Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 2 February 2023 01:34 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

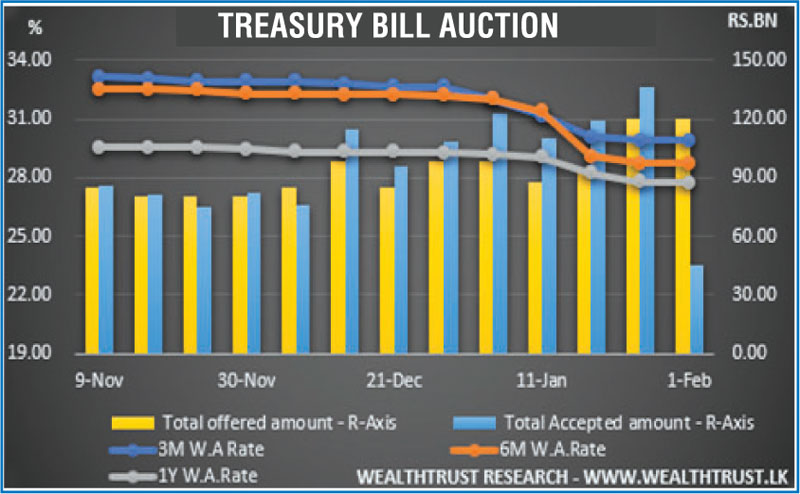

The 3 months (91 days) and 6 months (182 days) Treasury bill weighted averages remained unchanged at its auctions held yesterday for the first time in eight weeks while halting a decreasing trend witnessed over the last seven weeks. The averages stood at 29.91% and 28.72% respectively. However, the weighted average on the 364 day bill dipped by 6 basis points to 27.72%, continuing its decreasing trend.

The 3 months (91 days) and 6 months (182 days) Treasury bill weighted averages remained unchanged at its auctions held yesterday for the first time in eight weeks while halting a decreasing trend witnessed over the last seven weeks. The averages stood at 29.91% and 28.72% respectively. However, the weighted average on the 364 day bill dipped by 6 basis points to 27.72%, continuing its decreasing trend.

Nevertheless, the auction went undersubscribed as only Rs. 45.61 billion was accepted in total against a total offered volume of Rs. 120 billion while phase two of the auction will be opened for all three maturities at its weighted average rates until close of business on the day prior to settlement (i.e., 3.30 pm on 02.02.23).

In secondary bond markets, the 01.05.24, 01.07.25 and maturities changed hands at levels of 31.75% to 31.80%, 32.35% to 32.85% and 29.26% to 29.30% respectively.

The total secondary market Treasury bond/bill transacted volume for 31 January 2023 was Rs. 11.51 billion.

In money markets, the weighted average rates on overnight call money and REPO stood at 15.47% and 15.50% respectively while an amount of Rs. 109.52 billion was withdrawn from Central Banks SLFR facility (Standard Lending Facility Rate) of 15.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady for a fourth consecutive day at Rs. 362.14 yesterday.

The total USD/LKR traded volume for 31 January was $ 63.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)