Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 9 August 2016 00:05 - - {{hitsCtrl.values.hits}}

Housing economy in the Western Province

Western Province housing has been the biggest driver of the country’s housing sector over the years approximately with 30% share of the national housing stock. The housing sector at Western Province powers a lion share of provincial GDP and also contributes largely to the national GDP. Over the period 2001 to 2015, number of housing units in the province has increased from 1.289 million to estimated 1.748 million with an annual average growth of 3%. The highest growth is recorded in Gampaha District.

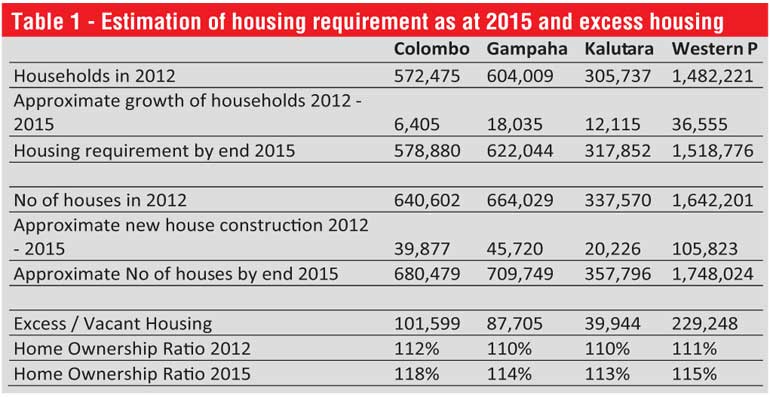

As per the census survey in 2012, Western Province had 1.482 million households, and 40% of them were in Gampaha District. Taking into account the population growth rate and average household size, approximately 36,550 households should have been newly added during the period 2013 to 2015. Accordingly, by end 2015, the province should have approximately 1.519 million households, and equivalent number of housing requirement. As tabulated in the Table-1.

In 2012, there had been 1,642 million housing units of different quality and types sheltering 1.482 million households, within the Western Province. This reflected a homeownership ratio of 111%. Considering the new house construction trend in the Province between 2001 and 2012, approximately 105,823 new houses should have been constructed during 2013 to 2015. As per the Central Bank statistics within the area of Greater Colombo itself all local authorities have approved 130,335 new housing construction between 2000 to 2010.

On the assumption that the brought forwards housing stock remain unchanged, with the estimated new construction, the province  should possess approximately 1.748 million housing units by end 2015, to shelter estimated 1.518 million households reflecting a homeownership ratio of 115%. This means that every, 100 households have 115 houses in the Western Province making a vacant ogresses housing stock of approximately 229,000 units.

should possess approximately 1.748 million housing units by end 2015, to shelter estimated 1.518 million households reflecting a homeownership ratio of 115%. This means that every, 100 households have 115 houses in the Western Province making a vacant ogresses housing stock of approximately 229,000 units.

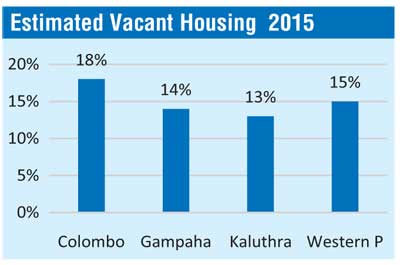

In Table-1, the estimated home ownership ratio in Colombo 118%, Gampaha 114% and Kalutara 113% in 2015 (Figure-1 and Table 1). Even at Rs. 1,000,000 per units, this is compounding to an idle assets base of Rs. 229 billion in the economy. Even if a percentage of new constructions replaces the old houses, the largest share of new construction has add on to vacant housing stock.

Housing sector also poised to shifting to larger residential units. From 2007 rising incomes led many locals to build larger housing units than previous years. The percentage of above 2000 sq ft house construction has escalated 36% to 46% from 2005 to 2010. With incomes expected to rise, larger units are increasingly the norm in the market.

As per the above estimation, the homeownership ratio has increased by 6% in Colombo, 4% in Gampaha and 3% in Kalutara, from 2012 to 2015. This points out that the rate of house construction is higher than the rate of households’ growth, making more and more houses are available for the rental market. This is fairly justified by the fact that except in high population densified urban pockets, rental housing is not feasible compared to commercial buildings. Nevertheless, over millions of peoples are daily travelling to Colombo from the other major townships for occupations.

Those who are in the higher end of the income pyramid, invest in second and third house with the anticipation of higher capital gains. In the Western Province capital gain is mainly driven by escalation of land prices. New rich community and foreign income earners and high income migrants from other provinces drive this market. At the same time , high rate of economic growth and employment, and high level of foreign employment remittances, have made formal housing finance more accessible and affordable to the above  middle income households.

middle income households.

On the other hand, higher rate of population aging and lack of adequate old age social security system, also contribute for the demand of investment housing. This trend has created 15% vacant or excessive housing situation. Therefore, demand for investment housing is increasing within the wider income segment of the population. Affordable wealthy residents in other provinces also choose Western Province, for investment housing very often. High level of vacant houses in the government sponsored housings schemes and private commercial housing schemes are mostly resultants of investment housing.

Within the increasing demand environment of housing from a large segment of the population, the lower middle and low income households generally and those who are in the informal economy in particular, have become the victims of the investments. They are becoming more marginalised and facing and increasing level of housing stress. As a result they opt to alternative temporary solutions such as slum housing and improvised housing. Demand driven land prices and increasing cost of construction are creating housing stress for many in the Western Province, left over number of low income households are being helped by Government’s housing assistance programs.

Investment housing is crucial in catalysing economic growth. It proliferates employments, resources mobilisation and capital market. But it has to be driven within a holistic policy framework so as to maximise economic gain and minimise the negative impacts on realisation of the right to adequate housing of marginalising groups. The Government is obliged to ensure progressively the accessibility and affordability of housing to this segment. Widening income inequality is another negative result of investment housing.

In the process of implementing the proposed 500,000 housing program sponsored by the government steps should be taken to ensure that houses go into the hand of most needy people. The proposed capital gain tax by the Prime Minister on properties and mansion tax are imperative in this direction.

The sources of estimates and figures in this article, unless otherwise mentioned are as per the industry research and analysis of the author and views does not necessarily represent that of HDFC Bank of Sri Lanka.