Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 11 January 2016 00:10 - - {{hitsCtrl.values.hits}}

Ricardo Hausmann

Sri Lankans’ strange psyche: Exports are good but Imports are bad

There is a popular economic belief among Sri Lankans that in order to build Sri Lanka as a strong nation, it should produce everything within the country and say goodbye to imports as far as possible.

It is so indelibly ingrained in the psyche of Sri Lankans that it is not a belief that could easily be erased. Anyone who speaks against it is immediately branded as somebody odd, without nationalistic sentiments and pro-Western. Hence, politicians of every generation have used it as an effective mantra to rally masses around them.

Historically, this belief was put into practice by directing public policy to impose import controls and develop what were known as ‘import substitution industries’. When these import substitution industries could not survive without continuous Government protection and support, that policy was temporarily abandoned in 1977 when the country moved for export-oriented economic growth. But subsequently, the nation, supported by convincing arguments by some critics, began to experience that even the export-oriented economic growth policies had failed to deliver their promises.

True that policy transformed the economic structure and generated some economic growth. But, that economic growth was not adequate to push Sri Lanka to the rich country club status within a generation, the aspiration of many.

Rechristening import substitution as import replacement

Hence, import substitution was rechristened during the last administration by giving it a new name called ‘import replacement economic strategies’. This new name was coined by its topmost economic policy official, Dr. P.B. Jayasundera, possibly to remove the bad spells which the previous import substitution policies had carried.

Thus, the policy package adopted by Sri Lanka since about 2005 paid lip service to export growth and concentrated on developing a domestic economy-based economic strategy as its policy thrust. The results are well known: though exports increased in absolute terms, they failed to record an increase compatible with either the domestic economic growth or world export growth. This was manifested by a sharp decline in the exports to GDP ratio from around 28% in 2004 to less than 15% in 2014. Similarly, Sri Lanka’s exports as a percentage of the global exports too fell from 0.08 in 2000 to 0.05 in 2014.

Imports are necessary even to promote exports

Sri Lanka, being a country with a small domestic economy in terms of both size and income, cannot think of generating high economic growth continuously without opening its borders for exports. Since the country does not have a sufficient supply of domestically available raw materials, it also requires the country to continue with an open import policy program. As such, without imports, the country cannot grow its exports. Hence, imports are connected to exports through a very strong umbilical cord and it can be severed only at the risk of impeding both exports and economic growth.

Increase the value added of import-based industries

If imports are necessary for exports then how could the country grow continuously since what it produces is leaked out in the form of a higher import bill? The secret lies in what the economists call the ‘value added’ in which the country would contribute to produce a more value-contained product by using its own labour resources, facilities and services.

This positive value added will generate local income and if the product or the service in question is sold to foreigners, it would then get sufficient foreign exchange revenue to pay for imports. Hence, the trick which a country should use is that it should produce by using imports a higher proportion of exportable goods and services.

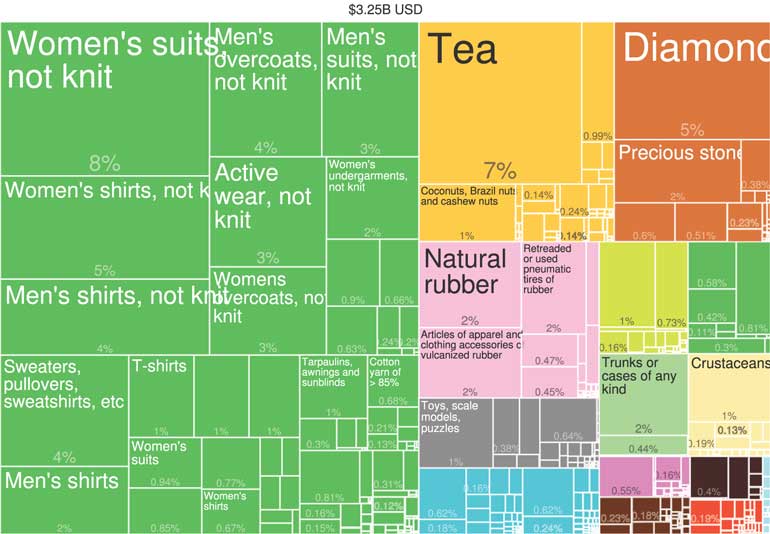

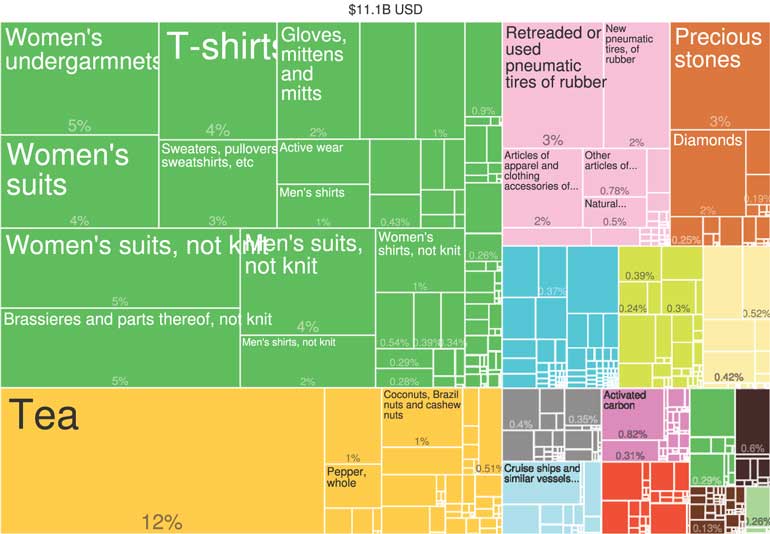

For instance, when the country went for garment and textile industry as an exportable commodity after 1977, the local value added was just 5%. With the development of a local supply chain, this has now increased to 45%.

Comparatively, tea generates a value added of 90%. But garments and textiles now earn three times more than tea. Hence, the value added of the garment and textile industry standing at $ 2.2 billion in 2014 has far exceeded that of tea industry which amounted to just $ 1.4 billion. Hence, a country can have a smaller percentage of value added but it can compensate itself if it has a bigger volume of exports.

Past growth has come from domestic services and not from exports

Then, how has Sri Lanka gotten into a severe foreign exchange crisis in the recent past? The blame goes to the domestic economy based economic policies pursued by the Government in the last 10 years.

During this period there was a significantly high economic growth in the country as announced by the Department of Census and Statistics amounting to on average about 6.5%. Yet, the whole of that growth had come from the domestic services sector comprising mainly trading activities, telecommunication, government services and the banking services.

Economists call these services non-tradables because they are mainly meant for domestic consumption and not for selling to foreigners. Hence, while the economy grew, its foreign exchange earnings did not grow in a commensurate manner as the growth in the economy.

Foreign exchange crisis is due to domestic orientation of production

The result was a higher import orientation by people who now had larger domestic incomes. Accordingly, it increased the import bill while stunting the export earnings generating a bigger and bigger trade deficit in each of the passing years. The trade deficit was partially met out of the moneys sent by Sri Lankans working abroad, called foreign remittances, according to the Central Bank. But, the recipients of foreign remittances too had a high import orientation. Hence, the money so received too leaked out of the country over the years, further widening the trade deficit and thereby augmentingthe foreign exchange crisis.

Accordingly, the proper economic strategy for the country should have been to produce not just for the local market but for the wider global economy. Having identified this dire need, the Economic Policy Statement of the Prime Minister, delivered in Parliament in November 2015 had announced that Sri Lanka should produce for a market much bigger than its local market meaning that exports are to rescue the country.

Ricardo Hausmann’s validation of policy strategy

This economic strategy was validated by Ricardo Hausmann of Harvard University’s Centre for Economic Development delivering the main address at the Sri Lanka Economic Forum concluded last week in Colombo.

Hausmann was responsible, along with MIT’s Cesar Hidalgo, for compiling an economic complexity index and preparing an economic complexity atlas for the world nations (available at: http://atlas.cid.harvard.edu/).

This writer in a previous article arguing that Sri Lanka should convert itself from a simple product producing economy to a complex product producing economy in order to win the global export markets introduced Hausmann and Hidalgo to Sri Lanka’s readers (available at http://www.ft.lk/article/109904/SL-s-future--Convert-the-simple-economy-into-a-high-tech-based-complex-economy).

Both Hausmann and Hidalgo have used the historical data to map the economic complexity of the export structure of the world nations and the map pertaining to Sri Lanka has not changed even a little bit since the first map so prepared for 1995. In his presentation in Colombo, Hausmann used this rich data base liberally in the form of graphs, maps and historical developments to prove his point.

Debunking the belief that growth should come only from the domestic economy

He first debunked the popular belief that Sri Lanka could grow and generate prosperity to its citizens merely by producing for the local economy. When he plotted the export growth against the economic growth for the last 10 year period, it showed that both variables had moved one for one in the same pattern over the period.

Accordingly, when exports went up, so did the economic growth. When exports faltered, economic growth too faltered. Thus, if there is any extraordinary growth that has been made by Sri Lanka over this period, that growth has simply come from better-performance in the export sector. This revealed that if Sri Lanka wishes to raise its growth and sustain it over the period, it should necessarily concentrate on tradable goods and services. Those tradable goods are used by people outside the country and therefore, Sri Lanka should have better trade relationships with its main customers if it is to promote them.

If on the other hand, Sri Lanka produces purely for the local market as it had done over the previous 10 year period, it could still attain some economic growth but that growth would not be adequate and sustainable. This is the crucial policy dilemma which Sri Lanka has been facing right now compelling the Prime Minister to choose a path leading along the export sector. Hausmann very clearly validated the path so chosen by the Government.

Sri Lanka’s simple product producing track record

Then, Hausmann went into the roots of the current crisis in the external sector to find that Sri Lanka had been concentrating producing simple technology products to the world market. There had not been any change in the product mix between 1995 and 2014. In both years, about 98% of the country’s exports had been simple-technology products like garments, textiles, plantation crops, etc. The danger with such a product orientation is that they are easily copiable and anyone with cheap labour could start producing the same to the world market in competition with Sri Lanka.

Garment and textiles sector being threatened by new entrants

This has already happened in the case of Sri Lanka’s lifeline of exports, namely, garment and textiles. With respect to these products, cheap labour countries like Bangladesh, Myanmar and Cambodia have already begun to compete with Sri Lanka away from the world markets.

Sri Lanka had a good fortune with the garment and textile sector in the past. It helped the country to reduce its reliance on the plantation crop sector and allowed it to provide employment to a sizeable portion of the country’s aspiring youth. It over the years became a good contributor to economic growth by increasing the value added from 5% to 45%. All these pluses it has brought to the economy are granted.

Yet, the future of the garment industry in the midst of competition coming from low wage countries as pointed out by Hausmann has been gloomy. It may also be threatened by the introduction of new manufacturing technologies like 3D Print Manufacturing by making it a household production rather than a factory production. Hence, Sri Lanka should seek out new production lines over which it still could command competitive and comparative advantages.

Sri Lanka remaining a laggard while others becoming leaders

Hausmann used his data base to identify the countries which too shared Sri Lanka’s product mix in 1995 in the past to find out where they are now. Strangely, countries like Thailand, Turkey and Costa Rica had shared the same product mix which Sri Lanka had at that time. That mix consisted of a proportionately high percentage of goods that used simple technology for production. The amount of high tech exports was negligible.

But those countries have now changed their product mix significantly into mainly complex technology using products. What has happened is that while Sri Lanka had been complacent with what it had in 1995, the other countries have successfully changed their product mix to sustain economic growth. Sri Lanka got itself elevated to the status of a lower middle income country. But the three countries under consideration managed to become higher middle income countries and are virtually at the doorstep of joining the rich country world.

Thus, Sri Lanka had been a laggard, while the other three countries had been leaders. This is a crucial lesson which Sri Lanka’s policymakers have overlooked in the past and should take into account immediately when framing its future growth strategies.

Sri Lanka’s competitive advantage in tourism and hi-tech products

The current challenge faced by Sri Lanka is how to catch up with the other fast-growing countries in the world. Haussmann gave some hints about this in his presentation.

According to him, the products in which Sri Lanka is doing well today such as tea, garments and textiles have no promise for the future. That is because Sri Lanka’s wage rates have increased over and above those of its competitor countries in both these products.

Hence, Sri Lanka’s choice is clear with respect to these products. It cannot reduce wage rates. But it can increase productivity in them and accommodate the increase in costs due to increases in wage rates. If it is not possible, it has to concentrate on other types of products over which it has competitive advantage due to its wage rates still being lower than its competitors. Haussmann opined that Sri Lanka can move into tourism industry and hi-tech products because its wage rates are significantly lower than the competitor countries. The biggest earners of tourism income today have been the rich countries like France, UK and Spain. The wage rates in those countries are significantly higher than those in Sri Lanka. Hence, with proper marketing strategies and logistical support, Sri Lanka can move into the tourism sector in a big way. Similarly, in the case of high tech products too, Sri Lanka’s wages remain significantly lower than those in the close competitor countries like Malaysia, Thailand and Indonesia.

Build the technological base over the next 10 to 15 years

What is therefore necessary is to build up the technological base of the country in order to become a hi-tech product exporter country. This is difficult, but not impossible as this writer has argued in a previous article on the subject in this series (available at: http://www.ft.lk/article/228844/Becoming-a-technologically-advanced-nation). But it is not a goal which Sri Lanka can attain tomorrow. It will take at least another 10 to 15 years for Sri Lanka to become a nation with hi-tech products, provided it lays a firm foundation for it.

The outcome of the Sri Lanka Economic Forum 2016 should be to lead Sri Lanka along this path.

What did Sri Lanka export in 1995

What did Sri Lanka export in 2014

(W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka can be reached at [email protected])