Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 7 October 2021 02:42 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

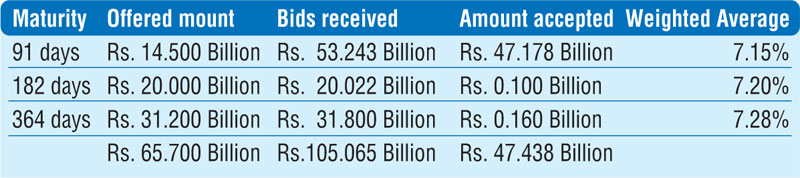

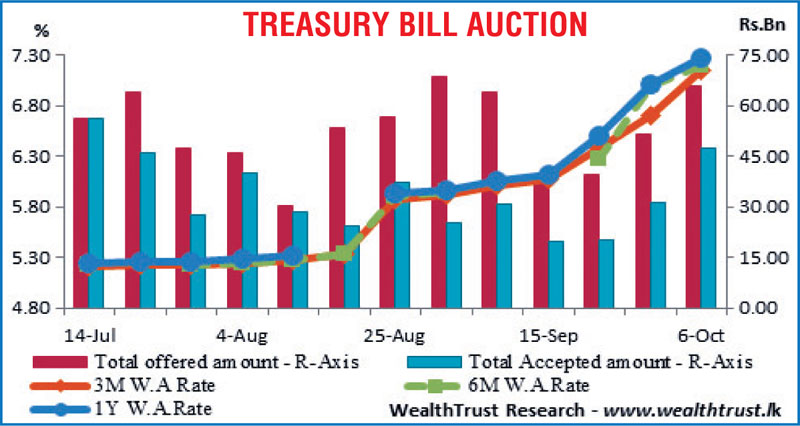

The weighted averages on the three- and six-month Treasury bills was seen exceeding 7% for the first time since March and April 2020 as it recorded increases of 45 and 21 basis points respectively at its auctions conducted yesterday, to record 7.15% and 7.20%. The 364-day maturity increased by 27 basis points as well to record a weighted average of 7.28%. The total accepted amount was seen increasing to a five-week high of 72.20% of its total offered amount, as an amount of Rs. 47.18 billion was accepted on the 91-day maturity alone against its offered amount of Rs. 14.5 billion. The bids to offer ratio increased to an eight-week high of 1.60:1.

The weighted averages on the three- and six-month Treasury bills was seen exceeding 7% for the first time since March and April 2020 as it recorded increases of 45 and 21 basis points respectively at its auctions conducted yesterday, to record 7.15% and 7.20%. The 364-day maturity increased by 27 basis points as well to record a weighted average of 7.28%. The total accepted amount was seen increasing to a five-week high of 72.20% of its total offered amount, as an amount of Rs. 47.18 billion was accepted on the 91-day maturity alone against its offered amount of Rs. 14.5 billion. The bids to offer ratio increased to an eight-week high of 1.60:1.

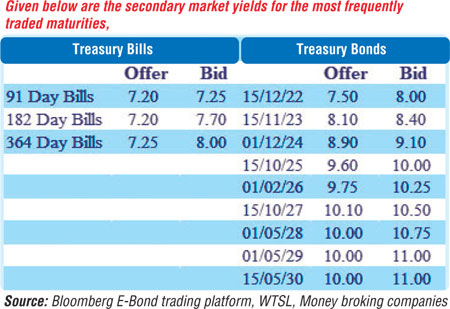

Selling interest on 2023 maturities saw its yields edge up yesterday, as 15.01.23 and 15.07.23 changed hands at levels of 8.30% and 8.50% respectively. In addition, 15.09.24 was traded at 9%.

The total secondary market Treasury bond/bill transacted volume for 5 October was Rs. 1.69 billion. In money markets, the net liquidity deficit stood at Rs. 48.05 billion yesterday with an amount of Rs. 99.89 billion been deposited at the Central Bank’s SDFR of 5% against an amount of Rs. 154.94 billion withdrawn from the Central Bank’s SLFR of 6%. The DOD (Domestic operations Department) of the Central Bank drained out an amount of Rs. 7 billion by way of seven-day repo auction at a weighted average yield of 5.97%. The weighted average rates on call money and repo stood at 5.90% and 5.92% respectively.

USD/LKR

The Forex market remained inactive yesterday.

The total USD/LKR traded volume for 5 October was $ 42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)