Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 15 March 2017 00:00 - - {{hitsCtrl.values.hits}}

The other day when the Prime Minister mentioned that Sri Lanka needs to honour debt payments to the value of $ 15 billion during the next four years, it sure shook Sri Lanka. This was in the backdrop of IMF apparently advising the Government that some strategic assets like the Hilton, Hyatt, etc. will have be divested to pay to meet such payments.

The other day when the Prime Minister mentioned that Sri Lanka needs to honour debt payments to the value of $ 15 billion during the next four years, it sure shook Sri Lanka. This was in the backdrop of IMF apparently advising the Government that some strategic assets like the Hilton, Hyatt, etc. will have be divested to pay to meet such payments.

On this macro shock came the announcement on the spiralling export business as at end November whilst the pressure on the consumer purse has also begun to hit Sri Lanka. Let me do a deep dive on the current situation Sri Lanka is up against.

For the first 11 months total exports have crashed by 2.2% to 9.45 billion dollars which means that overall exports for the year 2016  might be just over a ten and a half billion dollars which is a very poor performance given the expectations Sri Lanka had post the new government coming to play in January 2015. In fact Sri Lanka set a target of $20 billion by 2020 which is actually a dream given the current performance.

might be just over a ten and a half billion dollars which is a very poor performance given the expectations Sri Lanka had post the new government coming to play in January 2015. In fact Sri Lanka set a target of $20 billion by 2020 which is actually a dream given the current performance.

Whilst the overall exports of Apparel, registered a marginal growth of 1.4% to $4.5 billion dollars in the backdrop of my teacher from Harvard advising the current Government on developing the international marketing stating that Sri Lanka cannot compete on the exports front against countries like Bangladesh and that we must develop new segments like electronics.

The rubber business came in with a 0.4% performance at 0.705 billion dollars even though we are a top country in marketing hard types with companies like Loadstar showing the way. The tea industry even with all the weather-related issues is at a good performance of $1.16 billion dollars even though it is at a -6.2% as at end November 2016.

We need to keep in mind that the corporate sector of the tea industry is at the crossroads given that the National Budget stipulates that all RPCs will be moved to parcels of five hectares to increase productivity and efficiency. But the policymakers have forgotten that most RPCs have linked the properties to raise funding and overnight moving to the outgrowth model cannot be done in reality. Whilst there is merit in moving to this business model, doing so immediately will once further aggravate the situation, given the 2.5 billion dollar export target that the industry has set its eyes on.

Apart from the national picture as stated above, what is worrying in the month of November is that total exports declined further, registering 3.4% with the star categories like apparel also declining by 6.6% which is strange given that the US market is picking up with unemployment dropping to 4.8% whilst the EU is demonstrating an increased appetite in the key sectors Sri Lanka is driving performance on.

I guess the TPP being called off by President Trump will have an impact on the development of global trade whilst Sri Lanka has no option but push for GSP+ for the decision on 23 May. The issue now is the exchange rate impact given that this industry is heavily dependent on imports. Some are speculating that currency will hit the 160 mark to a dollar which does not augur well for an import dependent economy.

Whilst the tourism sector is driving ahead with a growth of 18.7% to cross three billion dollars, which is good news, the fact remains that the two million extra mouths to feed for a country with a 20 million population adds a lot of pressure to the supply chain.

Starting from the increased consumption of fruits and vegetables by foreigners to all varieties of rice and subsidised sugar in the last four months adds to the pressure to the widening trade deficit that hit 47% in the month of June. I guess it’s time to do some serious national planning and ask ourselves what optimum tourist arrivals a country like Sri Lanka should have given the scarce resources.

Let’s accept it, the trade deficit widening to 7.5% in the first 11 months makes us wonder where Sri Lanka is heading strategically. November in particular has seen a dangerous turn of events with the trade deficit widening to 47%, touching almost one billion rupees. Let’s hope the export performance will pick up in the near future to cross at least 15 billion dollars and thereby ease the fiscal pressure on the Government which is feeling the heat daily due to protest campaigns and corruption allegations apart from the rise in cost of living.

If we drill down to the impact to the Sri Lankan consumer, the data coming out on the GDP front is also not positive with the economic performance on a quarterly basis slowing down with 2016 registering a 4% growth. This means that inflation will pull down a typical consumer to cut their basket of goods given that the income has not actually increased whilst inflationary pressure is driving up the cost of living.

The best example is the announcement of sugar prices going up to Rs. 110 as against the 93 that was prevalent around a week ago. The rice prices between Rs. 70-80 adds to the pressure of the consumer purse which naturally will reduce the consumption of grocery items.

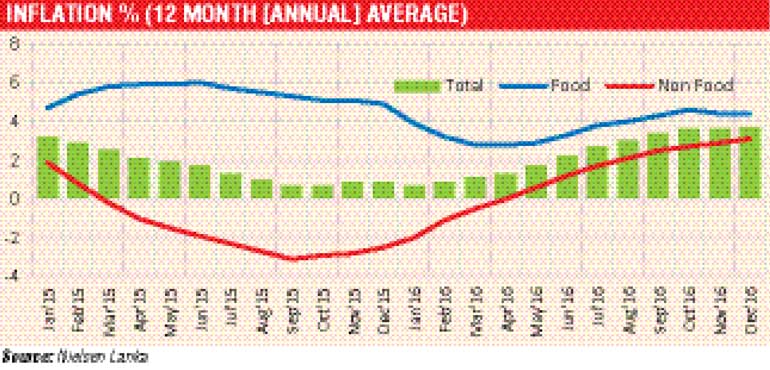

A point to note is that when an economy is around 80 billion dollars and it is an island nation, the best practices state that unless an economy grows by 7-8% the typical vibrations cannot be felt by a typical consumer in their daily lives. What’s worrying is not on the above numbers but more the rising prices food and non-food items based on inflationary numbers which is exerting pressure on the disposable income of a typical household which in turn is now having an impact on the usership and usage of key categories like shampoos, women’s hygiene products and for that matter the sales of matchsticks, etc., which are basics in today’s consumer lifestyle.

FMCG companies operating in these categories are feeling the dip and are struggling to achieve the end year financial numbers, which is not a good sign for a progressive country like Sri Lanka which is a focused on a growth agenda. The forecast by FMCG companies for the next financial year is also not very encouraging is the feedback from the market purely from a penetration and usage perspective.

If one understands the typical progression of consumer behaviour, the use of the above items (shampoos, sanitary napkins) are linked to the quality of life in a country. Hence, if there is a movement out of such categories it means there is an overall lifestyle changing taking place which gives a bad vibe to the multinational companies that are evaluating investment decisions.

This reality coupled with street protests on a daily basis in the city of Colombo denotes an unfavourable picture for probable investors, to which sadly the Government is grappling to give a solution. I guess the $300 million investment recorded last year on FDI further affects the confidence level which is not healthy for Sri Lanka which is under a progressive leadership.

If we dig deeper we will see that the latest research from specialised research organisations like Nielsen state that the total FMCG market is worth Rs. 215 billion and as at end of the third quarter of 2016, the Nielsen consumer track reveals that in Q2 and Q3 the overall growth was 6.9% and 7.6% respectively on this total FMCG value and this is driven on the price attribute.

The growth as at end Q2 2016 mentions that growth in the urban and rural markets has halved, which explains the issue at hand. Now the question that many are asking is, what will the year 2017/18 unfold and how do we once again win back the lost consumers in the categories one operates in and how do we get back to the usage levels that a typical household used in a given product category?

Sri Lanka will have to go back to the drawing board and understand the markets that are experiencing an export drop and ask if it’s a supply chain issue or a demand chain issue. Let’s accept it, exports from Sri Lanka account for less than 1% globally in specific countries and even category. Hence, absolute global fluctuations technically cannot have volume adjustments to Sri Lankan exporters.

On the Sri Lankan consumer end, one option to pursue is focusing on the plate of food and adjusting the taxing structure so that the price of the plate of food remains constant rather than just a peanut butter approach of taxing categories. The latter in fact has been advocated by experienced policymakers but when a country is in a catch 22 situation these equilibriums are tough to manage.

(The writer was the eighth Chairman of Sri Lanka Export Development Board and also headed the Government policymaking entity, the National Council for Economic Development in the Ministry of Finance. He had done his Executive Education from Harvard Kennedy School.)