Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 6 August 2021 01:23 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

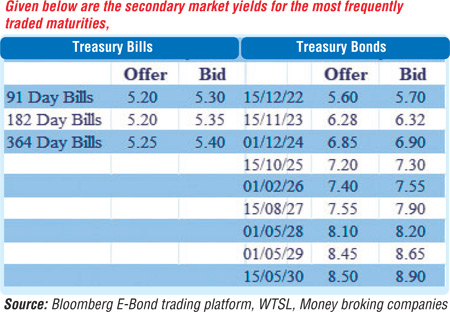

The yields of 2023 maturities resumed it downward run yesterday as the liquid 15.11.23 hit an intraday low of 6.30% while the 15.12.23 dipped to 6.35%. In addition, the 15.11.22 maturity traded at a low of 5.65% on renewed buying interest. The 15.10.25 maturity changed hands at a level of 7.25% as well. In secondary bills, November 2021 and February 2022 maturities traded at levels of 5.22% to 5.23%.

The yields of 2023 maturities resumed it downward run yesterday as the liquid 15.11.23 hit an intraday low of 6.30% while the 15.12.23 dipped to 6.35%. In addition, the 15.11.22 maturity traded at a low of 5.65% on renewed buying interest. The 15.10.25 maturity changed hands at a level of 7.25% as well. In secondary bills, November 2021 and February 2022 maturities traded at levels of 5.22% to 5.23%.

The total secondary market Treasury bond/bill transacted volume for 4 August was Rs. 32.40 billion.

In money markets, the weighted average rates on call money and repo averaged 5.07% and 5.13% respectively as an amount of Rs. 153.10 billion was deposited at Central Banks SDFR of 4.50%. The net liquidity surplus was registered at Rs. 60.92 billion yesterday with an amount of Rs. 92.18 billion been withdrawn from Central Banks SLFR of 5.50%.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 4 August was $ 29.10 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)