Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 28 December 2016 08:34 - - {{hitsCtrl.values.hits}}

The National Budget 2017 was submitted to Parliament by the Finance Minister on 10 November and subsequently passed in Parliament by a majority vote. As outlined in the Budget speech, the Budget 2017 expects a large increase in the tax revenue through various tax reforms, both direct and indirect taxation.

The National Budget 2017 was submitted to Parliament by the Finance Minister on 10 November and subsequently passed in Parliament by a majority vote. As outlined in the Budget speech, the Budget 2017 expects a large increase in the tax revenue through various tax reforms, both direct and indirect taxation.

This is a reversal in the trend observed in the Government tax revenue which had experienced a systemic decline as a percentage of GDP (tax/GDP) over the past decade. The Budget expects a notable increase in tax to GDP ratio in 2017 (from 10.1% in 2014 to 13.5% in 2017). This results in a dramatic reduction in the budget deficit from 5.7% in 2014 to 4.6% in 2017 in line with the fiscal consolidation plan.

Debt burden

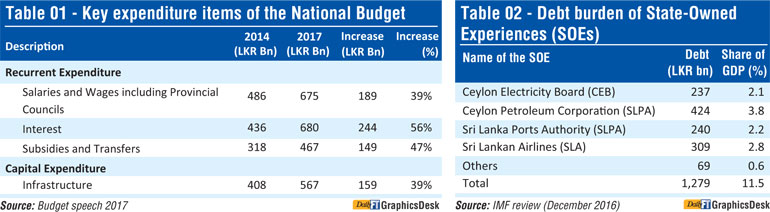

Among the key recurrent expenses, the wage bill has increased by Rs. 189 billion from Rs. 486 billion in 2014 to Rs. 675 billion in 2017. Interest payments on debt obtained by the successive governments have increased by almost Rs. 244 billion from Rs. 436 billion in 2014 to Rs. 680 billion in 2017. Capital investment side has also grown significantly from Rs. 408 billion to Rs. 567 billion during the same period.

According to the Budget speech, interest and capital repayment of existing borrowings remained excessive at Rs. 1,480 billion. This is expected to grow approximately Rs. 1,600 billion in 2018. Comparably, tax revenue is expected to grow by Rs. 771 billion from Rs. 1,050 billion in 2014 to Rs. 1,821 billion in 2017. More than 80% of tax revenue goes for servicing debt (interest and repayment of principal). The economic reality is that the total income of the Government is barely sufficient to meet the debt obligations.

The situation is further complicated if the loans obtained by State-Owned Enterprises (SOEs) and State banks for Government spending purposes are accounted. The majority of those SOE debt have been channelled to projects that are not generating sufficient returns to service debts (i.e. Hambantota Port) or debt obtained for giving large-scale subsidies (i.e. fuel subsidy). Social economic benefits of such projects are also highly questionable.

According to an IMF report, the debt burden of four major SOEs is in excess of Rs. 1,200 billion by the end of 2015. In addition to those listed below, SOEs like Road Development Authority (RDA) and Urban Development Authority (UDA) have borrowed heavily in the past. Since those SOEs cannot service their debt, finally it falls on the Government to service on their behalf. On this basis, the actual debt service cost is far higher than the budgetary provisions.

Strategic initiatives

The unsustainable debt burden is one of the key reason for downgrading of the country’s international credit rating. Lower credit rating increase the cost of debt. Understanding the complexity of the debt trap, the Government of Sri Lanka felt the need for undertaking tough economic reforms and improving the investor sentiment towards the country. Under these circumstances, the Government opted to obtain an Extended Fund Facility (EFF) from the IMF for an amount equivalent to SDR 1.1 billion (185% of quota and about $ 1.5 billion) in 2016. With the above facility, the Government agreed to embark on a broader set of reforms including fiscal consolidation.

As the Budget 2017 highlighted, the country has to undertake difficult economic reforms including rationalising the controversial investment in the past. Although there are no explicit statements in the Budget, the following key changes are taking place:

Conclusion

The Government has to take bold initiatives and make difficult decisions to meet the fiscal challenges of the 2017 Budget. The Government should commit to its fiscal consolidation plan while investing in the critical infrastructure projects which help to improve investor sentiment about the country.

A debt-funded growth model is not sustainable unless those infrastructure assets can generate sufficient economic returns to pay off the debt. Converting the infrastructure built through debt in the past to better economic use is challenging, however the Government has no choice.

(The writer is a CFA charter holder with local and international capital market experience.)