Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 23 November 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

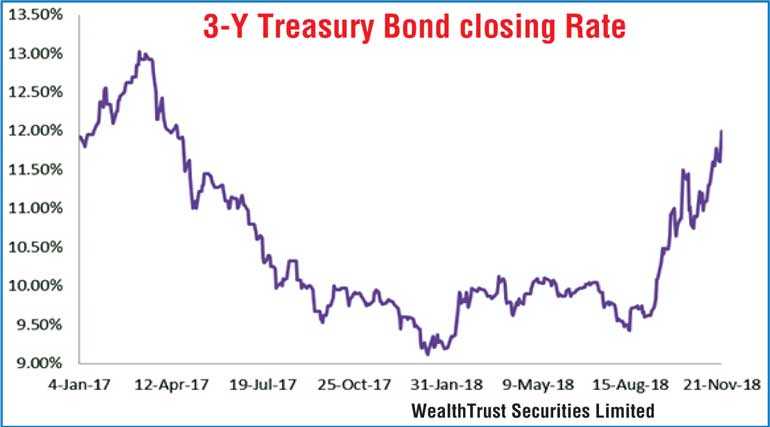

The three year Treasury bond yield in the secondary market was seen hitting the 12.00% psychological level on Wednesday for the first time in over 19 months or since the first week of April 2017, on the back of foreign selling interest.

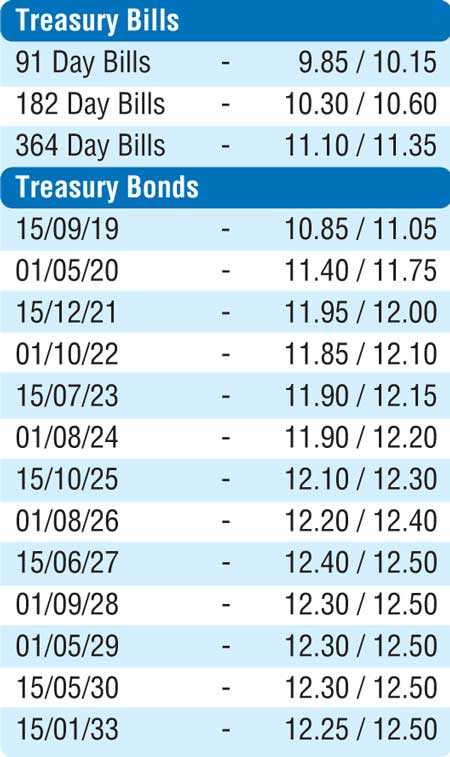

The 15.12.2021 maturity was seen changing hands within the range of 11.97% to 12.07% while the eight year maturity of 15.06.2027 was seen changing hands from a daily low of 12.35% to a high of 12.45% as activity remained muted across the rest of the yield curve.

The overnight call money and repo rate was seen averaging 8.95% and 8.94% respectively on Wednesday as the net liquidity shortfall stood at Rs. 64.35 billion. The Open Market Operations of Central Bank conducted three reverse repo auctions for durations of overnight, seven days and 14 days for successful amounts of Rs. 30.1 billion, Rs. 15 billion and Rs. 19.35 billion at weighted averages of 8.56%, 8.76% and 8.70% respectively. In addition, all bids received for the five outright purchases of Treasury bills totalling Rs. 25 billion were rejected.

Rupee dips below Rs. 178

The continued political uncertainty coupled with foreign selling in Rupee bonds saw the USD/LKR rate on spot contracts dip below Rs. 178 to close the day at a new low of Rs. 178.40/70 on Wednesday against its previous day’s closing of Rs. 177.30/50.

The total USD/LKR traded volume for 19 November was $ 112 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 179.15/65; three months – 181.15/65; six months – 183.80/30.