Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 23 June 2016 00:00 - - {{hitsCtrl.values.hits}}

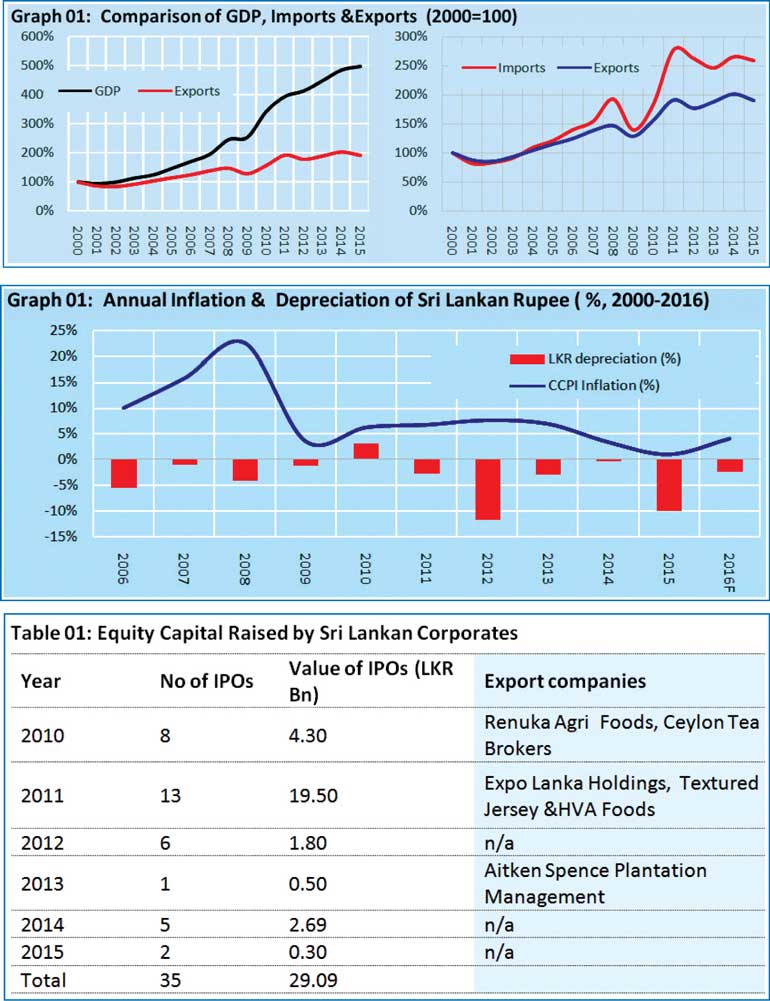

Growth of real GDP is used as a broader measure of the economic growth of a country. The GDP growth of Sri Lanka has averaged 5.7% during the last 15 years while the country has grown at an average rate of 6.4% since end of civil conflict in 2009. Despite headwinds, Sri Lanka has been able to maintain a decent GDP growth rate. However, economists argue that the GDP growth in the recent past had largely derived from the non-tradable sectors while contribution to the GDP from the tradable sector has diminished.

Growth of real GDP is used as a broader measure of the economic growth of a country. The GDP growth of Sri Lanka has averaged 5.7% during the last 15 years while the country has grown at an average rate of 6.4% since end of civil conflict in 2009. Despite headwinds, Sri Lanka has been able to maintain a decent GDP growth rate. However, economists argue that the GDP growth in the recent past had largely derived from the non-tradable sectors while contribution to the GDP from the tradable sector has diminished.

In this respect, let us first understand the difference between tradable goods and non-tradable goods and the implication of a growth model driven by the non-tradable goods.

Non-tradable goods can only be consumed in the economy in which they are produced; they cannot be exported or imported. Tradable goods are exported and imported across the borders.

The implication that the long-term growth derived from the non-tradable goods will not generate sufficient export income whereas consumption will keep on increasing the demand for imported goods as the domestic income level tends to rise with economic growth.

During the past few decades, no serious efforts have been made to modernise the exports of the country. Put it simply, our export mix remained almost unchanged during the last 10 years. This point further establishes by a retrospective analysis into our economic policy in the last few decades.Since the assumption of the office in January 2015, the new government has focused on a new strategic framework for the development of the country. In this regard, the government has engaged Ricardo Hausmann; Professor of the Practice of Economic Development at the John F. Kennedy School of Government at Harvard University and the Centre for International Development. The government has signalled clearly that there is a need for a drastic change in the economic policy direction towards export-oriented economy.

Economic implication of imprudent policies

Instead of modernising our exports sector and building up capabilities with focus on the export industries in order to serve international markets/customers, the country has heavily relied on the policies leading to import substitution and serving domestic market. One such aspect is our ‘exchange rate policy’. Sri Lanka has adopted a floating exchange rate system since 2001 which allowed the independent adjustment of the exchange rate according to the market forces of demand and supply.

The intervention of the Central Bank of Sri Lanka (CBSL) is limited to curb excess volatility in the exchange rate in the event of such excess volatility. Free floating exchange rate is a mechanism which automatically adjusts for structural and price differences among the trading nations. Analysts argued that despite the stated exchange rate policy, the CBSL had maintained soft peg to United State Dollars (USD) in the past. The outcome of such inconsistent policy was that our export competitiveness in terms of exchange rate has gradually eroded against our peer exporters. Sri Lanka had a history of high domestic inflation compared to its peer exporters. The inflation rate fluctuated in a wide range and as a result, predictability in the inflation rate remained very weak. Domestic exports were penalised with high inflation and an artificially held overvalued exchange rate (pegged to USD); this was quoted as ‘double jeopardy’ in the financial press. In a high inflationary environment compared to competitive exporting countries, if the exchange rate were not adjusted to offset the impact of higher domestic inflation, profits margin of the exporters will be squeezed pushing them out of the business. When a country adopts such imprudent policy for a long time period, entrepreneurs slowly moved out of the export industries and switch to local industries serving domestic market. Under such an environment, industrialists lobby for protectionism and focus on profiting from import substitution industries.

Sri Lanka experienced a similar situation in the past decade as evidenced in many aspects.

1. The local business conglomerates emerged during the last decade were engaged in the industries, serving the domestic market. The traditional export-oriented conglomerates such as Hayleys group engaged in a struggle for the existence and compelled to venture into sectors serving domestic market for their survival. The peer group engaged in sectors serving domestic market where price adjustment for the inflation is easy and were able to outgrow the traditional exports-oriented conglomerates. On the other hand, local businesses increasingly looked for sectors where government investments were directed such as infrastructure (roads, construction and real estate). The business entities, involved in the industries with high import tariff, infrastructure related industries with large investments by the government and the regulated industries were the winners. All of those sectors are economically considered as non-tradable sectors.

2. The listings in the Colombo Stock Exchange (CSE) in the recent past provide further evidence for this argument. The corporate sector had raised Rs. 29 billion equity capital via 35 Initial Public Offerings (IPOs) in the CSE during last five years. But, only a few companies, engaged in the export-oriented businesses (such as Expolanka, Heladiv Tea and Textured Jersey) raised funds via IPOs in the CSE. Other companies raised capital for domestic market oriented businesses.

The untold story here is the continuous decline in investment into the export industries. Sri Lanka has not been able to develop any industry with world recognition except apparel manufacturing which has carved a niche in the world apparel industry.

During the past decade, Sri Lanka has failed to enter into any meaningful trade negotiation with its trading partners. Moreover, Sri Lanka has lost certain concessionary access to major markets such as GSP plus trade concession enjoyed for a long period. Losing GSP plus resulted in major blow to wide range of our industries involved in manufacturing goods for the European market. The competitive exporters grabbed market share in the European markets from our exporters as they could produce and export at more competitive rates than us while enjoying benefits of competitive currencies. High domestic inflation, artificially held exchange rate and losing export concession in the major markets were a fatal combination. Ina nutshell, Sri Lanka has not been able to create a conducive environment to foster export-oriented industries. As a result, Sri Lanka experienced a continuous stagnation & in certain cases, a decline in exports. This is nothing but policy induced downfall of the export industries.

Measures to rectify past mistakes

Needless to mention that the result of the prolonged imprudent policies is not only harmful in the long run but also be painful to rectify. However, the current government has taken this as an utmost priority. Sri Lanka as a country cannot advance without an outward-looking industrial & economic policy. Local companies should be encouraged to look outside of the country to build businesses. There is a major role for the government to play in facilitating the local businesses to undertake a difficult path of developing business serving international customers.

However, the above policies alone cannot propel the export sector growth. The country needs to adopt a monetary and exchange rate policy conducive to export industries. These policies should bring in competitive exchange rate along with price stability. The recent policy measures taken by the Central Bank of Sri Lanka in this regard appear to be in the right direction. The CBSL has allowed the exchange rate to depreciate so as to make the real effective exchange rate favourable to the export sector. The competitive currency could enhance the profitability of the exporters and encourage entrepreneurs to venture into exports industries with a long-term vision. Similarly, the CBSL has shown its commitment to the prime objective of price stability by shifting to a tight monetary policy since early this year.

When a country is developing, the economy undergoes certain structural changes. Heavy reliance on the agriculture sector as a contribution to GDP decreased gradually while an increasing share is taken by the industrial sector. The share of its service industry takes prominence when the economy moved to high income bracket. Sri Lankan economy has stayed away from this natural transition; instead the service sector contributes to a large share of the economy. The export sector in the modern world is not confined to the goods as the cross broader trade in services is growing. In this context, Sri Lanka should look for leveraging the competencies built in certain service sectors to win export markets.

Conclusion

Economists observe that the Sri Lankan growth model in the past had centred on the non-tradable sector. The implication of such a model is that the country will run into external imbalances with low exports income which is not sufficient to cover the increasing demand for imported goods. High inflation, artificially fixed exchange rate and losing trade concession in the past have resulted in a continued decline in exports. As a result, local entrepreneurship class has shifted from the export-oriented industries to sectors serving the local markets in searching for higher profitability. The government having realised the repercussions of such imprudent policy, should create a conducive environment to develop the export oriented industries. In contrast to the past, the exchange rate and monetary policy framework of the CBSL appears to be supportive. The right policy mix will facilitate the economy to undergo transition from an agricultural to an industrial economy and leverage the service sector capabilities targeting export markets.

(The writer is a former Fund Manager at the Employees Provident Fund and Investment Manager at Hayat Invest Company in Kuwait).