking and financial services (BFSI) sector and the manufacturing sector that generate office space demand, government agencies have been very active for the past three to four quarters in leasing office space in brand-new office buildings. This trend is expected to continue in the near- to medium-term and should make way for noticeable rent and capital value appreciation in upcoming quarters.

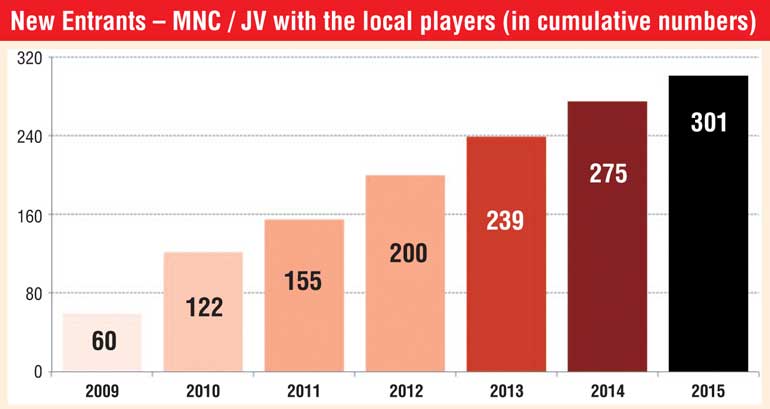

Currently, many multinational companies and address-conscious domestic firms contribute notably to office space demand in Colombo. It is observed that their deciding factors for office space are long and exhaustive. The buildings that meet all the criteria of these occupiers charge higher rents. According to a Jones Lang LaSalle (JLL) survey, Grade A buildings offering a greater number of parking spaces, food courts, professionally managed facilities, legal compliance, transparency in billing and recreation areas are  able to charge premium rents. These premiums help rent appreciation for the respective micro-markets.

able to charge premium rents. These premiums help rent appreciation for the respective micro-markets.

MNC occupiers are generally seen as quality and address-conscious tenants and if they find a space which meets their requirements, they usually do not hesitate to pay a premium for the space.

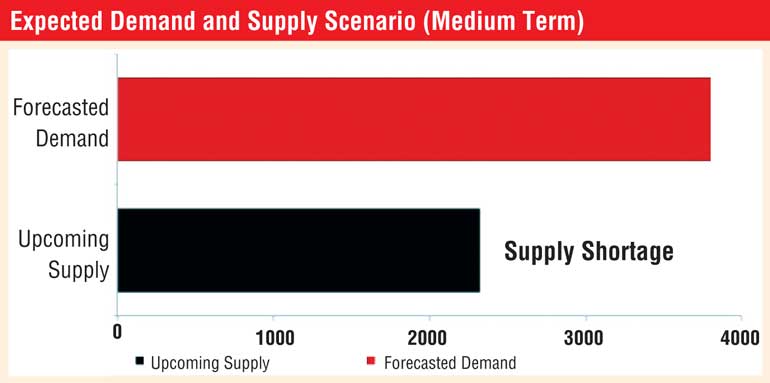

According to JLL Research data, it is forecast that demand will continue to exceed supply. As indicated in the chart, demand for Grade A space in 2016 will be around 3.8 million sq ft, and with the current supply at approximately 2.3 million sq ft, this will leave a shortfall of 1.4 million sq ft.

Lease renewals are expected to be done at notably higher rents. As negotiating power will be with the landlords, quoted values are expected to go up, as will execution values. This will lead to rent appreciation. The rents in three pockets – Colombo 1, Colombo 2 and Colombo 3 – are shown in the table. The y-o-y rent appreciation has been notable.

Currently, the landlords of Grade A buildings are able to increase rents 10-15% biennially and the excellent physical and social infrastructure of the buildings helps produce office environments that are conducive to business.

JLL Research estimates that the pace of capital value appreciation is likely to be higher than rent appreciation in upcoming quarters. The current rent yield stands at 5.0% and this is likely to dip minimally by 10-20 bps in the upcoming quarter. Nevertheless, as capital value appreciation is expected to be in the range of 7-8% y-o-y, this offers total returns in the range of noteworthy 11% to 14% on an annual basis.

The selection of office space is based not only on the location and the office space infrastructure but also on modern amenities, parking, proper maintenance, energy savings, power backup and security. These ad hoc services play a key role for corporate occupiers in improving operational efficiency. Hence, the office space market, particularly Grade A, would be a lucrative avenue if a prudent understanding of the relevant occupier’s demands is echoed in the offering.

The writer is the Chairperson –Jones Lang LaSalle Sri Lanka