Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 16 February 2016 00:01 - - {{hitsCtrl.values.hits}}

In office real estate, vacancy levels in prime commercial areas play a vital role in deciding who shall have the better bargaining power while executing the transactions. Minimal vacancy levels in commercial pockets give developers an edge while negotiating. Office occupiers always find it tough to find the right office space in such landlord market conditions.

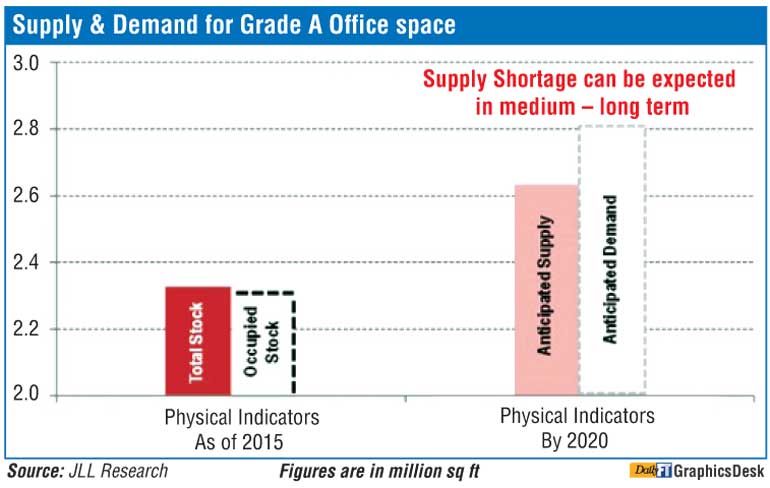

The current situation in Colombo office market is no different. Presently, Sri Lanka has eight Grade A office buildings with a total area of 2 million sq ft, all of which are nearly fully occupied and located in the CBD of Colombo. The occupancy rate of these buildings is as high as 95% as at the end of 2015, up from 60% in 2009.

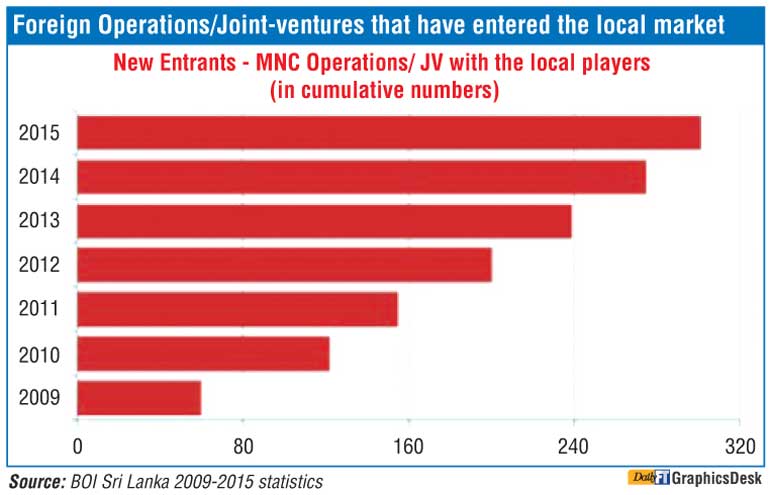

A stable and business friendly environment generated by the government helped restore investor confidence. On one hand, domestic companies showed stable growth, and on the other a surge was recorded from 2009-2010 of foreign companies entering the country. The Government’s infrastructure developments including the development ports and roads led to the construction industry expanding over the past years. Among the MNC’s, construction, food processing and IT businesses showed interest in opening up offices.

Future trends indicate that the demand for office spaces in upcoming years is likely to be robust. Macro indicators of Sri Lanka  support the hypothesis. In 2016, out of 189 countries, the World Bank listed Sri Lanka at 107, as opposed to 113 in 2015, in terms of ‘Ease of Doing Business’. Recent policy changes proposed in 2015-16 budget are expected to impact private and foreign investments positively. Revival signs in the Sri Lankan economy can be seen from the promising GDP growth expected in the next few years. According to the Asian Development Bank, the GDP growth rate is forecast to reach 7% in 2016 from 6.3% in 2015.

support the hypothesis. In 2016, out of 189 countries, the World Bank listed Sri Lanka at 107, as opposed to 113 in 2015, in terms of ‘Ease of Doing Business’. Recent policy changes proposed in 2015-16 budget are expected to impact private and foreign investments positively. Revival signs in the Sri Lankan economy can be seen from the promising GDP growth expected in the next few years. According to the Asian Development Bank, the GDP growth rate is forecast to reach 7% in 2016 from 6.3% in 2015.

Meanwhile, as Sri Lanka’s commercial capital, Colombo is considered one of the upcoming commercial hubs of South Asia, it is expected that greater activity in commercial real estate will soon be observed.

From the market research done earlier by JLL in 2015, there were clear signs that the office space demand would be greater than the quality supply by end of 2020. Although there is a pipeline of 2.6 million sq ft for supply in medium term, demand of 1.5 million sq ft from the IT/ITeS sector alone is expected in the upcoming years.

The new government’s plans of making Sri Lanka the most competitive economy in South Asia will contribute to the incremental demand of office space not only from BPOs but also from FAOs (Financial Accounting Outsourcing). Furthermore, Travel and Tourism is expected to grow with the new budget of 2016 proposing the promotion of the MICE (Meeting Incentives Conferencing and Exhibition) sector.

Interestingly, for the past four quarters, due to the limited quality space available, CBD sub-market rents have increased 7-10% y-o-y in almost all Grade A buildings. New entrants such as MNC firms are likely to be flexible and ready to pay premiums for space that meets their specifications.

It is going to be a prime need for the authorities to make the path for the occupiers to source office spaces better. Some suggestions are:

City development authority can notify some of the land parcels from neighbouring submarkets to commercial development use to ease pressure on the CBD areas. Commercial office developments in those pockets will allow occupiers some more options to choose from in the medium term.

Developers should look at sustainable buildings as a strategy to control their costs considering the long term perspective. Green buildings will become a necessity in the future and will also improve the working environment of the occupiers. The local authorities and town planners need to provide a greater focus on the infrastructure front, and issues such as parking, traffic congestion, and sewage management.

Dedicated spaces can be developed for open spaces and recreational areas to create a better environment. Successful implementation will lead to a well-rounded development of the commercial hub Colombo.

(The writer is Chairperson of Jones Lang LaSalle Sri Lanka).