Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 6 July 2016 00:00 - - {{hitsCtrl.values.hits}}

Given the post-Brexit uncertainty and all the speculation that is going on about the real impact of Britain leaving the EU, many theories abound, with the doomsayers and optimists taking different viewpoints. Due to the complex and unprecedented turn of

Given the post-Brexit uncertainty and all the speculation that is going on about the real impact of Britain leaving the EU, many theories abound, with the doomsayers and optimists taking different viewpoints. Due to the complex and unprecedented turn of  events, it is evident that no one can really predict what will unfold as time goes by.

events, it is evident that no one can really predict what will unfold as time goes by.

Nevertheless it may be opportune even at this early juncture, for Sri Lanka tourism to take a good hard look at British tourist arrivals over the years, in an analytical and manner, and try to ascertain the real importance of the British market to Sri Lanka tourism.

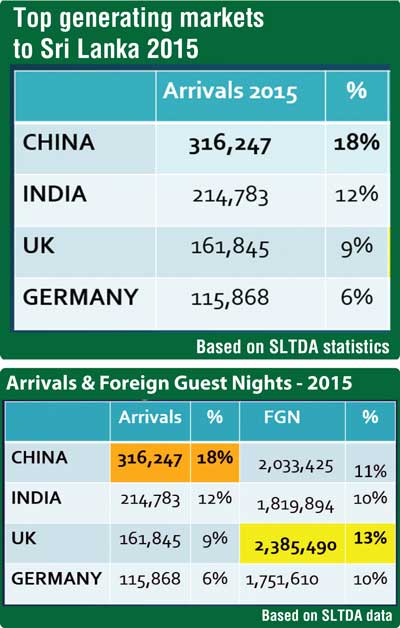

Traditionally the UK has been an important market for Sri Lanka, generating about 18% of the total arrivals to Sri Lanka in 2008. The UK was the top tourist generating market for Sri Lanka, but lost its position to India in 2009. It held on to this No. 2 position until 2015, when it was relegated to the third slot by China, which climbed to the top. However the UK still generates close upon 10% of Sri Lanka’s total arrivals

Arrivals and foreign guest nights to Sri Lanka 2015

While arrival numbers are a vital measure of tourism, there is another more important index that is usually tracked to ascertain tourism trends. This is referred to as Foreign (or International) Guest Nights (FGN) or (IGN).

This is equivalent to one foreign guest, spending one night, at an approved accommodation providing establishment.

Therefore FGN (or IGN) takes into consideration the duration of the tourists’ stay and not just the arrival numbers. Higher the FGN, the longer the tourist stay in the country, and obviously, higher the spend, which increases the overall tourism revenue earned.

In addition, higher the FGN and longer the stays, the more places the tourist will travel to, within the country. It is a well-known fact that longer staying tourists, such as the Europeans and British, generally go on excursions around the country. In this manner, the tourism revenue earned is spread over a wider area of the country, (often rural), without being concentrated in one particular area.

Therefore it would be worthwhile to compare the FGNs of the top four generating markets to Sri Lanka.

This reveals some interesting aspects.

While China takes the top slot with 316,247 arrivals, making up 18% of the total arrivals to the country in 2015, it accounts for only

2,033,425 FGNs (11%)

However, the UK generates a higher number of FGNs of 2,385,490 FGNs (13%), higher than either India or China, even though the overall UK arrival numbers (161,845) are almost 50% less than China.

Hence when FGN is considered, the UK is in the top slot, with China and India second and third respectively.

It is obvious that tourists from the UK have a major impact on the overall tourism scenario in Sri Lanka, and are therefore a vital and important component of Sri Lanka’s tourism market.

With the weakening UK currency, changes to aviation regulatory framework, and other post-BREXIT woes, and whatever long term effects will unfold in the UK, there is no doubt that outbound UK travel will take a hit in the short term. Since Briton, as shown in the foregoing analysis, is an important source market for Sri Lanka tourism, it would be prudent for Sri Lanka Tourism to be mindful of the behavior of the British tourist market in the short term, as the UK settles down in the post-Brexit era.

Sri Lanka may have to resort to tactical promotional offers, and other creative initiatives to keep the British interest in Sri Lanka as a tourist destination alive.

References:

http://www.traveller.com.au/what-could-brexit-mean-for-travellers-gpq6er