Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 31 January 2017 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka as a brand is valued at $ 80 billion and is poised to be $ 100 billion in 2017

Last week’s revelation of Sri Lanka certainly made many of us who love this country not very proud of our performance last year. A point that needs to be understood is that each and every one of us in the corporate sector and policymaking entities are responsible for this situation. It is also our duty to make the correction too. Let me give some key insights.

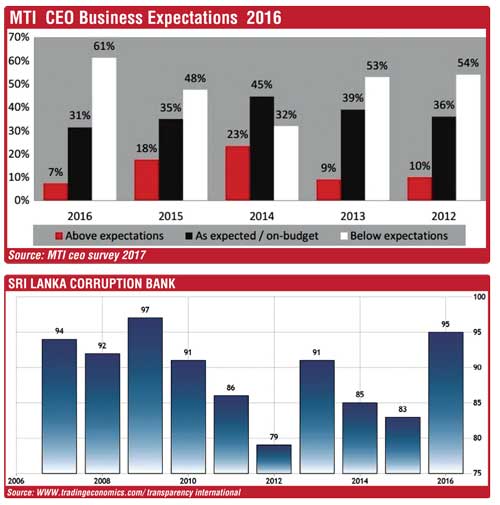

CEO Survey – 60% say below expectation

The recent MTI survey 2017 revealing that 61% of CEOs stated that their organisation performed below expectations was not surprising given the policy inconsistency and issues on the macro economy. But the real issue is the increasing trend on the negativity on the performance since 2015 from 48% to 61% in 2016 and the agitations we see virtually on a daily basis on the protests campaigns by the masses, which disrupts traffic and also affects perception for foreign visitors. The unfavourable evening media on news channels adds to the low business sentiments experienced during the day.

An international organisation has valued that each protest costs the country a staggering Rs. 100 million, which means it is high time we address the issue, given that it is now making its way to international media. This will hurt the quest of brand Sri Lanka hitting the $ 100 billion status in 2017. Currently we are in the eighties.

SL Corruption Index jumps to 95

It is sad but the truth is that Sri Lanka’s alleged corruption practices in the last two years have hit the global media with the latest Corruption Perception Index jumping to a 95 standing as per the latest report by Transparency International. Sri Lanka on average was at 82.6 in the last 15 years and in the recent past dropped from 85 to 83 in 2015 and then jumped 12 places to 95, which certainly won’t help brand Sri Lanka.

A point to note is that whilst we can point fingers at the public sector, the reality is that it is the private sector that makes the public sector corrupt. Hence, unless we as a nation do not address this issue based on strong values and business ethics, the root of the problem cannot be addressed.

GDP 4% growth and Consumer Confidence 52

If we do a deep dive on the economy of the country based on the private sector expectation being at a low ebb of 61%, stating that the expectation has not been achieved, we see the GDP growth registered has dropped to 4% in 2016. Such a growth in fact cannot even be felt by a consumer as the economy is just $ 80 billion. I remember a World Bank economist stating at a global conference that in island nations like Seychelles, Mauritius and Sri Lanka, for economic growth to touch the life of a consumer, it must grow between 7-8%.

Quarter three GDP has registered at 2.5% growth in the backdrop of the devastating floods that the country experienced whilst the Nielsen Consumer Confidence Index touched a low 52 which means that we must acknowledge that the pressure on the consumer on savings and job prospects would be high. In fact research indicates that 46% state that they don’t have spare cash which is up 13% from the last quarter. The cost of rice being in the nineties in the backdrop of exchange rate depreciation will further put pressure on a consumer.

Export revenues at -4% is also not helping the economy pick up given that exports have the potential to fuel economic growth. GSP+ and ECTA coming into play in the next few months is the best news Sri Lanka has had and I feel the task of the private sector is to fully utilise preferential trade and thereby ramp up the supply chain so that the benefits can hit the country early.

Trump factor and TPP

The Trans-Pacific Partnership agreement better known as ‘TPP’ was a trade agreement that would have changed the way trading will be done across the world given that nearly 40% of the economy would have been covered, whilst the US would have strengthened its leadership in the Asia-Pacific region.

Given that the executive order has been signed by President Donald Trump, the agreement that has taken almost seven years to bring to light has turned to just a paper document. The 11 other countries that have already signed to have access to the vast US economy will now have to refashion their statement on why such an agreement is good for their respective economies.

The ramifications from this decision will have an impact on Sri Lanka’s export potential too, which is sad given that Sri Lanka needs all the help required to jumpstart the economy.

The Peterson Institute for International Economics had projected that President Trump’s trade policies could trigger trade wars with China and Mexico, and lead to a recession which will cost four million American jobs and can have severe ramifications as almost 70% of apparel exports from Sri Lanka are sourced by the US economy. We e should watch the political economy at play in the US and its implications for Sri Lanka.

Share price decline by 9.7%

If we were to do a deep dive on 2016, we see that the overall ASI has dropped by 9.7% to 6,228 points whilst the market has lost Rs. 193 billion on market capitalisation. On a random sample the net earnings have dropped by 10% which we need to analyse by sector to understand the strategic changes that an organisation must do based on the specific sectors that it has in the portfolio.

For instance the service sector is growing strongly with tourism driving the numbers. However the bottom line is yet challenged in the tourism sector due to supply chain costs and infrastructure costs being higher than the counterparts and earning potentials on revenue. I guess with a strong marketing campaign planned for 2017, we will soon start attracting top end clientele into the country and hence the ROI projections will change in properties like Shangri-La. However the 12% to 28% tax increase will bleed the sector and needs some thinking by the policymakers.

Way forward

In this backdrop the projection globally for the economy from Davos is positive. The MTI CEO has also indicated the private sector is very optimistic towards 2017 and I guess like one of my previous bosses of Brazilian origin mentioned, “The best surfers emerge in troubled waters.” Hence the challenge is for us to adjust and drive our own business. Some recommendation are as follows:

1) Do a deep dive of the consumers and with a gains and loss analysis we can identify the positives and areas to improve to hold the consumer base.

2) Agree on what change is required – end purpose. It is only once this is understood that any form of change must be done.

3) Analyse the supply chain and understand where the bleeding is happening so that it can be focussed and re-engineered. Think about outsourcing logistics and warehousing as the top companies in Sri Lanka use companies like Advantis for such purposes. Bring in a digital environment. Drive a stakeholder partnership structure with disciplines like a lucid organisation structure and remuneration including ownership.

4) Let’s accept that there is talent in our organisations that require strong leadership whilst managing the political economy in a country such as Sri Lanka.

5) Be ready for tough retaliation when changes are mooted but that is what Sri Lanka requires. Change is always a double-edged sword.

6) Let the team earn the success and celebrate. It’s the new ethos of business.

7) Let the journey begin today. Not tomorrow.

(The author is a marketer by profession with 20 years’ experience working for top US and British FMCG multinationals, winning twice the Best Marketer Award and Business Achiever Award. He has also served the UN for five years winning the Best Project Award for Sri Lanka. He is an alumnus of Harvard Kennedy School Executive Education.)