Saturday Mar 07, 2026

Saturday Mar 07, 2026

Friday, 15 July 2016 00:00 - - {{hitsCtrl.values.hits}}

A few years ago, a new technology began shaking up the global capital markets: The advent of ‘high-frequency trading’, where

A few years ago, a new technology began shaking up the global capital markets: The advent of ‘high-frequency trading’, where  machines take positions on stocks in competition with human investors. High-frequency trading is out of reach for ordinary investment firms and the general public, who can only dream of access to cutting-edge technology. Its speed, measured in microseconds, has necessitated new dark fibre lines to be laid from Chicago to New York for the use of competing hedge funds. Despite continued growth, high-frequency trading remains in a black box.

machines take positions on stocks in competition with human investors. High-frequency trading is out of reach for ordinary investment firms and the general public, who can only dream of access to cutting-edge technology. Its speed, measured in microseconds, has necessitated new dark fibre lines to be laid from Chicago to New York for the use of competing hedge funds. Despite continued growth, high-frequency trading remains in a black box.

Yet another new technology, known as ‘robo advisors’, now provides automated asset management with little or no human interaction. However, unlike high-frequency trading, it is a technology that is available to the general public and ordinary investment firms. Robo advisors use well-defined algorithms and rich user interfaces that can interact with clients, ask questions, and personalise portfolios based on investor responses. They have begun to change dynamics in wealth management and will be tapping new markets in the future. Robo advisors represent one of the strongest technology waves so far, and it is now making its way to retail investors.

Robo advisors: is it something new?

Robo advisors are well-defined algorithms that carry out the job of an investment advisor or wealth planner. Modern portfolio theory and new strategies might underlie the technology, and they can also be ETF-backed. The great novelty of robo advisors is, however, not in the service they provide, but in the manner in which the service is delivered: they are available online via either browsers or mobile apps. Investors need not personally meet with wealth planners or advisors – they can simply open up a robo advisory app and provide investment details, risk levels, and other relevant information, and the robo advisor will plan the portfolio within seconds. It can also rebalance an existing portfolio.

Why robo advisors?

Wealth management is an expensive service that requires a lot of effort and human interaction. Investment advisors usually sit with investors to plan their retirement or manage their wealth. A human advisor can support only a limited number of investors, usually a few, and will therefore set a minimum investment level for the provision of their service. As the cost of planning and management is high, the minimum investment level will be correspondingly high: not everyone can afford to meet the minimum investment level for wealth management services.

Robo advisors can almost entirely replace human advisors while providing higher scalability. They have no limit to client numbers. This reduces management fees and commissions drastically, since fund-management organisations no longer need to maintain large payrolls for human wealth managers.

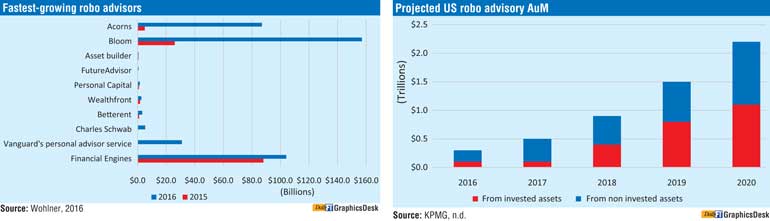

Whether machines can provide services at the same quality as what humans provide will always be debated. That said, robo advisory has been growing rapidly; as of 2015, the industry has reached $ 19 billion.

Robo advisory taps a niche market

Fund-management firms chase investors who have many thousands of dollars in retirement plans. Generally speaking, they are not interested in young professionals who have, for example, only $ 500 to invest. Robo advisors, however, tap a retail market where even an investor of $ 500 can own a portfolio to suit his or her risk appetite and expected benefits. Robo advisors thus enabling small-scale investors could boost the economy by making wealth planning available to everyone at minimal fees. Some robo advisory firms even offer the service for free for very small investments.

Do robo advisors pose a threat to traditional asset/wealth-management firms?

The threat from robo advisory to traditional firms is real, although it might not be significant at the moment. Robo advisory lacks human involvement, but involves a lot of technology, so it might not be to everyone’s taste. Not everyone is comfortable with technology and not everyone has confidence in technology. Robo advisors are popular among the young generation, who are comfortable with technology and show greater confidence in it. Even the smaller cap for an initial investment poses a barrier to the young generation against buying wealth-management or asset-management services. However, robo advisors have drastically reduced this cap. Moreover, the young generation likes to have information at their fingertips and performance at high speeds. Robo advisors thus meet many of the young generation’s demands.

“CFA Institute found that large majorities of investors in Canada (81%), the US (73%), and the UK (69%) believed they would still want the help of an investment professional, instead of the latest technologies and tools, in three years’ time.” (Flood, 2016)

Robo advisory is still small, but natural law will increase the threat to traditional investment advisors as the younger generation replaces the older one and becomes the demography that makes large investments. Given their ease around technology and their familiarity with robo advisors from a young age, the guarantee that they would move to traditional investment advisors is weak. The future might not be rosy for traditional investment advisory firms. Some of the biggest asset managers are now providing robo advisory for low prices in order to win clients. Black Rock, the largest asset manager, acquired FutureAdvisor with an eye on its robo advisory technology (Reuters, 2016).

Impact on investment advisors

Robo advisors are initially expensive to develop, but they enjoy minimum running costs and high scalability. They also work at ultra-high speeds; humans are no match for them in terms of information processing, report generation, and on-demand information. Replacing expensive human investment advisors with cheap computers can significantly save costs and also benefit clients via very low management fees.

Importantly, robo advisors work strictly according to creator-defined rules and cannot take emotions into account. A human advisor, while not being as fast as a robo advisor, can take emotions into account and can understand a human client better than a computer. A human advisor can therefore provide clients with personalised plans that capture certain information types that elude computer algorithms. Investment advisors now have a benchmark to beat: robo advisory’s low management fees. In this situation, human advisors should be compelled to sharpen their skills and generate more returns for their clients in order to stay ahead of the competition. Under the current economic conditions, advisors will face considerable price pressures.

“We see the advent of robo-advice as an example of automation improving the productivity of traditional investment advisers, and not a situation where there is significant risk of job substitution,” Citi analysts led by Ronit Ghose wrote in their report. “Higher net worth or more sophisticated investors will, in our view, always demand face-to-face advice.”

Robo advisory for Sri Lanka

Sri Lanka is a small market for equity and fixed income. The country might not have large investment funds, but robo advisory does not necessitate an involvement of large funds. Robo advisory could attract young professionals willing to invest small funds, and therefore might be the ideal start-up fund, since it does not require a lot of staff and expensive investment professionals. A hybrid model might work very well.

Currently, the country has very few wealth management firms. It will be easy to introduce robo advisory, since wealth management firms might have their own tools that can be connected to a front end and converted into a product for small investors. Human advisory can be retained as a premium service, while robo advisory can be sold as an economical option.

Sri Lanka has many high-end technology and research organisations that include software engineering and finance disciplines. These organisations could provide robo advisory solutions for Sri Lankan wealth management firms as a separate service segment within wealth management. Thus, wealth management firms could enter new market segments and look for low-commission, high-volume sales.

Some wealth management firms could acquire out-of-the-box robo advisory solutions to introduce to local investors. However, own products might be a wise option, given that a firm’s trading strategies could be continued for greater advantage. Examples of this have been noted in high-frequency trading, where banks acquired out-of-the-box solutions, but often developed the tools’ core component. It is unclear how far we are from the entry of proper robo advisory into our market, but an entry will provide a new set of investors access to our financial markets. Sri Lanka has ample human resources for the development of robo advisory systems on par with those of developed markets.

Future of robo advisory

Robo advisory is only the tip of the iceberg. Today, investment banks and financial institutes are spending heavily on technology, having seen its potential. According to Business Insider (2015), Goldman Sachs’ tech team have a headcount of around 9,000 – similar to Facebook’s in the US (including non-technical staff). This means some banks have more engineers working on technology than do technology companies proper.

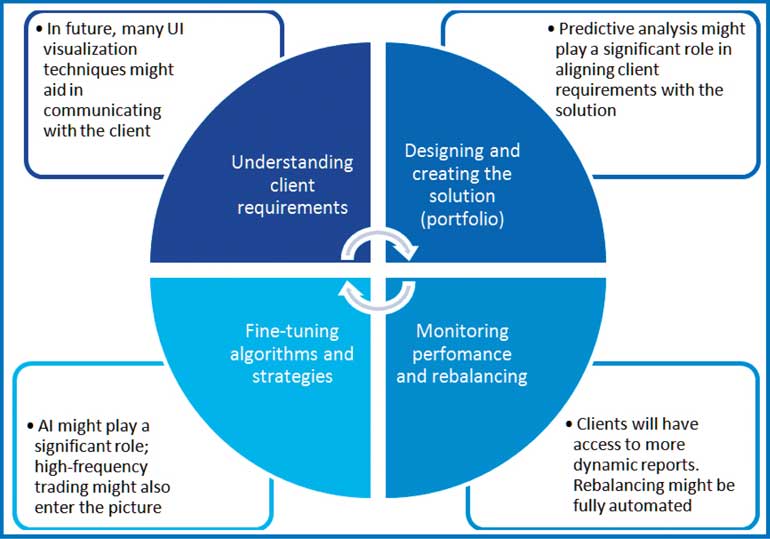

Alongside growth in big data and machine learning, robo advisory will have increasingly more room to grow. Engineers can introduce complex strategies to robo advisory, enabling bots to process peta bites of data within seconds to take stock positions and rebalance portfolios. This will render asset/wealth management highly competitive. Humans can combine their understanding of emotions with robo advisory technology.

Artificial intelligence (AI) will play a significant role in robo advisory. Advisory technology of the future will involve a lot of complex strategies backed by AI and predictive analytics. AI-based hedge funds are already in business; soon, robo advisors connected to AI-based ETFs will automate the investment process. Investors will have personal advisors on their phones so that they can be better connected and able to participate actively in rebalancing and maintaining their portfolios.

Trading floors will soon become less crowded. Just as electronic trading has pushed traders off the trading floors, robo advisory technology too could reduce human advisory. If earnings are published in standard formats, robots will be able to execute not only quantitative models, but also equity-based models. It might not be long before we see AI-based, fully automated analysts that can produce forecasts faster and more accurately than human analysts can. It will be a battle only between top-end analysts and computers, as advisors/analysts with mediocre modelling capabilities will be easily outsmarted by technology.

(Rohan Fernando is Vice President, Quantitative Research at Copal Amba Colombo. The views expressed herein are solely those of the author and do not

represent the views of his

employer, Copal Amba.)

Bibliography

Bloomberg, 2016. Citi: Robo-Advisers Will Never Take the Place of Traditional Investment Managers. [Online].

Deloitte, 2015. Robo-Advisors Capitalizing on a growing

oppotunity, s.l.: s.n.

Flood, C., 2016. Race to provide robo-advice hots up. [Online]

Available at: http://www.ft.com/intl/cms/s/0/30cbb40a-dcbd-11e5-827d-4dfbe0213e07.html#axzz4As9u56cT

KPMG, n.d. Robo advising, s.l.: s.n.

KPMG, n.d. Robo advising catching up and getting ahead, s.l.: s.n.

Reuters, 2016. [Online]

Available at: http://www.reuters.com/article/us-lpl-roboadviser-idUSKCN0XA2DH

Wohlner, R., 2016. [Online]

Available at: http://www.investopedia.com/articles/financial-advisors/030216/which-roboadvisors-are-growing-fastest.asp