Thursday Feb 12, 2026

Thursday Feb 12, 2026

Monday, 11 April 2016 00:00 - - {{hitsCtrl.values.hits}}

The first quarter of 2016 is already gone. In the balance part of the year the country will have to focus on getting its priorities right. What are we going to aim for? The policy planners and corporate captains will have to jointly craft a strategy that will help to navigate the country’s economy through a sea of internal and global challenges. In the wake of the Fed rate hike in the US and the gradual hikes of the same anticipated for the future, foreign borrowing costs of developing countries, including Sri Lanka, will increase. This will force the Government of Sri Lanka to focus more on domestic sources to fulfill its borrowing requirements. This, in turn, will push up domestic interest rates, further increasing the Government’s debt servicing costs. Therefore, the government will have to cut down

The first quarter of 2016 is already gone. In the balance part of the year the country will have to focus on getting its priorities right. What are we going to aim for? The policy planners and corporate captains will have to jointly craft a strategy that will help to navigate the country’s economy through a sea of internal and global challenges. In the wake of the Fed rate hike in the US and the gradual hikes of the same anticipated for the future, foreign borrowing costs of developing countries, including Sri Lanka, will increase. This will force the Government of Sri Lanka to focus more on domestic sources to fulfill its borrowing requirements. This, in turn, will push up domestic interest rates, further increasing the Government’s debt servicing costs. Therefore, the government will have to cut down  its unnecessary/wasteful expenditure and manage its expenditure prudently.

its unnecessary/wasteful expenditure and manage its expenditure prudently.

The Government will have to be careful when launching ambitious projects such as the Western Province Megapolis Development project (estimated to cost over $40b). The funding for such projects would be crucial. If such mega projects are going to be funded through government debt (either foreign or domestic debt), that will only aggravate the already precarious debt burden of the Government.

In the period ahead, the government will have to carefully tackle the pressure on both the interest rates and the exchange rate. Fiscal consolidation and attracting foreign direct investments (FDI) will be crucial in overcoming these challenges.

The next section deals with the need for fiscal consolidation.

Fiscal consolidation is crucial

The budget deficit needs to be kept in check. Otherwise, Sri Lanka will not be able to reduce its high debt/GDP ratio which is estimated to have recorded 74.9% in 2015. The budget deficit which was as high as 9.9% in 2009 was gradually brought down to 5.9% in 2013, with a marginal increase to 6% in 2014. The figure for 2015 is not yet known, but it is likely to be around 7.0%. Therefore, the government will have to urgently focus on fiscal consolidation with a view to reducing the country’s debt/GDP ratio. Rating agencies place considerable emphasis on debt/GDP and external debt/GDP ratios of a country in assigning a sovereign credit rating to it.

Fitch Ratings downgraded Sri Lanka’s Long-Term Foreign and Local-Currency Issuer Default Ratings (IDRs) to ‘B+’ from ‘BB-’ along with a negative outlook in February, 2016. Standard & Poor’s ratings agency has been less harsh on Sri Lanka. While lowering the outlook on Sri Lanka’s ‘B+’ long-term sovereign credit rating to negative from stable, citing rising fiscal and external imbalances, S&P has kept the ‘B+’ long-term sovereign credit rating on Sri Lanka unchanged.

In view of the above, Sri Lanka will have to get its act together and take steps to reduce its fiscal deficit and also reduce its debt/GDP ratios with a view to maintaining (let alone improving) its sovereign credit rating. Otherwise, the country will have to face the risk of a downgrade/further downgrade of its sovereign credit rating by the rating agencies. In the event of a downgrade/further downgrade of its credit rating, Sri Lanka will be required to pay higher premiums on its foreign borrowings, posing further challenges to fiscal consolidation.

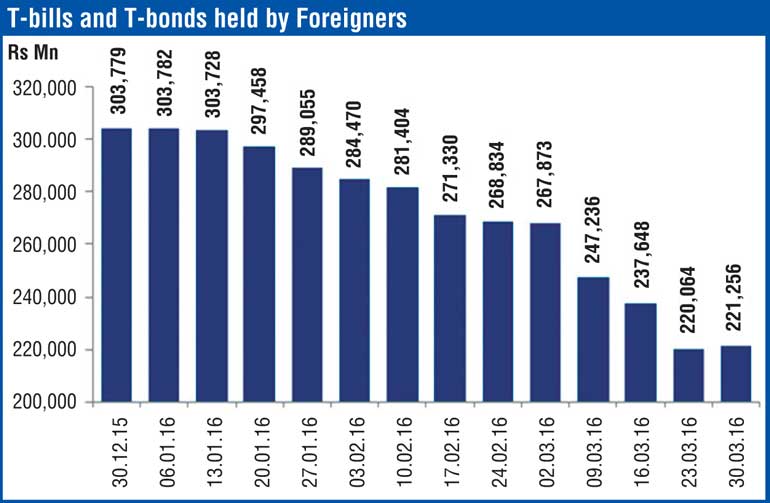

In the ensuing period the rating agencies will closely monitor some key areas. They will watch and see whether there will be a sustained decline in Forex reserves of the country either due to reduced access to international markets or a significant increase in Forex outflows (as has been happening during the past 2-3 months - see figure). The rating agencies will also be on the lookout for any deterioration in the fiscal situation, since such a slippage will only contribute to worsen the government’s already high debt/GDP ratio. In addition to these areas, the rating agencies will closely watch whether the government will adhere to policy coherence and credibility. Lapses in policy coherence and inconsistent policies will aggravate macroeconomic imbalances and heighten external vulnerabilities. Therefore, the government will have to be particularly mindful of this factor and get its policies right while avoiding backtracking and policy reversals. A case in point is the budget for 2016 presented by the government in November, 2015. Many proposals contained in the original budget speech have been subsequently amended or are in the process of being amended. As a result, a final set of budget numbers are yet to be announced. Indeed, one can argue that the biggest risks for the country in 2016 spring from the unrealistic budget assumptions about the government’s income, expenditure and how the budget deficit is going to be bridged without causing macroeconomic chaos.

In view of the above serious concerns, the government will have to take corrective action as a matter of highest priority. Number one on this list would be the implementation of a consistent and predictable policy framework leading to a reduction in risks to economic and financial stability. Another priority area would be to get the government finances under control.

A declining government revenue/GDP ratio and a tax/GDP ratio have posed major challenges to Sri Lanka’s fiscal consolidation process, making it very difficult to maintain social expenditure and public investments. In contrast, Bangladesh’s tax/GDP ratio shows an increasing trend over the past several years. Sri Lanka’s tax to GDP ratio of 11.5% is the lowest among the countries with a similar level of development. Therefore, broadening the government’s tax/revenue base should be an integral component of an urgently required short-medium term fiscal consolidation strategy aimed at improving Sri Lanka’s public finances. On the external front the government will have to focus on a strategy aimed at replacing debt with FDI with a view to reversing its burgeoning debt burden.

Replacing debt with FDI

According to a recent survey conducted by the Ceylon Chamber of Commerce (CCC) among prospective foreign investors (who attended the CCC’s Sri Lanka Investment and Business Conclave 2016), over 33% of survey respondents had cited Sri Lanka’s close proximity to the East-West trading routes and the easy access to the regional markets in Asia as a key factor for considering investing in Sri Lanka. Out of the survey respondents 18% had cited ‘the level of economic policy certainty’ as a key deciding factor, while 16% had cited ‘the level of political stability’ as a key deciding factor. ‘Tax incentives’ was a low deciding factor as only 6% of respondents had reported that it was a key factor for investment consideration.

The above survey results clearly indicate that manifold incentives and tax holidays play only a limited role in attracting foreign investments. In selecting their investment destinations, foreign investors mainly look for macroeconomic policy coherence and consistency, and political stability. They need to be assured that macroeconomic policies of the host nation are unambiguous and predictable. They also need to be assured that policy/tax changes are done with prior notice and not retrospectively. Additionally, availability of skilled workers, labour market flexibility, access to markets, rule of law, and good infrastructure facilities and logistics could be viewed as central in attracting FDI. Further, good governance should be ensured in both the public and private sectors through appropriate legislation and regulatory/enforcement mechanisms.

Apart from what has been mentioned above, another key area that the government will have to focus on is getting the economy’s incentive structure right. The next section deals with this aspect.

Getting the incentive structure right

By guaranteeing jobs in the public sector for the graduates who pass out from state universities, the government discourages our educated youth from working in the private sector. Similarly by not putting in place a proper public transport strategy, the government encourages the use of fuel inefficient private transport. Additionally, this situation has paved the way for a proliferation of three wheelers. Are we incentivizing our youth to work in the public sector or be employed as three wheeler drivers? There are labour shortages in much more productive manufacturing sectors (particularly in the Export Processing Zones). However, taking into consideration the current incentive structure that is in place, our youth will be tempted to take the easier paths rather than working at the more productive private sector enterprises. Therefore, we as a country should get our incentive structure right. If otherwise, we will continue to encourage inefficient use of fuel (which is imported and expensive) and a misallocation of valuable human resources.

Conclusion

There is pressure on the interest rates to rise while at the same time there is pressure on the rupee to depreciate against the US dollar. With a view to alleviating these pressures, the government will have to focus on fiscal consolidation and replacing debt with FDI. Broadening the tax/revenue base; achieving macroeconomic policy coherence, consistency, and predictability on a sustained basis; and getting the country’s incentive structure right will be crucial in putting the economy on a sound footing. Besides, all of this will have to be done with a sense of urgency.

(The writer counts over two decades of experience in the field of economic research in the private sector. He has earned a BA (Hons) in Economics, an MA in Economics and a PhD in Economics at the Department of Economics of the University of Colombo. He can be reached at [email protected]).