Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 1 August 2016 00:01 - - {{hitsCtrl.values.hits}}

The Monetary Board decides to tighten monetary policy

The Monetary Board in its latest monetary policy review done last week has decided to make money more expensive to people. People here include all within Sri Lanka – the general public, companies, state-owned corporations and the Government proper.

In central banking jargon, this is called the ‘tightening of monetary policy’. In terms of this tightening, the Board has decided to increase its policy interest rates by a mega dose of half a percent, while keeping the mandatory reserve which banks have to keep with it at 7.5% of banks’ deposit liabilities (available at: http://www.cbsl.gov.lk/pics_n_docs/latest_news/press_20160728a.pdf).

In central banking jargon, this is called the ‘tightening of monetary policy’. In terms of this tightening, the Board has decided to increase its policy interest rates by a mega dose of half a percent, while keeping the mandatory reserve which banks have to keep with it at 7.5% of banks’ deposit liabilities (available at: http://www.cbsl.gov.lk/pics_n_docs/latest_news/press_20160728a.pdf).

This decision is a reversal of the Board’s policy of making money available cheaply to people despite the mounting evidence, for quite some time, that the Board should do the opposite.

A nation dancing on the table at high tempo

The mounting evidence consisted of a number of imbalances, also known as macroeconomic imbalances, which the country’s economy had been experiencing. The sum total of the imbalances had shown that the country had been living beyond its means in every respect.

Everyone – people, companies and the government – had been spending freely the income which they had not earned. It meant that that living had been maintained through borrowing, handy at the time of making it but woeful when it has to be repaid for lack of means.

This is a situation similar to people dancing on the table insanely without bothering to find out what the next day will promise them. To facilitate the dance, funds were provided by the Central Bank by freely printing money, the banking sector by creating credit and the Government by borrowing both from the domestic and foreign sources.

The remedy would have been to halt the dance forthwith. This is an unpopular move but a central bank has no choice in this respect. It has been created by the nation to make this unpopular move and that is the responsibility of the Monetary Board in terms of the Monetary Law Act or MLA under which the Central Bank has been established.

As William McChesney Martin, Jr., one time Chairman of the Federal Reserve Bank, the central bank in the US, said it was the job of the central bank to take away the punch bowl just when the party gets going. Obviously, the dancers would not be happy. But a central bank has to make these unpalatable choices for the sake of a stable and a growing economy in the years to come.

There are economic imbalances everywhere

In Sri Lanka’s case, the ongoing free party had created a number of imbalances as follows. The external sector had a big hole, putting pressure for the rupee to depreciate against the US dollar and forcing the government to seek out a bailout package from IMF. The official foreign exchange balances, known as foreign reserves, were falling at a rate to a level even below the next 12 months’ foreign loan repayment obligations.

The budget was out of control with a widened deficit in both the revenue account and the overall operations. The rising overall deficit had forced the government to borrow more increasing its indebtedness to both the citizens of the country and the foreigners. It thus reignited the external debt crisis.

Money and credit levels were rising, bringing a new enemy, inflation, back to the fore. With these imbalances overshadowing the economy, no new investments, either by the local private sector or foreigners, were taking place leaving the cash-strapped government to fill the gap.

Since the government too could do only a little with its own fiscal problems, the inadequate investments had reflected in a slowing down of economic growth. These symptoms had been present in the economy for some time, but the Monetary Board had stubbornly refused to take any preventive action. It was, therefore, left to the new Governor of the Bank, Dr. Indrajit Coomaraswamy, to rejuvenate the frail wisdom of the Board. To his credit, Coomaraswamy has done so in his very first monetary policy review done in July 2016.

A Monetary Board taking an offensive stand

A Monetary Board taking an offensive stand

This writer in a number of articles published in this series alerted the Board to the ominous developments taking shape in the economy needing urgent fixing.

The latest was published in April 2016 under the title ‘Dilemma in monetary policy: The Monetary Board caught in The Devil’s Alternative?’ (available at: http://www.ft.lk/article/534654/Dilemma-in-monetary-policy--Monetary-Board-being-caught-in--The-Devil-s-Alternative-?).

The objective of the articles was to get the passive Board to action so that the catastrophe could be avoided through proactive action. But when the situation deteriorated to such a critical level, its choice was one involving the devil’s alternative.

That was because at that point whatever the action which it would take would harm the economy. Hence, the best course of action would have been to take preventive action in advance. But the Board defended its inaction by issuing a statement countering this writer (available at: http://www.ft.lk/article/536676/Central-Bank-responds-to--Dilemma-in-Monetary-Policy--Monetary-Board-caught-in--The-Devil-s-Alternative-?-).

The Board, instead of taking the warning seriously, referred to this writer as a ‘retired employee of the Central Bank’ implying that an opinion expressed by a retired employee did not merit consideration by the Board.

Now the situation has deteriorated to a critical level

But the subsequent events proved that the Board’s approach was faulty. It had to finally seek a bailout package from IMF which it had downplayed earlier as unnecessary. In securing this bailout, it had promised IMF that it would, among others, introduce monetary policy reforms involving the tightening of the monetary policy, a flexible exchange rate regime and an inflation targeting framework.

In June, Moody’s rating agency had, descending from its earlier stand to be on par with the other two rating agencies, namely, Standard and Poor’s and Fitch, downgraded Sri Lanka’s economic outlook from stable to negative. The reason for downgrading? The worsening macroeconomic outlook of the country which the Board had refused to admit earlier.

In the meantime, the inflation rate, as measured by the Colombo Consumers’ Price Index or CCPI, started to move up from less than 1% in January 2016 to 6% in June. The rupee continued its downward slide against the US dollar from Rs. 143 per dollar in December 2015 to Rs. 146 per dollar in July 2016.

The free foreign exchange reserves, net of gold holdings that cannot be used for making immediate foreign payments, fell to $ 4.2 billion by end of June 2016. However, the total loan repayment commitments within the next 12 month period as at that date amounted to $ 5.5 billion. The Government and the Central Bank had temporary breathing by going for a sovereign bond issue of $ 1.5 billion in July. However, this cannot be done forever and action had to be taken to put the macroeconomy back to balance.

The enlightened vision of Dr. Coomaraswamy

Dr. Coomaraswamy hinted at the course of action he would take in his maiden address to the staff at the time he took office at the Bank in early July (available at: https://www.youtube.com/watch?v=riEqOx8oc0U).

He said that he was advised by the President that he should do his duty in a straight way and he should not fear anybody. He further said that if the Bank fails to create a strong macroeconomic platform in terms of strong macroeconomic fundamentals, nothing else would be possible. This nothing else is nothing but the measures to be taken by the government to generate growth and create wealth for people. He opined that it would make people within and outside have confidence in the country.

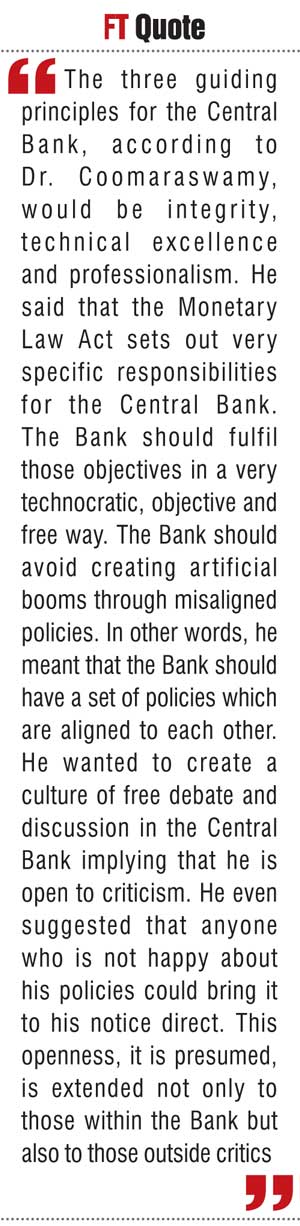

The three guiding principles for the Central Bank, according to Dr. Coomaraswamy, would be integrity, technical excellence and professionalism. He said that the Monetary Law Act sets out very specific responsibilities for the Central Bank. The Bank should fulfil those objectives in a very technocratic, objective and free way. The Bank should avoid creating artificial booms through misaligned policies. In other words, he meant that the Bank should have a set of policies which are aligned to each other. He wanted to create a culture of free debate and discussion in the Central Bank implying that he is open to criticism. He even suggested that anyone who is not happy about his policies could bring it to his notice direct. This openness, it is presumed, is extended not only to those within the Bank but also to those outside critics.

Giving correct direction to the Board is a must

What Dr. Coomaraswamy spelt out in his maiden address was a fine piece of guidance to the Monetary Board. The Board’s previous monetary policy stance was misaligned as this writer had pointed out on numerous occasions in articles in this series.

The Central Bank’s objective was to attain ‘economic and price stability’ meaning that the Board cannot be complacent merely by having a low inflation rate when there are imbalances in other sectors in the macroeconomy. It, instead, sought to boost growth by making money available at cheaper rates and promoting credit growth in the economy.

When things started to go out of control, it used the wrong policy instrument, namely, requiring banks to keep more money with the Central Bank as idle balances, known as statutory reserves. It widened the interest margins of banks enabling them to make more profits. It also induced banks to resort to arbitraging, i.e., making profits by borrowing at low rates from the Central Bank and lending to customers at prevailing market rates. The end result was the leakage of the liquidity created by the Bank to promote growth out of the country through increased payments for imports and purchase of foreign services.

It created a hole in the balance of payments putting pressure on the rupee to depreciate against the US dollar and forcing the country to lose its foreign reserves. To build reserves and meet foreign exchange obligations, the country had to borrow more from external sources. Those borrowings in turn increased the country’s vulnerability further. Thus, the Board’s own misaligned policies contributed to the creation of an external sector crisis as well.

The Board should be open to criticism

When outside critics, including this writer, pointed out the misalignment in the Board’s policies, it was not open to listen. Instead, it first took a defensive attitude which later became offensive.

The Board should have read the message in its proper spirit. Instead, it started to shoot the messenger, even going to the extent of ridiculing the critics personally. One has to only go through the press statements issued by the Central Bank on behalf of the Monetary Board in the previous few years to discern this. Dr. Coomaraswamy wants his officers to demonstrate technical excellence and professionalism in their work. But the Board which is at the top of the Central Bank has demonstrated that it was lacking both.

Two pressing issues needing immediate fixing in the Central Bank

Dr. Coomaraswamy is planning to take the Monetary Board and the Central Bank in the proper direction. The first monetary policy review under his management is a testimony to it. Yet, he has inherited a sick Central Bank and curing that sick person is a quite a challenge. Two of the most pressing challenges he is facing are as follows.

The continuously loss making Central Bank

The Bank had been making losses continuously since 2013 – Rs. 87 billion in total – causing a depletion of its capital base from Rs. 182 billion as at the beginning of 2013 to Rs. 54 billion by the end of 2015.

When this writer pointed this out, the Board took it very lightly pronouncing that a central bank is not supposed to make profits. When it was pointed out that, though it was true that central banks are not supposed to make profits, they are not supposed to make continuous losses either causing a rapid depletion of its capital base.

The Board then took up the position that it was still not a problem because a central bank could be recapitalised by the government at any time if there was such a requirement. What the Board had not reckoned was that Sri Lanka did not have a government which has such free money to waste on a loss-making central bank.

The Bank’s present administration and staff costs amount to about Rs. 12 billion per annum. Since this is like a permanent fixed cost which the Bank cannot cut for any reason, unless it earns this amount annually, it is subject to a serious financial crisis. There can be some easing in this situation in 2016 due to the fact that there is a liquidity shortage in the market on a day to day basis and banks are borrowing from the Central Bank at its new lending rate of 8.5%. But the Board has to be cautious about this since it amounts to earning income out of printing money and thereby inflating the economy. Thus, the Bank will have a temporary relief but in the long run, it will have a bigger problem of facing higher inflation.

The Entrust fiasco is just a tip of an iceberg

Then, there is what known in the market as ‘Entrust Fiasco’ which the Board had chosen to sweep under the carpet in the past. In this fiasco, according to market sources, those who have invested in government Treasury bills and bonds through this primary dealer have lost about Rs. 10- Rs. 12 billion.

This is because though the investors have delivered cash, they have not been supplied with bills and bonds. This is a fraud which has caused investors to lose trust and confidence in the country’s financial markets on one hand and the professionalism of the Central Bank as the market regulator, on the other.

Some of the big losers have been Central Bank’s own funds managed by the Monetary Board as disclosed indirectly by auditors in the annual accounting statements of the Bank. These accounting statements have disclosed those losses as ‘uncollateralised REPOs’ in funds operated by different schemes of the Bank: Regional Development Department Rs. 1400 million (p 52 of Part II of the Annual Report 2015), Pension, Widows’ and Orphans and Widowers’ and Orphans’ funds Rs. 283 million and Medical Benefit Scheme Rs. 129 million (p 42 of Part II of the Annual Report 2015).

In addition, the auditors have not disclosed it but the market believes that the Bank’s own Deposit Insurance Fund too has lost money due to these uncollateralised REPOs. A REPO is by nature a lending against collateral and if these REPOs have not been collateralised, that means that these moneys have been lost by the investors. There are private sector investors who have lost about Rs. 7-Rs. 9 billion due to this fraud. What the Board has done is to hand over the management of the primary dealer company in question and its subsidiary companies to the National Savings Bank.

NSB cannot compensate the investors who have lost money; neither can the primary dealer do so because it is bankrupt. Hence, the liability is now knocking at Dr. Coomaraswamy.

Dr. Coomaraswamy has started his work by giving a new direction to the frail Monetary Board. It is hoped that he would succeed in his endeavours for otherwise the country would be driven to a perilous situation.

(W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at

[email protected]).