Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 17 August 2017 00:14 - - {{hitsCtrl.values.hits}}

Last week, the Yahapalana Government, which came on the promise of good governance and weeding out corruption, had its first blow, when a senior minister and deputy leader of the party had to resign over allegations of corruption.

Whilst the share of voice on media was very high, research insights revealed the fundamentals of the country was facing more severe challenges. In fact, these issues must be addressed as a priority than the country focusing on the governance issues, is the view of the private sector that is responsible for paying salaries of people and giving them a livelihood.

Sri Lanka must become a $ 100 billion economy from the current $ 83 b economy – 3.8% growth

The overall GDP growth registered a 3.8% growth in the backdrop of a severe drought in fourteen districts and the health issues related to dengue reducing the productivity levels of the people, but the fact of the matter is that island nations must grow by 5-6% if the people must feel it in their daily lives.

Whilst we can be positive, Sri Lanka is going through some rough times and we must accept that the economy has slowed down. The issue is to find out if it is due to the macro economy or is it due to the inefficiency of the system. The private sector agitation is that that government machinery is moving too slow and it was not what was expected by the people when the new Government was voted in on 8 January, 2015. In addition to that, when corruption issues keep surfacing, resulting in a high share of voice leading to resignations from the hierarchy and governance, issues like the cocaine discovery in government warehousing tends to point the finger to the root cause which does not augur well for the country.

The last three quarters’ performance as per the Department of Statistics: the agriculture GDP numbers have declined by -2%, -8.4% and -3.2% respectively. Whilst this can be attributable to the adverse weather, the service sector which accounts for almost two thirds of the economy also depicting the negative trend is worrying. To be specific, a 4.8% GDP growth in Q3 2016 to 4.6% growth in Q4 2016 and this year to 3.5% in Q1 2017 means the service sector economy is contracting. Rather than the higher share of voice and high share of media on issues like corruption it’s time that Sri Lanka focus on correcting these issues which will alter the fundamental that lead to stronger business growth is the private sector view. End of the day almost 70% of the economy is driven by the private sector and if we move the economy from $ 83 billion to $ 100 billion by end 2017 we have to listen to the deeper vibes of the private sector.

Key issues

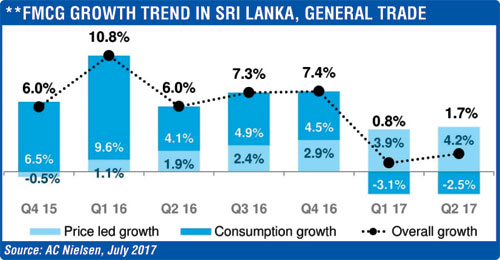

If one does a deep dive on these numbers at a household level, the real burning issues emerge. The overall consumption of the FMCG industry at a household level has declined by -3.1% in Q1 to -2.5% in Q2, 2017 as per the latest report by AC Nielsen. What this means is that either people are moving out of the category or they are reducing the usage of product. I guess at a micro level a company can study by way of a gains and loss analysis and thereby get a better insight to consumer behaviour at the ground end. But the fact remains that inflationary pressure is driving a behavioural change. In this backdrop, the planned provincial council elections will not be positive to the government in power. We must also note that all basic staple foods like rice, sugar, lentils, cowpea, sprats are all being imported into the country hence the depreciation of the exchange rate tends to have an impact on the price and there by the consumer selling price. This further aggravates the quality of life of the lower of the pyramid which is almost 40% of Sri Lanka’s population. These are the issues that need to be focused on by policymakers, is the cry from the housewives of Sri Lanka. The policy some years back was to change the tax structure so that the cost of a plate of food remains stable, which in fact was a pragmatic view of managing the economy. But today, when taxes are levied based on categories it leads to inflationary pressure.

Lifestyle changes

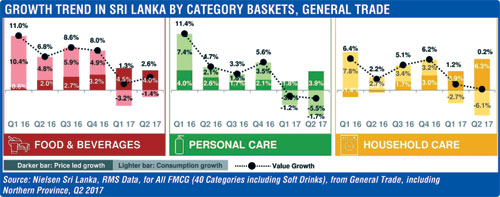

If we analyse the AC Nielsen report from a segmental basis, we see that the food and beverage sector records a negative growth of 3.2% and 1.4% respectively in Q1 and Q2 of 2017. This is reflective of the slowing down of the business of packaging suppliers.

On the personal sector side of consumption, the numbers have reduced by 1.2% and 5.5% respectively in the two quarters of 2017 which is worrying. The challenge is to identify the root causes for the declining trend and how it can be corrected. May be a provincial sub sector analysis can point what impact the drought had on the numbers.

Whilst on the household side of the business, the GDP value has contracted by 2.7% and 6.1% respectively which is a sharp decline that needs to be clearly analysed. Maybe consumer end health check will explain the logic more precisely. A point to note is that these numbers will result in a down turn of the overall retail trade and this in turn will have a spiral affect across the value chain. Maybe the monsoon rains will help to change the growth trajectory of these numbers. Time will tell I guess.

Property market – bubble?

The Central Bank Governor has hummed the warning bells on the bubble forming of the property market which has led to the squeeze in funding from the lending organisations. Whilst this may be true of the luxury end condominiums at the middle income households, the appetite for convenience living is yet there, is the view of the industry. Whilst there is a slowing down of the business, the opening up of foreigners having the ability to purchase apartments even close to the ground floor at a premium could stimulate demand whilst the access to loan facilities can help stable this business, but the inflationary pressure on the system is creating a strain in the country which is not healthy as the construction sector was the most robust business for the Sri Lankan economy. Maybe it’s time that the industry comes under the belt of exports and looks for new markets globally or moves into aggressive marketing in the service apartment business so that a new market like tourism will come into the game plan.

Tourism – crossroads

The decline in the tourism numbers by 2.5% in May this year, fuelled by the dengue epidemic and the drought, was not a welcome shock given that the formal industry is already reeling due to the market moving to the informal sector of the country. The overall numbers as at end May is at 4.6%. The graded hotels are already suffering from a low occupancy and high food/beverage prices that are having a negative impact on the bottom line. This is usual during the off peak season but the last two quarters in particular have been outside the usual seasonal dip. Some hotels are up for sale due to excessive bleeding, whilst others are acquired by banks for liquidation which does not reflect a positive vibe to an industry that is identified to lead the economic growth agenda of the Government. The much talked about global marketing campaign has not yet materialised even after two-and-a-half years post the new forward-thinking Government coming into Sri Lanka. It is even more sad that in the last two-and-a-half years, we see three chairmen been appointed to lead the business when neighbouring counties like Maldives have a policy of a minimum 5-8 years a person stay in office so that there is consistency of policy. I guess the result of the sharp brand identity globally of Maldives has come about due to the consistency internally in the management. A lesson for Sri Lanka to think thorough.

Maybe another point to ponder is that the last new product launched by Sri Lanka tourism was in 1972 when the elephant orphanage came to being in the country. Even after thirty years, the penetration of this product is only 40% as at last year’s data of visitors to Pinnawala as against the two million tourists that came to the country. Countries like Malaysia, Singapore, and Dubai tend to launch new products every 3-4 years which is how they keep the tourism brand contemporary and attract new segments of tourists into the country. A classic example is the theme park feature that will be launched by Singapore tourism in the Changi Airport. Maybe it’s based on the research insight that there are many transit passengers at the airport that can be turned into a revenue source for the country. An interesting development to the global tourism landscape which I am sure other airports will follow like Heathrow and Dubai.

Apparel exports at -4.7%

On the export front, in the first five months exports have increased marginally to 4.3% at $ 4.4 billion meaning that the benefits of GSP+ has not kicked into the system. The overall import bill at $ 8.6 billion at a 12.6% growth does not reflect well on a country that is stacked on a $ 56 billion debt agenda. Incidentally, 96.5% of the revenue is currently utilised to service the debt, which means that the country does not have a bankable balance sheet. Maybe it’s time that the share of media highlight these deeper issues than focus the country’s attention on governance issues which have been perennial problems in Sri Lanka and globally of any government. Maybe a more pertinent move will be if the appointment of chairmen by ministers to legitimatise corruption in their own ministries which many detested and quit in the Yahapalanaya Government. Sad but these facts must be brought into the mainstream so that a new culture can be brought into Sri Lanka.

On the area of exports what is important to note is that the current thrusts on free trade agreements( FTA’s) is commendable be it GSP+, FTA with China and the proposed FTA with Singapore. But the reality of the export industry is that the core issue is a supply challenge than demand issue. Even if we take the current FTA with India and Pakistan the supply issues and NTB’s are key reasons for the low utilisation of the facility for the last ten years. A classic example is the FTA with India. The export numbers have been below $ 1 billion for the last decade or more even though successive governments have tried strengthening the Indo-Lanka bilateral ties.

Worker remittance -7.2%

Apart from tourism and exports, a key foreign exchange earner is the worker remittance. The performance in the first five months is at $ 3.3 billion registering a decline of 7.2% which is not healthy but we have no option given the Middle Eastern political turmoil and the unemployment level in Sri Lanka at around 4%. The latter is particularly a key issue and if we want to move the export business from 10 billion to 20 billion by 2030 and tourism to target 7.5 billion from the current 4 billion means we will have to import skilled labour unless the Government request for a population explosion by the people of the country. This was done in China at one time but it will not work in Sri Lanka due to strong cultural nuances and burning cost of living issues.

Next steps

Hence, we see that the issues that the country is faced with are more fundamental in nature and very disturbing. If we do not move away from the political agenda and move the country to a business agenda it will further deteriorate the unbankable balance sheet the country has.

(The author has served the country as the Chairman Sri Lanka Export Development Board, Chairman Sri Lanka Tourism and Chairman of the 30 billion Lanka Sathosa retail outlet chain and went on to serve the United Nations (UNOPS) for a five year tenure when the country won the best global award. He is an alumnus of Harvard Kennedy School.)