Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 30 May 2017 00:07 - - {{hitsCtrl.values.hits}}

It’s strange but brand Sri Lanka has been under attack for the last two years. Overall exports have declined by 5% in 2015, then again by 2% in 2016. The total FDIs have declined in 2016 in the midst of the global pool expanding, which does not bode well for a country that is having a progressive government at play.

The corruption allegation from the bond scam to many others that keep hitting the websites and main line media do augur well for the Yahapalanaya Government that was voted in on the premise of good governance. The private sector is very disappointed for brand Sri Lanka and had a lot of hope on 8 January 2015 which the change. Many who agreed to serve the current Government from the private sector have moved back due to the financial irregularities at play which does not hold in good stead for the country.

Brand Sri Lanka valued at $ 80 billion is continually being battered in the last two years from financial irregularities to manmade disasters and now natural disasters – Pic by Shehan Gunasekera

Brand Sri Lanka valued at $ 80 billion is continually being battered in the last two years from financial irregularities to manmade disasters and now natural disasters – Pic by Shehan Gunasekera

In this backdrop brand Sri Lanka has been challenged with a drought that affected a million people and then the Meethotamulla disaster that took the country across all media globally which sure dented the equity of the brand which is valued at around 80 billion dollars currently.

Today, we are challenged with the flood situation that has taken away 161 lives and left almost half a million people without shelter, which once again adds pressure to the $85 billion economy which is under severe financial pressure with the debt serving wiping away 96% of the revenue collection of a year.

The overall country economic competitiveness dropping from 91 to 113 in the last two years makes Sri Lanka’s balance sheet non-bankable strictly from a technical evaluation. The question is, where do we go from here?

Whilst the above is happening internally, the silver lining was the GSP+ facility that was voted in by the EU to be granted once again to brand Sri Lanka. Whilst the positives are strong, a point to note is that the upward swing that can be expected is approximately $ 500 million.

Let›s say that toys, ceramics and the seafood industry regaining the lost EU market coupled with the apparel industry taking the incremental to a billion dollars will take the total exports to only 11.3 billion dollars. This performance is in the backdrop of the import bill soaring from $18.7 billion to 19.3 billion dollars and does not augur well for the country. What these numbers mean is that unless there is a strategic shift in the export numbers to touch 20 billion dollars, brand Sri Lanka will continue to be under pressure.

In this backdrop the Harvard Development Centre on Sri Lanka has revealed that only seven new product categories have been launched globally in the last 15 years (2000-2015 time period). These seven products have accounted for just 0.1 billion dollars in revenue which explains the weak performance of the country in the area of changing one’s operation to cater to the changing dynamic of customer needs globally.

There are more aggressive countries in the global market place – Thailand has launched as much as 70 new products generating $ 21.6 billion dollars tourism into the country whilst China has launched 76 new products, generating $ 331.6 billion dollars into the country, which highlights the challenge that countries like Sri Lanka must address even though the World Bank ranks Sri Lanka as the best performing in the ‹Doing Business› ranking for South Asia.

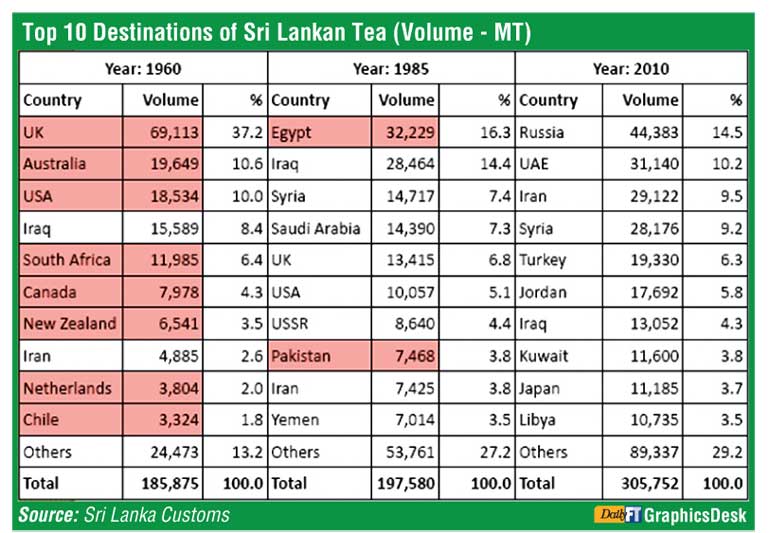

In this backdrop if we examine the top 10 destinations of Ceylon Tea in the 1960s, 1985 and in 2010 we can see how Sri Lanka has failed to build brand equity and hold on to its consumers over time. Every 15 years we are challenged with the task to find new  markets and develop a new relationship with consumers which is the most costly exercise that one is challenged in a business.

markets and develop a new relationship with consumers which is the most costly exercise that one is challenged in a business.

In 1960 the top five markets were UK, Australia, USA, Iraq and South Africa. In 1985 the top five were replaced with Egypt, Iraq, Syria, Saudi Arabia and UK falling to No. 5 position at 13.4 million kilograms of tea from the 69.1 million kilograms it did way back in 1960. By the year 2010 the top five countries were Russia, UAE, Iran, Syria and Turkey which just explains the crunch issue that we are up against.

This may be due to the economic bloc formations or due to trade agreements or by different tariff adjustments coming to play but the fact remains that if we had a strong branding campaign this impact could have been mitigated given that consumer loyalty could be elucidated for which people will be ready to pay a premium.

Whilst Sri Lanka is celebrating 150 years of being in the tea business, we have a golden opportunity to propel the country’s image globally using the vehicle tea, the logic being that Ceylon Tea is consumed in over 31 countries across the world and touches millions of people by way of taste, smell, touch and visual elements. Hence the brand aura of Ceylon can be mobilised by Sri Lanka just like Japan used Sony or Toyota brand names.

If we are serious about using Ceylon Tea for nation branding purposes, we should ideally select the top 10-12 markets and invest 30-40 million dollars on brand promotional work above the line and below the line and monitor the habits of the modern trade for driving penetration of Ceylon Tea. But the sad story is that money collected from October 2010 via a promotional levy has touched over Rs. 3 billion but not yet utilised, the reason being the cutting-edge policy change not supporting such marketing-oriented initiatives.

In the backdrop of Sri Lanka regaining GSP+, if we track back on the success of the apparel industry in the early ’80s Sri Lanka was termed as mere contract manufacturers and some even used to refer to the industry as tailors but thereafter with some strategic thinking by the industry, it gave leadership to the world by making Sri Lanka the fashion apparel of the world for ethically-manufactured clothing.

This has given teeth to the industry in competing with price-savvy merchandise coming in from Cambodia, China and Bangladesh and today this noble industry is targeting five billion dollars plus in export revenue by making Sri Lanka an apparel hub in Asia for R&D and technology sharing for fast fashion.

We see a similar trend in the tea industry, where with strong leadership the plantation industry which was nationalised in the 1970s came under Government control and went on in the 1980s to make a bold decision to make the Colombo Auctions control the global demand chain by breaking away from the great London auction system. The Colombo Auctions today commands the highest values for tea globally and is testimony that this decision was correct.

Then, in the 1990s the supply chain was privatised to the private sector which gave the opportunity for new thinking to be introduced to the industry with strong R&D power and capital infusion that resulted in Sri Lanka demonstrating the best performing country globally for value addition tea at a commanding 43% whilst turning around the business to a 14.2 billion profit within a few years of operation.

Whilst brand Sri Lanka has been battered continuously for the last two years, from the above case in point we can see that the skill set in the private sector is right together to capture global market share be in tea, apparel or with new product development but what is required is strong policy reforms, which incidentally has been the cry of the private sector but sadly once again we see Sri Lanka losing the traction to gain advantage of this opportunity. The questions are, who is to blame, who needs to be changed and who ultimately must take ownership for the current status quo.