Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 14 June 2016 00:01 - - {{hitsCtrl.values.hits}}

Analysis of merchandise imports and exports data of Sri Lanka reveals that the trade deficit (import export gap) has widened over the years. The deficit had in fact doubled since 2007. Despite a number of initiatives taken by the successive governments, the country has failed to increase its exports significantly. Since 2007, exports have grown a mere 4.1% ($ 2.9 billion) while non-oil imports have grown at a faster rate of 8% ($ 7.5 billion).

The new government elected in early 2015 has emphasised the need to follow a growth model driven by exports. The government plans to develop special economic zones (SEZ) around the already-existing infrastructure as well as plan future infrastructure projects to make those investments commercially viable. To achieve a growth driven by exports, the country needs to strengthen its competitiveness in the international market. Maintaining competitiveness in the input cost, restructuring the labour market and development of skills in the labour force, easy access to development finance, maintaining competitive exchange rate policy and bilateral and multilateral trade partnerships (i.e. Free Trade Agreements – FTA) are among the priorities.

As identified above, a competitive currency is a critical success factor for the export competitiveness of the country. There were instances in the past where, the exporters raised serious concern over exchange rate policy maintained by the Central Bank of Sri Lanka (CBSL) which has contributed towards erosion of the country’s competitiveness vis-à-vis its peer group. On this backdrop, it is  important to look at the current exchange rate policy and its implications which have also drawn lots of criticism from various groups.

important to look at the current exchange rate policy and its implications which have also drawn lots of criticism from various groups.

As published in the official website of the Central Bank of Sri Lanka (CBSL), the country has adopted a floating exchange rate system since 2001 which allowed an independent adjustment of the exchange rate according to the market forces of demand and supply. In the event of excess volatility in the exchange rate, the CBSL would intend to intervene to curb such excess volatility. In order to ensure an orderly functioning of the market, the CBSL prescribes maximum net open position (NOP) limits for Commercial Banks (LCBs) and closely monitors the activities in the domestic foreign exchange market.

However, market participants observe that the CBSL, in practice has deviated from this stated policy in many occasions and has intervened to stabilise the exchange rate. At the extreme, analysts argue that the CBSL in certain times has maintained soft peg exchange rate policy completely deviating from the stated floating exchange rate policy. Exporters have expressed their displeasure over this soft peg exchange rate policy which was viewed as impediment to maintaining country’s export competitiveness.

The CBSL has allowed exchange rate to depreciate at the time of economic crisis in the past. The Budget 2012 proposed to devalue the exchange rate by 3%, by passing the mandate of the Central Bank of Sri Lanka. The proposal for devaluation surprised foreign exchange market. Soon after, the CBSL stopped intervention into foreign exchange market and subsequently the exchange rate depreciated by 12% during the year 2012. After the sharp depreciation, experienced in 2012 the exchange rate stabilised for the following two years (2013 and 2014), showing only marginal depreciation of 2%.

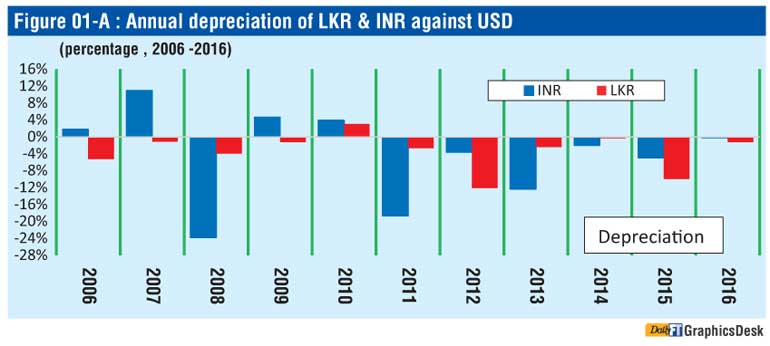

However, Indian Rupee (INR), the currency of our largest trading partner, depreciated by 14% against United States Dollars (USD) during the above same period. Figure 01-A demonstrates annual depreciation of Sri Lankan Rupee (LKR) and Indian Rupee (INR), against United State Dollars (USD).

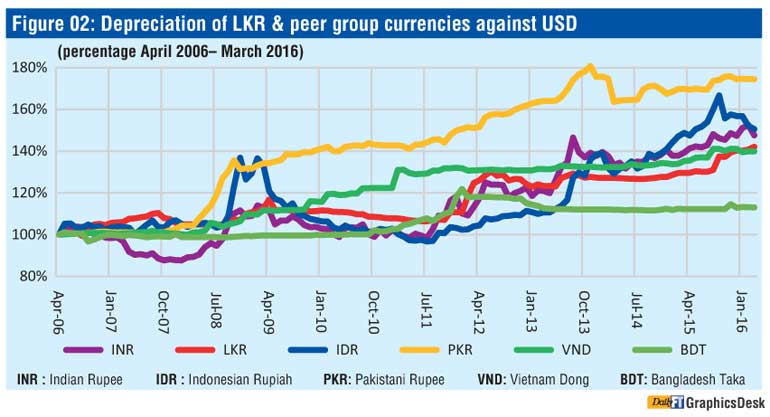

The general public is perturbed by the exchange rate depreciation experienced in Sri Lanka since the assumption of the new government in January 2015. Critics attribute this adverse movement to presumed bad economic policy of the present government, without clear fundamentals. Analysis of the performance of peer group currencies against USD reveals depreciation of LKR against USD is identical as the case with the currencies of the peer group.

Some regional currencies have heavily depreciated against USD. The above comparison suggests the recent depreciation of LKR against USD is not unusual and standalone. USD had unprecedentedly appreciated against almost all market emerging market currencies. For the purpose of comparison, it is worth to note that Indian Rupee (INR) has depreciated 42% against USD since 2010 while Lankan Rupee (LKR) experienced depreciation of 28% during the same period. This comparison with Indian Rupee (INR) is important as the largest trading partner of the country.

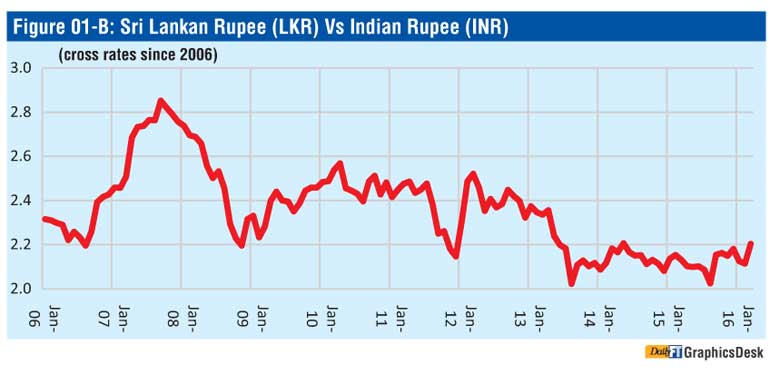

As shown in the Panel B of Figure 1, Indian Rupee (INR) has in fact depreciated against Sri Lankan Rupee during past 10 years. Figure 2 shows the depreciation of peer group currencies since 2006.

The hindsight is that the recent depreciation of LKR would help our exporters to remain competitive in tough global environment. Due to the economic slowdown in our major export destinations, primarily the United States and Europe, our exporters face severe competition and could possibly lose market share. The GDP growth, driven by the exports cannot be achieved without maintaining competitive exchange rate. In theory, depreciation of a local currency encourages exports while curbing expensive imports.

If Sri Lankan Rupee (LKR) didn’t adjust appropriately in comparison to its competitors, our competitiveness in the international markets would be seriously eroded as everyone else in the peer group has already adjusted.

Imported inflation

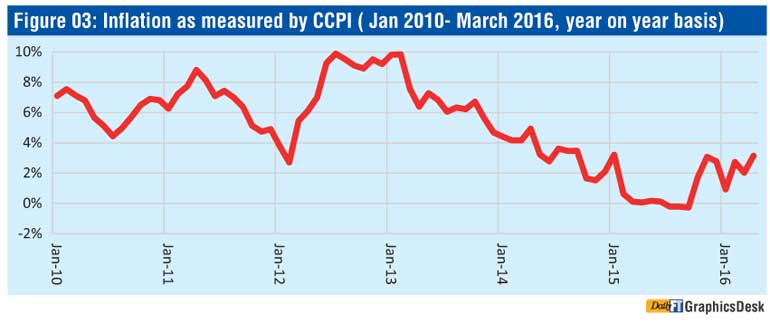

One of the key concerns of the depreciation of Sri Lankan Rupee is imported inflation as many essential goods including fuel, cereal and large number of food items are imported into the country. Sri Lankan rupee depreciated nearly 10% against the USD during 2015. The latest estimate for the consumer price inflation in the country as measured by Colombo Consumer Price Index (CCPI) is 4.8% (May 2016, year on year basis). The inflation in the food category is 5.6% while the non-food category has increased by a lower rate of 4.2%.

The uptick in the inflation has largely emanated from the non-tradable goods. This could be attributed to seasonal variation in food prices due to bad weather prevailed in the country. To put this into perspective, it remains within the comfortable zone of the Central Bank of Sri Lanka. Further analysis of consumer basket of Colombo Consumer Price Index (CCPI) reveals, only 30%-40% of the basket could perhaps be affected by such exchange rate depreciation. Given the administered nature of the fuel price and many imported essential goods, space for such imported inflation is further lessened.

As mentioned earlier, depreciation of currency helps to curb unwanted imports. Even if the prices are not administered, the imported inflation will be less severe as the global oil and commodity prices have significantly plunged. It is a better time to absorb part of the shock now. Such adjustments could have been severe had commodity prices remained elevated.

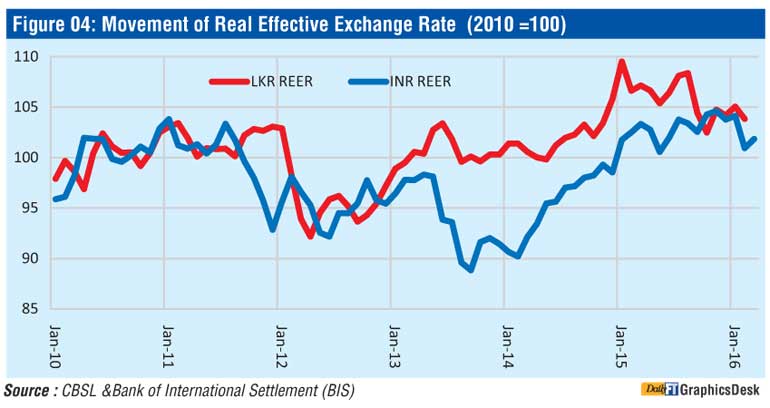

Real value of a currency (exchange rate) is measured through real exchange rate; a broad summary measure of the prices of one country’s goods and services relative to those of another country or group of countries. According to Bank of International Settlement (BIS), a nominal effective exchange rate (NEER) is an index of some weighted average of bilateral exchange rates.

The real effective exchange rate (REER) is the NEER adjusted by some measure of relative prices or costs; changes in the REER, thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners. The observation of real effective exchange rate (REER) of Sri Lanka and India suggests that recent depreciation of Sri Lankan rupee has allowed the currency to remain in line with its real valuation. If LKR was artificially held fearing imported inflation, REER could have remained above the equilibrium level.

Having understood the need for modernising our export sector, fairly valued currency is a necessity for maintaining the country’s competiveness.

From the policy perspective, the CBSL has raised interest rates and allowed the exchange rate to depreciate significantly in response to weak internal and external environment. The CBSL has stated that there is no need of further tightening of monetary policy at that time indicating the adjustment would take effect with a lag. However, if the Fed (the Central Bank of the United States) decided to raise its reference Federal Funds Rate, the USD may tend to appreciate further. The CBSL may consider it is appropriate action to raise local interest rates in such an environment to manage the impact of possible USD appreciation.

The Central Banks around the world have different mandates. The main objective of a central bank is to maintain price stability. The Central Banks have to carefully navigate the economy in controlling inflation without curtailing economic growth. The CBSL has two core objectives: maintaining economic and price stability and maintaining financial system stability with a view to encourage and promote the development of the productive resources of the country. Analyst argues that the CBSL should focus on interest rate anchor while allowing free movement in LKR, implying such policy would enable the country to maintain healthy growth in exports by maintaining competitive exchange rate policy while facilitating the growth in domestic economy by relatively low interest rate regime.

Despite widespread criticism, the recent depreciation of LKR should be viewed as a necessity from the analyst perspective. It could be attributed to the appreciation of USD against all currencies in the emerging markets and our peer group, rather than standalone weakness of LKR or the underlying economy. The fear of high imported inflation is insignificant at this environment as the international commodity prices have fallen significantly. The depreciation of LKR has helped Sri Lankan exporters to remain competitive in tough global environment as indicated by real value of the currency.

(The writer is a former Fund Manager at the Employees Provident Fund (of the Central Bank of Sri Lanka) and former Investment Manager (international investments) of Hayat Invest Company in Kuwait.)