Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 19 April 2016 00:10 - - {{hitsCtrl.values.hits}}

Yesterday’s Daily FT reported that Sri Lanka is negotiating for a IMF facility of $ 1-2 billion whilst over the weekend the papers reported that respected Central Banker W.A. Wijewardena had mentioned that a minimum 4.5 billion was required given the loans we had to pay in 2016.

It was quite demotivating from the information given that Sri Lanka boasted GDP growth of over 7% at one time with poverty registering at single digit level, so was the unemployment number. How did we get ourselves into this situation?

Whilst the obvious is that Sri Lanka tried to live above its means, a more important question to ask is where were the technocrats and Parliament that was at times part of this decision making? More importantly, what had the IMF and World Bank done in advising the Government on this trajectory of growth?

Especially given the IMF’s vast experience on managing tough economic conditions, how come an institution of such repute had not given more stringent regulations given that we as a country had rejected liquid support not long ago? Maybe Sri Lanka can be a lesson to the world that IMF will allude to as a case in point in the years to come.

In this backdrop let me take the most recent World Competitiveness Report and do a deep dive to understand the salient points on the pillars by which the world ranks an economy.

Sri Lanka will be case in point globally of a country that lived beyond its means and now has to turn to IMF support

Sri Lanka will be case in point globally of a country that lived beyond its means and now has to turn to IMF support

SL – What happened?

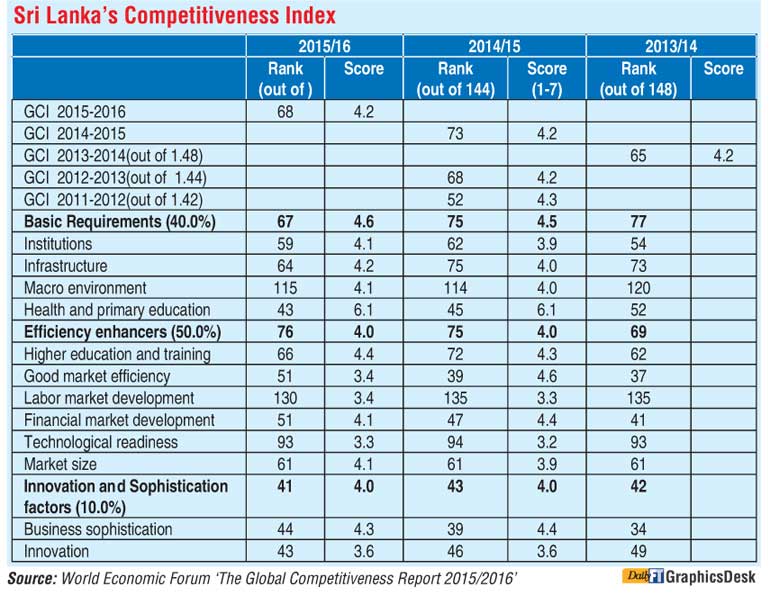

Whilst noting that Sri Lanka’s performance has picked up from 73 in 2014/15 to 68 in 2015/16 a point to note is that way back in 2011/12 we were a commanding No. 52 with an overall rating of 4.3. I remember many commented that Sri Lanka would be a top 30 economy in the world competitive rankings within three years.

Sadly, Sri Lanka slipped to a poor 73 last year and now got back to 68. I guess the lesson to the world is how ‘absolute power corrupts absolutely’ where now we have the elite and key public having to attend numerous corruption probes that have resulted in Sri Lanka having to keep looking back rather than actually driving the overall growth agenda.

If we go into the details of the Competitive Index 2015/16 on the attribute of ‘Higher Education and Training,’ we have dropped from 62 to 66 in the last four years, which is strange given that Sri Lanka is driving towards being an education hub and on the area of executive training we are inundated with top notch speakers coming into the country from different chartered institutes on a weekly basis.

But I do agree on the connectivity of universities and private sector organisations on human capital transfer being at a low ebb, despite being the foundation of a knowledge economy. Maybe it’s time we correct this without the rhetoric that things are fine on just indexes. On another perspective is that maybe Sri Lanka’s development may be right but other countries have outpaced us, which is something that needs a deeper analysis so that we will know who Sri Lanka’s competitors are on this front.

The Efficiency Enhancers score falling from 69 to 76 in the last four years is worrying, especially given that on the attribute of Business Sophistication, the rank dropping from 34 to 44 is not positive and is strange given that many companies are going global and many links have been forged with top companies of the world. The million dollar question is, what do we need to do drive our efficiency given that 73% of the economy is driven by the private sector?

The fact of the matter is whilst we are focused on Sri Lanka, somebody is doing better than us. We need radical reforms to make Sri Lanka a ‘modern economy’ rather than the political economy that has been at play in the last four years. But a point to note is that reforms that are required are at technocrat level and policy and let’s not get this confused with politics.

For example, how can we make the tea industry modern if at policy level changes are not being made to increase the lease period to 66 years (at least two cycles of the life of a bush), introduce the monitoring of the performance of the RPCs on a quarterly performance on the area of fertiliser application and replanting programs, payment of lease rentals?

SL – Where to improve?

A key area that needs close examination is the rank improving from 73 to 68 from 144 countries where the burning issue if I am to be blunt is labour market efficiency. On this attribute if we have to correct, one needs an iron fist and to be honest it will not be possible given the Coalition Government at play and the overall sentiments we see of the people towards the policymakers.

The question is, how do you balance the decision-making given that almost 78% of the economy is driven by the private sector? The issues to address will be retrenchment, layoffs, VRS, wage increases linked to productivity and reducing the number of holidays, which are very contagious issues that have even changed governments in some countries.

The importance of this factor is stronger given that unemployment levels are at single digit below 5% and the economy is expected to expand to 100 billion with key strategies like driving towards a megapolis and trade agreements, which are essentially service-driven and require skilled people. This aptly summarises the challenge Sri Lanka is up against and what we can expect in making Sri Lanka a modern economy.

SL – Things going good

If we carefully look at what’s going good for Sri Lanka, the Basic Economic ranking increasing to 67 from the low 75 is good news for the hard work done post-war. We must acknowledge the Innovation ranking improving to 43 up three places. These two attributes alone means that Sri Lanka will see very positive results in the years to come, especially due to the more connected policies at play from the current Government. We must now develop on these strengths by driving connectivity to the semi urban and rural economies so that we can stimulate the SME businesses of Sri Lanka.

We must combine technology readiness which Sri Lanka scores low at a rank of 93 and link it to innovation and business sophistication so that with integration we drive a modern industrial sector. The best case in point is how the apparel industry has developed the business model to have a 65% value addition by developing the design element in the value chain.

I guess Ceylon Cinnamon, Ceylon Crafts and Ceylon Sapphires must take a hard look at the industry business model. The BPO industry targeting to be a $5 billion business is interesting given that AT Kearney has ranked Sri Lanka to be a top 20 in the global out-servicing industry.

So what happened to SL?

Rather than questioning the World Economic Forum data, we must do a soul search. Maybe the starting point is to revalidate the key data that we evaluate the country and check the perceptions people have on them. The best case in point is inflation. For three years we say that our inflation is at below 5% and as at now at 3.5% when each of us know all prices of the basket of goods has  increased by a minimum 12-15% in our households.

increased by a minimum 12-15% in our households.

This is not only from the urban consumer but also the rural housewife given that we have an increased two million mouths to feed – tourism. In other words, demand has outpaced the supply chain and basic economics say that prices have to increase.

The second is that whilst the Sri Lankan economy has expanded from a 40 billion to a 70 billion dollar plus economy in the last five years, our competitors has beaten us on the key parameters of competitiveness. This means that we must become market driven and change the game which makes Sri Lanka become competitive on the attributes that the world evaluates.

In simple words, let’s be marketing-oriented rather than being product-driven that is myopic in typical marketing jargon but I wonder how the VAT increase is going to play given that the hit that many companies never budgeted for.

New faces and new things

The new face of the Port City project post the loan swap was only the start of game change that will have to do get out of the debt trap. We must also attract the top four Indian companies into Sri Lanka – Ambanis, Tatas and Infosys just to name a few. We must attract the top four US and Chinese corporations into Sri Lanka so that one can access the FTAs we have with India and Pakistan and China in the near future.

We have to align ourselves to Regional Economic Partnerships targeting a regional FTA which will give a country access to 3.4 billion consumers and a value of 20 trillion dollars. Sri Lanka has no option but to play the high-ground game. If not we cannot really reap the peace dividends.

The move to cooperate with the UNHCR is strategically a wise move that is working. Sri Lanka needs these kinds of reforms in today’s global world. I guess the engagement of the INGO/NGOs with the Government senior officials was another reform that will support the trade engagement of the US and EU in the future. We have to remember the world is connected.

Conclusion

I will not agree totally with the data of the World Economic Forum’s Competitiveness score but it gives us insights into how the world perceives Sri Lanka’s performance and as against its competitors how we stand. We must also be sensitive to other global ranking scores like Nation Branding Index and Doing Business Index so that we use them as feedback loop to our performance.

(The author serves the country on many private and public sector boards of management and is a respected thought leader and award-winning marketing professional who has worked in top multinational organisations. The thoughts expressed are not the views of the offices he holds in Sri Lanka or globally. He is an alumnus of Executive Learning, Harvard Kennedy School.)