Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 6 June 2016 00:20 - - {{hitsCtrl.values.hits}}

Implicit admission of guilt

Implicit admission of guilt

The Monetary Board of the Central Bank has at last chosen to break its stoic silence over allegations against two main Treasury bond fiascos supposed to have taken place in the Treasury bill and bond market in Sri Lanka over the last 15 months or so by issuing a statement on the policy it recommends for adoption by the public debt management in the future (available at: http://www.cbsl.gov.lk/pics_n_docs/latest_news/press_20160602e.pdf ).

The statement is brief and does not address the issues raised by civil society activists and market participants. Yet, in a world where disclosure and transparency are valued high, even such a small gesture by the Monetary Board, as the statutory authority responsible for raising funds for the Government and for maintaining good governance principles in the market, is welcome. The Board has taken a step backward in its present statement by implicitly admitting that the systems in practice had not been ideal and need improvement.

First bond fiasco: Black mark on good governance government

First bond fiasco: Black mark on good governance government

The first bond fiasco took place in February 2015, less than two months after the new good governance government was voted into power. In that fiasco, it was alleged that inside information relating to the issue of a 30-year bond had been leaked to a primary dealer company owned by the son-in-law of the incumbent Governor enabling that company to make a killing in the Treasury bond market.

The Governor dismissed the charges flatly and the Monetary Board stood firmly by him. But civil society and the Opposition were not convinced of a clean deal as claimed by the Governor and the Monetary Board. They pressurised the Government to conduct an impartial investigation and deal with the culprits promptly.

Civil society had fought hard to bring the new good governance government to power and, therefore, in its eyes, the alleged incident was a black mark with which the less than two-month-old Government had been indelibly stigmatised.

Irrelevant TOR of the lawyers’ committee

Two inquiries were made; one by a committee of lawyers appointed by the Prime Minister and the other by the Parliamentary watchdog, the Committee on Public Enterprises or COPE. This writer’s services were obtained by both committees on an honorary basis to get clarifications on the complexities involved in the issue of Treasury bonds and the operations of the bond markets.

The Lawyers’ Committee (Full report available here: https://www.colombotelegraph.com/wp-content/uploads/2015/05/Bond-Report.pdf) did not have as its terms of reference the mandate to investigate the particular bond issue in question. Instead, it was required to investigate three unrelated issues and report back to the Prime Minister.

The first was to report on the reasons for the Public Debt Department to offer Rs. 1 billion to the public in the bond issue in question. The second was to document the sequence of events and key statistics associated with the said bond issue with respect to each primary dealer. The last was to report on the results of bond auctions and the private placements made from 1 January 2012 to the auction in question.

Lawyers’ Committee making some valuable observations

Hence, the investigations of the Lawyers’ Committee were confined exclusively to these terms of reference. Accordingly, it did not attempt at finding whether there was any irregularity or insider dealing in the auction in question.

However, the Committee reported (p 7) that the primary dealer firm belonging to the son-in-law of the incumbent Governor, namely, Perpetual Treasuries, had submitted a bid for Rs. 2 billion in its own name and several other bids amounting to Rs. 13 billion through another primary dealer, namely, the Bank of Ceylon or BOC.

All these bids had been submitted at prices ranging from Rs. 86.76 to Rs 97.87 per 100 rupee-bond. Out of them, bids to a value of Rs. 13 billion, submitted through BOC, had been submitted at prices below Rs. 91 just a few minutes before the closure of the tender at 11.00 a.m. on the day of the issue.

Selling below the prevailing market price

Selling below the prevailing market price

The Committee also reported that the Treasury Bond Tender Committee had decided to accept up to Rs. 10 billion, though it had advertised only for Rs. 1 billion. Out of these bonds, Perpetual Treasuries had been successful in winning bids amounting to Rs. 5 billion.

Had the Tender Committee decided to accept up to Rs. 20 billion, all the bids that had been submitted by Perpetual Treasuries in its own name and through BOC would have been successful. The bids accepted from Perpetual Treasuries had been at prices ranging from Rs. 90.16 to Rs 97.87 per 100 rupee-bond.

However, the secondary market price of a 30-year bond adjusted for its interest rate of 12.50% per annum on that particular day, according to Central Bank data, had been at Rs. 121 per 100 rupee-bond. What this meant was that a bond which could have been sold at around Rs. 121 had in fact been sold at prices pretty much below the face value of the bonds issued. Hence, critics argued that the Government had lost about Rs. 30 for every 100 rupee-bond which the Tender Committee had issued.

Monetary Board going into Sleep Mode

The Committee had also observed that securing 50% of the bonds accepted at the auction by Perpetual Treasuries had been rather unusual (p 12). Since an investigation into that aspect was outside its terms of reference, it had refrained from making further inquiries into it.

However, it has been suggested that ‘in the interest of the public since the said transaction involves public funds and fiscal regulations of the Government, a full scale investigation by a proper Government authority is warranted’. What it implies is that the Committee, in its wisdom, has suspected an irregularity. The suspicion is cast on the Central Bank’s higher management including those in the Public Debt Department and the Tender Committee that determined the auction in question.

Hence, it was up to the Monetary Board, as the statutory body responsible for issuing public debt and for maintaining good governance practices in the financial sector, to initiate such an inquiry. However, the subsequent events have shown that the Monetary Board had not only gone into a ‘sleep mode’ with regard to this inquiry, but also defended the irregularity-cast bond auction in public to justify its inaction. Thus, the Monetary Board failed to harness a valuable opportunity to clear its name and emerge as a body upholding good governance practices in the financial sector.

Another act of inaction by the Board

A similar observation has been made by the Committee on the unprofessional behaviour of the Chief Dealer of the Bank of Ceylon who had submitted bids amounting to Rs. 13 billion on behalf of another primary dealer, risking the bank’s funds, without approval from the higher authorities at the bank.

Similar to the previous case, the terms of reference of the Committee did not permit it to go into a full inquiry into the affairs of BOC. Hence, it had recommended that the BOC conduct a full-scale investigation and if necessary, a forensic audit, into the operation of the dealer room of BOC.

The investigation includes calling for explanation from the chief dealer and his superiors with regard to the ad hoc type decisions they have made with respect to dealing activities of the bank.

Here again if the BOC did not conduct this inquiry it was up to the Monetary Board to direct it to do so. However, the Monetary Board, strangely, went into the sleep mode in this instance too.

Loss to the Government could have been calculated

With regard to the losses involved in the bond issue in question, the Committee had relied on an explanation given by the Central Bank management that there had not been any loss to the Government.

The Committee had questioned Mrs. Deepa Seneviratna, Superintendent, Dr. Mohamed Aazim, Assistant Superintendent (he was in fact Additional Superintendent) and Mr P. Samarasiri, Acting Governor in this regard.

It reports that all these three officers maintained that there was no loss to the Government as a result of this bond issue (p 13). A judgment delivered by the Supreme Court in the case of infamous Greek Bond losses had also been furnished in support of this argument.

However, the Committee appears to be half-hearted with this conclusion of the senior central bank officers. Since the calculation of any loss arising from the bond issue was outside its terms of reference, the Committee had to go by what the Central Bank officers had maintained.

However, it had observed that there was no impediment for the Government and or Parliament and or any organisation with public interest to engage in the necessary mechanism in establishing loss to the Government. This is another area where the Monetary Board has failed in its duty.

Suspicion about leaking of information by Public Debt

The Committee has also observed that there was a lack of transparency in the affairs of the Public Debt Department of the Central Bank. It has particularly criticised the Public Debt Department for a lack of appropriate supervision of primary dealers and good management practices. It has also suspected that vital information in the Public Debt Department could also have been compromised.

The Committee has therefore observed that a full-scale investigation should be conducted into the activities of Public Debt Department and its officials and any other department of the Bank to ascertain whether such sensitive information has been leaked out. This is a serious charge because it breeds opportunities for insider dealing making one participant richer at the expense of others. Hence, it is in the interest of the Monetary Board to take corrective action even without bidding from a committee. But the Board had failed in this instance too.

The abortive COPE inquiry

Since the Monetary Board had gone into sleep mode and there was mounting criticism in the market about its inaction, the Parliamentary watchdog, COPE, decided to use its powers to investigate the alleged bond scam.

A subcommittee of COPE was established by the Speaker in this regard under the chairmanship of COPE’s chairman. This writer was once again invited by the COPE subcommittee to assist it in technical matters.

When COPE was on its job, Parliament was dissolved making the inquiry a non-event. However, a truncated draft, claimed to be the COPE’s report under preparation is now available in public domain (available at: https://www.colombotelegraph.com/index.php/bond-scam-full-text-of-interim-report-of-cope-inquiry/).

The Chairman of COPE at that time has not disputed this draft report. Unlike the Lawyers’ Committee, COPE did not have any limitation on its inquiry. Yet, the report in the public domain does not provide any final finding with regard to the bond issue in question. Hence, it is up to the newly established COPE to re-establish an inquiry into the alleged Treasury bond fiasco in question.

A second bond scandal hitting the market

Just a little longer than one year after the first bond fiasco, the market was abuzz with the story of another bond fiasco. In this case, it was alleged that the Public Debt Department had sold Treasury bonds to a particular primary dealer at prices well below the prevailing market prices and allowed that primary dealer to make another killing in the market by driving the prices up within another two to three day period. But after the bonds had been disposed of by this buyer, the bond prices had receded to their original level. This writer pointed this out in a previous article in this series (available at: http://www.ft.lk/article/537863/A-cherry-picking-Monetary-Board-when-another-major--bond-scandal--is-rubbing-on-its-nose).

EPF buying from the secondary market at high prices

The story circulating in the market today is that EPF is no more in the primary market in an effective way thereby allowing predatory companies to corner the market completely. Two independent analysts have already commented on the Board’s conniving failure on this count (available at: http://www.economynext.com/Sri_Lanka_central_bank_denies_bond_auction_manipulation_as_concerns_rise-3-4802-3.html#.VxwajrGffEM.mailto and http://www.sundaytimes.lk/160424/business-times/too-much-bonding-at-cb-auctions-greater-transparency-urged-190596.html).

EPF’s inaction paves way for the entry of predators

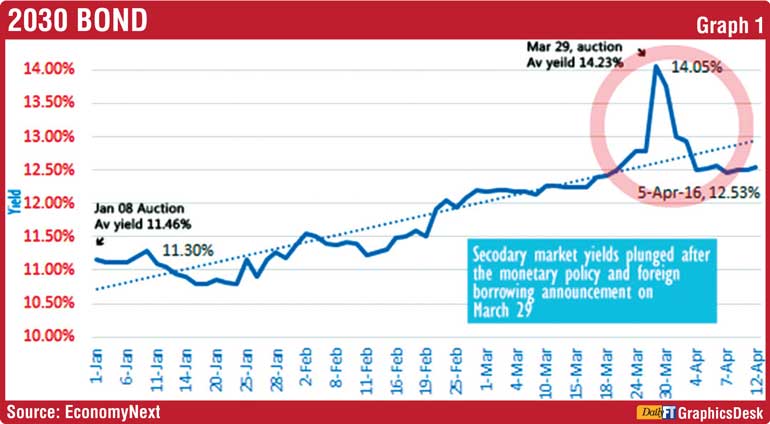

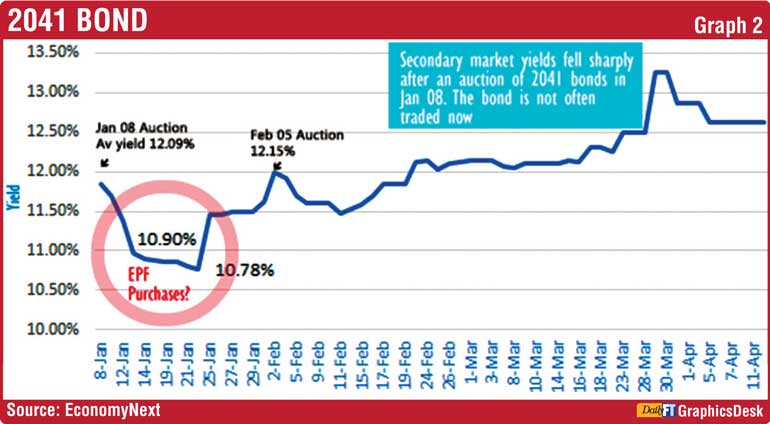

The analyst commenting in EconomyNext has documented the interest rate developments in the Treasury bond market prior to and before the Treasury bond issue in question in late March 2016.

He also had graphically presented how EPF had been manipulated, perhaps without the Board’s knowledge, to permit some predatory primary dealers to dump their pumped-up bonds on EPF. This writer’s article under reference above carried both these graphs but they are reproduced again for the benefit of the readers.

Civil society asks for full information

This story maybe untrue, but the Board does not release full information to the market giving wings to such rumours. Hence, it is in the interest of the Board to release full information to the market without waiting for civil society activists to demand for such information in terms of the 19th Amendment to the Constitution.

The media has already reported one such demand for information (available at: https://www.colombotelegraph.com/index.php/chandra-demands-for-information-on-treasury-bond-issuance/ ).

The Board taking cover behind an irrelevant law

However, the Monetary Board writing through its Secretary, an officer of the Central Bank, has declined to release the required information taking cover under the provisions of Section 45(1) of the Monetary Law Act.

That section applies to officers and servants of the Central Bank and not to the Monetary Board. When this section is interpreted widely, it prohibits the Secretary to the Monetary Board who is an officer of the Bank to divulge any information which he comes to know about banks, their clients, affairs of government departments, corporations, companies partnerships and persons to a third party. However, that restriction is not placed on the Monetary Board which can divulge such information to clear its name.

Failure to disclose will breed whistleblowers

The information sought for by civil society relates to a Treasury bond auction that has taken place some three months ago. Hence, if the Board is genuinely interested in maintaining and upholding transparency, it could first obtain this information from the officers concerned and decide, on the basis of the vitality of such information whether it could be released to public domain.

The Board can be adamant in its stance, but it cannot prevent whistleblowers from releasing information to the market; this has already happened in the case of a credit card account maintained by the bank for the Governor. Similarly, a document is now in circulation in the market claiming to be the results of the Treasury bond auctions held in late March, 2016. No one can say for sure whether this document is authentic, but the reputation of the Board has already been dented irreparably.

At last, guilt is admitted?

In this background, the statement issued by Monetary Board on 2.6.2016 is a demonstration that it has woken up from a demonic dream. In this statement, the Board says that the process it has been following in issuing Treasury bonds and bills has been similar to the practice it had followed since February 2015.

That practice refers to the full use of the market to raise funds for the Government. But the Board has admitted that this practice is deficient since it has recommended the Public Debt Department to have pre-bid meetings with primary dealers, to learn of the global best practice for adoption regarding the amount advertised and the amount accepted and to get the EPF to actively participate in primary auctions. Thus, as alleged by market participants, EPF had not been fully active in the primary auctions in the past allowing predatory bidders to corner the market.

(W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])