Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 6 January 2025 04:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

“Volatility is a trader’s best friend.” The year 2024 marked an eventful one for the Government Securities market driven by some pivotal developments in the space of politics, monetary policy, debt restructuring and global impacts.

Highlights

The year kicked off with yields still at elevated levels due to the lingering impacts of the 2022 economic and political crisis. However, they were drastically lower than the year prior where yields had crossed 30+% on selected tenors. The T-bond section of the yield curve was upward sloping and relatively flatter as compared to the year prior, having normalised and recovered from a steep inversion when yields were at historic highs. For reference, the year opened with the 2026, 2027, 2028 and 2030 tenors quoted at the 2-way rates of 13.80%/13.95%, 13.85%/13.95%, 14.15%/14.25% and 14.15%/14.30% respectively.

Meanwhile in secondary market bills, the 3-month, 6-month and 12-month tenors were observed quoted at the 2-way rates of 14.15%/14.45%, 14.00%/14.15% and 12.75%/13.05% respectively, continuing to exhibit an inversion in the T-bill section of the yield curve. The monetary policy rates stood at 9.00% on the Standing Deposit Facility Rate (SDFR) and 10.00% on the Standing Lending Facility Rate (SLFR) while the Statutory Reserve Ratio was at 2.00%. The USD/LKR rate on spot contracts opened the year at 321.50/322.00. The overnight banking sector liquidity stood at a deficit of 105.69 billion.

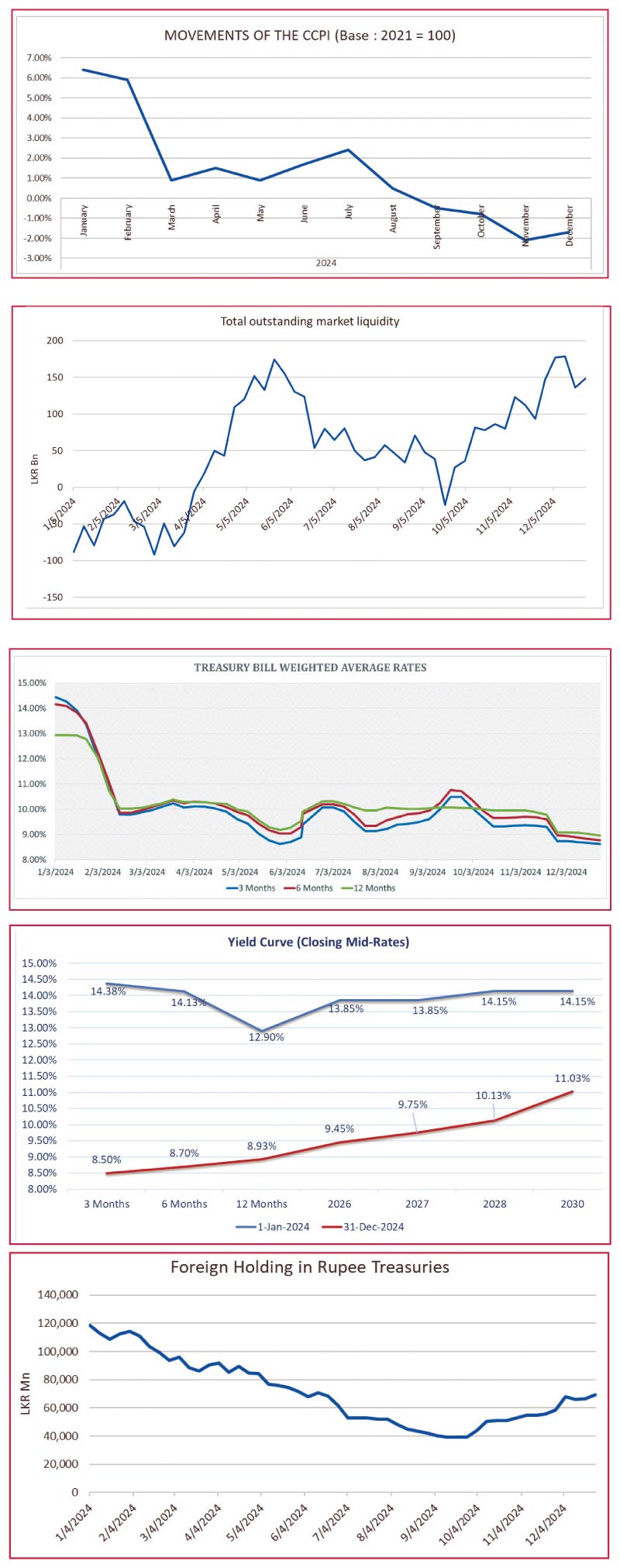

In 1Q2024 yields were seen declining drastically, with a bull run propelled by improving macroeconomic indicators which showed robust recovery and improvement from the crisis-levels. In particular, sharp disinflation saw the CCPI index range down from 6.4% to 0.9% during the quarter. GDP growth exhibited a strong recovery and was registered at 5.30% YoY during the quarter. In addition, monetary easing seen in 2H2023 and a further 50-basis-point easing on the standing facility rates in March 2024 drove market expectations of looser monetary policy, prompting G. Sec yields to adjust accordingly.

The quarter also saw the Domestic Operations Department conducting outright purchase auctions for Treasury bonds, which supported the bullish momentum. As such the market rallied, fuelled by strong sentiment and steep declines in yields were observed at primary auctions up until a slight reversal at the tail end of the quarter. However, foreign holdings in LKR treasuries continued to dwindle during the period dropping from Rs. 118.46 billion at the start of the quarter to Rs. 90.60 billion, as foreign investors sought to realise gains from the bull run. The banking sector liquidity had improved to a positive of Rs. 85.83 billion. In conclusion secondary bond market rates were seen closing the quarter considerably lower with the 2026, 2027 and 2028 bonds quoted at the market two-way quotes of 11.35%/11.40%, 11.91%/11.94% and 12.10%/12.20% respectively. Furthermore, the T-bill section of the yield curve was observed normalising and as such 3-month, 6-month and 12-month tenors were observed quoted at the 2-way rates of 9.90%/10.10%, 10.20%/10.30% and 10.20%/10.30% respectively.

2Q2024 initially saw yields continue to creep up, following an extended bull run that lasted until the latter part of 1Q2024. Both primary and secondary market rates continued to edge up on profit taking pressure as market participants looked to book profits. However, the momentum quickly shifted and rates were seen declining on the back of strong demand. This was driven by a vastly improved overnight banking sector liquidity which was supported by increased foreign exchange inflows from foreign worker remittances and tourism earnings. Total outstanding market liquidity, which had been steadily increasing, was seen peaking at Rs. 174.38 billion which was at that point a three-year high, during the week ending 22 May 2024. This surge in liquidity caused yields to nosedive once again. The market experienced a rally with aggressive buying observed both at primary auctions and the secondary market. This was supported by progress in the External Debt Restructuring (EDR) talks with the Steering Committee members of the Ad Hoc Group of Bondholders as well as Bilateral Creditors.

The quarter also saw the successful completion of the second review of the IMF program. CCPI inflation during the quarter was seen remaining well below the Central Bank’s target of 5.00% and was recorded at 1.70% in June. The country’s key monetary policy rates were maintained by the CBSL during the quarter, taking a pause on its monetary easing cycle which had seen a prior cumulative drop of 700 basis points since easing began in June 2023. Despite these developments, the exodus of foreign holdings in rupee treasuries continued and had fallen to Rs. 62.05 billion as at the end of 2Q2024. GDP growth was recorded at 4.70% during the quarter. However, the latter part of the quarter saw a steep reversal as liquidity declined significantly and profit taking pressures built up, erasing gains. Secondary bond market rates on 2026,2028, 2029 tenors were seen closing the quarter at the 2-way quotes of 10.85%/11.00%, 11.90%/12.00% and 12.15%/12.30% despite being quoted at lows of 9.85%/9.95%, 10.55%/10.65% and 11.10%/11.35% respectively in end-May.

Similarly secondary market treasury bills on the 3-months, 6-months and 12-months tenors closed the quarter quoted at 10.00%/10.15%, 10.10%/10.25% and 10.25%/10.45% respectively. This was significantly above the weighted average levels of 3-months: 8.62%, 6-months: 9.04% and 12-months: 9.18% recorded at 29 May Treasury Bill auction, which at that point were 2-year lows and below the SLFR rate of 9.50% across the board.

3Q2024 also saw significant volatility, being a gripping quarter. In early July, rates were seen declining on the back of news that Sri Lanka had reached a debt restructuring agreement with its International Sovereign Bondholders. The terms helped pave the way to achieving debt sustainability, improving fiscal space and restoring confidence in the international community such as continued IMF support, credit ratings and foreign capital market access. This was augmented by bullish outcomes at primary auctions. Market participants were observed reading this as a turning point in the recent spike in yields observed at the tail end of the previous quarter. In addition, July saw further monetary easing, with a 25-basis point reduction on the standing facilities which led to the SLFR and SDFR being decreased to 8.25% and 9.25% respectively.

However, momentum quickly shifted and yields were seen moving up amidst the political uncertainty around the 2024 Presidential election. In the run up to the election, this trend continued and the market was characterised by continued selling pressure which led to yields surging drastically. This was further compounded by decreasing market liquidity during the quarter and reflected in the limited uptake at Treasury bond auctions. For context, yields spiked at the Rs. 290 billion Treasury Bond Auction (incidentally one of the largest on record) conducted on 12 September, reflecting the upward trajectory observed in the secondary market and the continual increasing trend at primary auctions at that time.

The auction raised only 81.81% out of the total amount offered and saw a 15.02.28 and 15.06.29 maturity issued at the weighted average rates of 13.79% and 13.98% respectively. Similarly, Treasury bill auction weighted average rates were seen increasing to elevated levels of 3-months: 10.49%, 6-months: 10.76% and 12-months: 10.07% on 18 September.

However, following the conclusion of the Presidential election G-Sec yields were seen nosediving and the market began to rally. The bull run saw sustained aggressive buying interest pushing yields down by almost 200 basis points on selected tenors. By the end of the quarter, market two-way quotes on 2026, 2027, 2028 and 2027 bonds were recorded at 10.70%/10.85%, 11.45%/11.55%, 11.83%/11.85% and 11.95%/12.00% respectively. This was supported by a low inflation environment with the CCPI recording deflation of -0.50% YoY in September which came amidst high GDP growth of 5.5% YoY during the quarter. However, in the month of September 2024 Foreign Holdings in Rupee Treasuries continued to decline, falling to the lowest level since February 2023 before the EFF program with the IMF was established.

4Q2024 carried over the positive momentum from the previous quarter driven by a decisive outcome at the parliamentary election, the successful conclusion of the external debt restructuring with the International Sovereign Bond exchange receiving a high take up of 97% and the ensuing credit rating upgrades delivered by Fitch and Moody’s which moved Sri Lanka out of default status. The CBSL introduced a major development in monetary policy during the quarter by announcing the adoption of a single policy interest rate mechanism.

The SLFR/SDFR was replaced by the new Overnight Policy Rate (OPR) as its primary monetary tool. The OPR would guide the Average Weighted Call Money Rate (AWCMR) around the announced target. At the 6th and final Monetary Policy Review of 2024, the OPR was set at 8.00%, 50 bps below the prevailing AWCMR. The Standing Facilities were adjusted to 8.50% (SLFR) and 7.50% (SDFR), reflecting a 75-bps reduction. This marked a cumulative 800 bps reduction in standing facility rates since the easing cycle began in June 2023. The bullish sentiment was further fuelled by the continued easing of interest rates and increased overnight market liquidity, which propelled rates further down.

CCPI inflation continued to showcase a low-inflation environment with deflation being recorded in every month of the quarter, with December CCPI index value recorded at -1.70% YoY and an annual average value of 1.20%. During the quarter foreign holdings in G-Sec saw a strong recovery, increasing once again to end the year at Rs. 69.26 billion. As such, yields declined further and Secondary Bond Market quotes ended the year on 2026, 2027,2028 and 2029 bonds at the 2-way rates of 9.40%/9.50%, 9.75%/9.85%, 10.10%/10.15% and 10.65%/10.75% respectively. The volatility witnessed during the year made it a “Actioned packed one” while the overall outcome of the G-Sec market was very bullish during the year 2024 with investor returns continuing to be very high as significant trading opportunities were available throughout the year. The term “Volatility is a trader’s best friend” was evident during the year.

In conclusion, the Government Securities Market closed the year 2024 on a strong note, subsequent to bounds of volatility following significant developments in the political and economic environments. The year 2025 commences on a considerably stronger footing with much more optimism.