Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 16 May 2016 00:00 - - {{hitsCtrl.values.hits}}

There is a series of articles being published recently discussing certain aspects in the economy, monetary policy measures, Government securities market and banking sector. From the perspective of an average person, some articles warrant further clarifications and responded with another dimension of opinions, practicalities and data as evidence. Opinions and comments should be backed by data to prove the position.

Some constructive criticisms published these days seem to be directional but do not carry a single position as they contradict the own opinions in the same article or different articles written at different times by the same writer.

One such recently published article says CBSL policy rates should be adjusted up to increase the market interest rates so that inflationary pressure can be curtailed. However, the particular article criticises increase in the general interest rates due to the increased Statutory Reserve Ratio (SRR) for commercial banks by CBSL. The same article further explains that market interest rates have increased above the CBSL policy rates due to excessive borrowing by the Government and this has given arbitrage opportunities for market participants. In another place of the article, it states that market interest rates have currently increased as a results of CBSL selling dollars in the market and on the other hand printing money through lending to the financial institutions.

According to these articles, all actions taken by the Monetary Board in the recent past are wrong and have no economic substance. For them, there are lot of distortions in the market due to the actions by the Monetary Board. For rational analysts most of these criticisms are non-other than blame games. For a rationale reader, these constructive criticisms are too vague to gauge the most desirable action because these criticisms do not show one position.

Has the world ever come across an economy which sailed smoothly without any turbulence over a period of time? If it is the case, we will have to get economics books and concepts re-written and all the central banks can also be closed. Turbulence in an economy is inevitable and temporary turbulences can be turned to crisis situations. Such crisis situation can be caused through fundamental issues in the real sector or the finance sector or can be created simply due to irrational exuberance of a section of people or loss of confidence due to speculations. Certain economic crises are alleged to occur or worsen due to speculations created by few selected groups within the system or outside the system who worked for an agenda.

Corrective actions and policy directions can be painful in the short run and can be harder or less hard on different quarters of the economy. Short term increase in interest rates is a painful exercise for financial institutions which are running a net large daily borrowing position in the market while it is favourable for the counterparts which are running a net large lending position in the money market. During a currency depreciation, importers will have to bear conversion losses and business losses while exporters are happy earning conversion gains and business gains and wise versa.

The fundamental question is whether Sri Lanka is really in an economic crisis which is going out of control today and how critical it is compared to what the economies in the other parts of the world are experiencing today. Further, how we have experienced previously similar or worse circumstances.

CBSL’s declaration on the actual status of the economy is unarguably a part of conduct under the transparency and good governance. What is not acceptable in the eyes of the general public is the CBSL declaring a cherishing of the economy and adopting actions in contrast to the said status of the economy.

As analysts, if we try to undermine the deliberation by the CBSL to declare the actual status of the economy as a pre-obituary notice, we are not endorsing transparency and good governance although we advocate both attributes. It is an utter exaggeration to rate the current status of the economy as a patient in critical condition where emergency unit treatment is required.

Have CBSL’s recent actions distorted market interest rates?

Have CBSL’s recent actions distorted market interest rates?

The low interest rate structure consists of all the interest rates in the market prevailing at low levels. Key such interest rates are: Sri Lanka Inter-bank Borrowing Rate (SLIBOR), Average Weighted Deposit Rate (AWDR), Average Weighted Prime Lending Rate (AWPLR), Treasury securities rates and Repo rate. In line with the decline in overall interest rates, deposit rates represented by AWDR of the banks also declined and so the banks’ lending rates also (as represented by AWPLR).

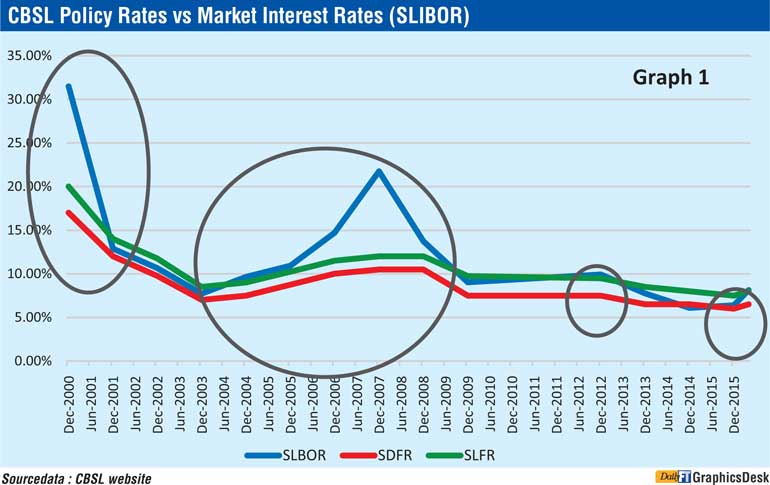

Money market interest rates are always very volatile within a very short period of time largely impacted by the day-to-day liquidity in the banking sector. CBSL policy rates include two legs – CBSL Standing Lending Facility Rate (SLF) which is the lending rate to the banks for overnight. The second leg is the CBSL Standing Deposit Facility (SDF) rate which is the rate at which banks can park its excess money with CBSL for overnight. Currently, these two rates stay at 8% and 6.5%, respectively. Currently, SLIBOR has slightly gone above the SLF rate. However, it is not a situation for banks to make arbitrage profits.

Arbitrage profits are the risk-less profits made without committing funds for a period, even for one day. SLBOR is the rate applicable for lending and borrowing by banks in Sri Lanka in rupee terms without any collateral. Borrowing from CBSL standing facility by Bank X and lending to such money to Bank “Y” at a higher rate does not fall within these definition of arbitrage profits. Bank “Y” directly does not go to the CBSL and borrow at relatively lower rate than the rate charged by Bank “X” because it does not have adequate Government securities to pledge with CBSL as collateral for borrowing. Therefore, Bank “Y” goes to Bank “X” and ask for money at inter-banking rate without collateral. Therefore, Bank “X” assumes risk of Bank “Y”, therefore, risk premium should be added to the interest rate charged from Bank “Y”. This money is lent by Bank “X” at least for one day. It is a misleading definition for arbitrage profits.

As depicted in Graph 1, this phenomenon of SLIBOR going above the SLF rate is not a market condition exceptional to the current status. If it is attributed to the results of mismanagement by the Monetary Board, this mismanagement has been there systematically for above last 15 years. It is a short-term phenomenon which tends to prevail in the market when interest rates are under pressure. Currently, SLIBOR is slightly higher than SLF rate by about 0.2%. In contrast, historically this difference between SLIBOR and SLFR has been sometimes about 10% or more.

Are depositors deprived under the current circumstances?

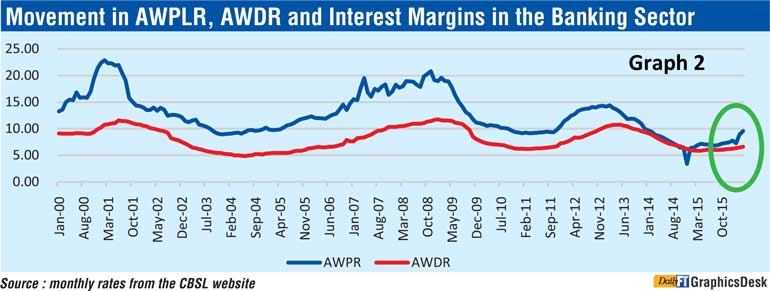

Another misconception against the Monetary Board increasing the SRR is of the adverse impact on the depositors since the deposit rates are reduced to accommodate the cost of increased SRR while lending rates are kept at the same level. This opinion contradicts with reality and otherwise is proved by the readily available market information about the movements of the banks’ deposit rates and the lending rates (Graph 2).

Today, no bank or any other deposit taking finance institution is in a position to reduce deposit rates arbitrarily as very easily their deposit base can be cannibalised by competitors. Banking sector deposit rates increase but not as fast as the increase in the lending rate and wise versa. Lending rates are more sensitive to the latest developments in the money market while deposit rates react with a time lag of few months.

Therefore, what practically happens is that the banking sector passes the cost of increased SRR in the form of increased lending rates to the borrowers which will make the borrowing costly, thereby curtailing the credit growth. This is exactly the intention of the any monetary authority in using the SRR as a tightening tool. It is what has been achieved in the market.

Do banks enjoy supernormal profits?

Do banks enjoy supernormal profits?

Similar to the Monetary Board being a very easy and common target, the banking sector is also criticised whether they make profits or losses. The misconception is that banks are making extraordinary profits at every occasion whether interest rates increase or decline.

Thanks to too many financing institutions in the sector with all having the permission to accept some form or all forms of deposits, the banking sector is so competitive with under-cutting practices in deposit mobilisation to lending. This is the actual and practical picture in the banking sector. During 2014 and 2015, bank’s interest margins narrowed to the bottom and negative margins were also experienced by the sector (Graph 1). This means banks lent at lower rates than their cost of funds because they wanted to keep both the depositors and the borrowers for future business profits. This is exactly what is happening practically in the banking sector.

During 2016, interest margins earned by banks slightly increased by first quarter of 2016 due to increase in lending rates, not due to decline in deposit rate. But this margins will narrow down in months to come as deposit rates follow up the lending rates with a time lag of few months. Banks’ lending rates get adjusted faster than the deposit rates during an increase or decline in general interest rate structure. This is the exact practical scenario in the banking sector. Therefore, it is not rational to conclude by looking at a point of data to say that banks are left for supernormal profits.

During 2016, interest margins earned by banks slightly increased by first quarter of 2016 due to increase in lending rates, not due to decline in deposit rate. But this margins will narrow down in months to come as deposit rates follow up the lending rates with a time lag of few months. Banks’ lending rates get adjusted faster than the deposit rates during an increase or decline in general interest rate structure. This is the exact practical scenario in the banking sector. Therefore, it is not rational to conclude by looking at a point of data to say that banks are left for supernormal profits.

It is a very primitive approach to measure the performance of whatever a business unit by simply looking at profits. The most accepted parameter is “profitability” in which Return on Equity (ROE) and Return on Assets (ROA) are evaluated. Every year, your profits will simply increase although under same rates of return as you commit more and more money in the business. What matters is the rate of return you generate from the business on such committed money.

If the banks can simply reduce the deposit rates detrimentally to the depositors and enjoy increased margins continuously, banks do not have a reason to move away from core-banking business and increasing focus on non-core banking business. Banks tend to do so because under the stiff competition, they cannot make adequate margins to make target rates of returns for their shareholders through traditional lending activities. However, these is no any adversity for the economy due to banks adding non-core banking activities into their business portfolio. This shift has already occurred in other parts of the world and a large component of the banks’ bottom line is contributed by non-core banking business. This is where financial innovation and efficient use of capital is achieved.

Loan to value ratio for vehicles

Credit growth in the banking and finance companies was contributed considerably by leasing/hire purchase on vehicles. Vehicle imports increased during 2015 at a high rate eating up the country’s foreign currency. These imports were facilitated by the easy financing schemes offered by banks and other financial institutions. This created three prong concerns to the economy and the stability of the finance sector altogether.

1. Foreign currency drain was experienced on vehicle imports.

2. It added to the excessive credit growth exerting pressure on inflation.

3. It increased the risk exposure for the lending institutions which required them to keep more impairment provisions. Under the new accounting standards, lending institutions are required to assess the impairment under each institutions historical experience for about 1-3 years and make provisions in accordance.

It is clear for a rational person that the increase in import duties for vehicles is not claimed by CBSL as a revenue generation activities to the Government, but as a mechanism to excessive control dollar outflows one of deferrable imports. With the increase of this duties coupled with banks decelerated appetite for vehicle leasing, the vehicle demand dropped drastically easing pressure on exchange rates during 2016.

Has the objective of the CBSL been achieved?

Credit growth of an economy is promoted by low interest rates and the banking sector high liquidity. Excessive credit growth is followed by the inflationary pressure. When SRR is increased the impact is two folds. Firstly, commercial banks have to sterilise more funds from deposits received in rupee terms. Commercial banks’ ability for money creations and lending through deposit money is restricted.

Secondly, a percentage of deposits equivalent to SRR does not generate lending income to the banks. Banks have to increase the lending rates to recover their cost of SRR funds which are kept with the CBSL. Therefore, through increase in SRR, both low interest rates and the excess market liquidity can be addressed. It will bring desired results through curtailing credit growth in the banking sector. These desirable results are already being achieved in the banking sector.

Credit demand in the sector commenced decelerating. Both lending and deposit rates increased. SRR swept part of the excess liquidity in the banking sector which made money for lending expensive, thereby curtailing credit growth. In today’s context of the banking sector dynamics, it is beyond the reality to say that SRR is a dead duck as it has already brought the intended results.

Institutional investors are always blamed

Officials of the public sector institutional investors are bombarded with various criticisms and allegations for which they had to stand up and explain the investment strategy routinely. These criticisms and allegations are existing for last 15 years, as the writer has experienced, against public sector institutional investors including EPF and ETF and continue to emerge.

The most common allegation emerging throughout this long period is that few public sector institutional investors attempt to suppress Government securities rates giving an undue advantage to the Government. These criticisms came from various market practitioners and professionals. Reference has been given in many instances in the reports of certain multilateral agencies. They used to term these institutional investors as “captive sources” in the Government securities market.

This public perception, although it is wrong, was there due to several institutional arrangements and size of the funds base. The fund size of these institutions accounts for trillions to hundreds of billions of rupee. It is not a surprise for somebody to assume that with such a large fund base whether these funds could overshadow the Government securities market and suppress market interest rates. Seriousness of these long-term allegations against EPF and ETF, not like Government banks and other Government funds, is that if EPF and ETF to suppress the market interest rates, the realised losses or opportunity losses have to be borne by the working population of the country, not the Government.

These were all only public perceptions due to institutional arrangements and other practices adopted those days. However, what is interesting is certain parties which level allegations against institutional investors change their stance from time to time on practices adopted by the institutional investors. Because, certain parties now seemingly taken a U-turn in their criticisms against EPF in particular. Those criticising parties indicated two main reason as evidence for EPF funds to be “captive” in the Government securities market.

First is the perception of the market of a conflict of interest as the CBSL being the custodian of the EPF money and at the same time CBSL being the agent for the Government to manage public borrowings. As the manager for the public debt, the Monetary Board has to time public debt placements and the quantum trying to reduce the interest rates on the Government securities in order to reduce the cost of funds to the Government.

On the other hand, as the manager of the EPF money, the Monetary Board is vested with the fiduciary responsibilities to earn the highest possible interest rates for the EPF money while ensuring the safety of such investments. This is where the perceived conflict of interest by the Monetary Board arises in the eyes of the general public. This perception is worse when the Deputy Governor in charge of EPF and the Deputy Governor in charge of the Public Debt Department is the same.

It is a very prudent measure taken by the Monetary Board several years ago to place these two departments which carry very conflicting objectives and responsibilities fall under two Deputy Governors so that the same Deputy Governor does not have to recommend the Monetary Board of the EPF bidding rates in the primary auction and at the same time recommend the Monetary Board with the acceptable rates and quantum of Government securities primary auctions of the PDD.

The other very strong criticism level against EPF playing as a “captive source” to Government is the EPF’s direct access to the primary issues of Government securities. Market suspected that when EPF had the direct access, through over-the-counter transactions, whatever the quantum is allocated to EPF at presumably lower rates relative to the market rates. Market participants suspected that only the balance part is made available to the rest of the competitive bidders. The market criticisms were on both the perceived appropriate rate and the quantum received by the EPF to distort the market with artificially suppressed rates.

Apart from that, EPF members also raised questions on the rates EPF received at the primary auctions through direct bidding. They questioned whether these rates can be the best rates possible for EPF funds. These perception and assumptions were not healthy for the EPF management, orderly market performance and the EPF members. Under these circumstances, it is a very prudent approach to restrict EPF and any other public sector institutional investor coming directly to the Government securities auctions through private placements.

On the other hand, it is a new and seemingly implausible criticism to say that the Government securities market can be dominated and manipulated by few private sector investors with several billions of rupees in hand. Based on the ample size of the Government securities market, this criticism is much beyond the acceptability.

Should or shouldn’t the auctions be cancelled by the Public Debt Department?

The Public Debt Department (PDD) of CBSL has the necessary legislative powers to accept or reject an auction. However, market participants and primary dealers criticise PDD for auction cancelations complaining that their trading and investment transactions cannot be planned properly. Further, they have to incur cost of bidding arrangements and time allocation which are wasted once the auction is cancelled.

The other side of the story is that, on the basis of a borrower, PDD also has its rights to postpone the borrowing or scale down when the rates and funds supply are not in its favour. At the same time it is acceptable for the borrower to scale up the borrowings given he needs funds for a cause at acceptable rates.

It is not different than an individual going for a personal loan from a bank. The individual borrower submits the application filled and signed and awaits the offer from the bank. Bank makes an offer with all the terms and conditions and the interest rate applicable. Assumed all the terms and conditions are agreeable, but if the interest rate is not affordable should the borrower go ahead and borrow from the bank? Instead, the individual borrower will differ his borrowing or will go to another bank. He will borrow from another bank only if that bank charges a lower rate than what was quoted by the previous bank.

Therefore, PDD also has two similar approaches – either cancel the auctions when they are not comfortable with the bidding rates or approach other lenders. This was where the EPF members and market participants were puzzled previously when EPF was given direct access to private placements of Government securities. However, this perception does not exist now as the EPF is not permitted private placements as per the market information.

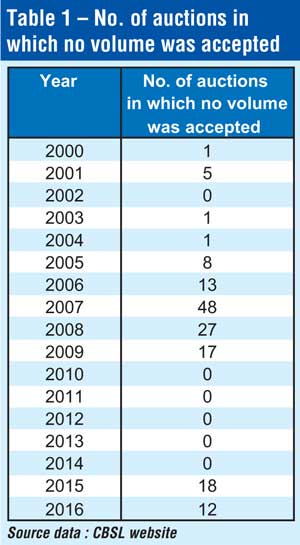

Further, important to note that cancellation of primary auctions is not an extraordinary feature adopted by the PDD of the CBSL only during the recent history. Auction cancellations were witnessed previously also. These auction cancellations tend to happen when interest rates are under pressure (Table 1).

(The writer is a former Fund Manager in the EPF Department of Central Bank of Sri Lanka and the former Vice President – Integrated Risk Management at DFCC Bank.)