Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 7 April 2020 01:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

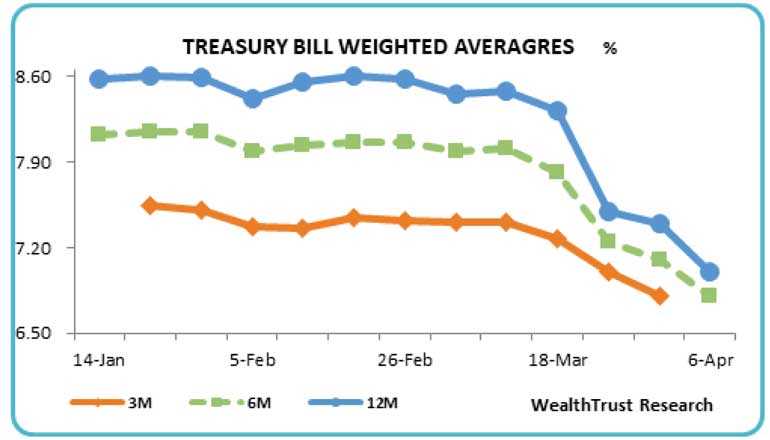

The weekly weighted average rates were seen recording steep declines once again at its auctions held on Monday due to a shortened trading week.

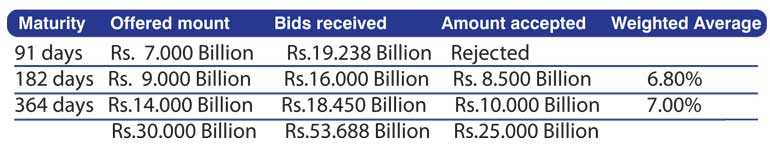

The market favourite 364-day bill recorded the sharpest decline of 40 basis points to hit the 7% psychological level for the first time since December 2015. The 182-day bill trailed closely, recording a dip of 30 basis points to 6.80% while all bids received for the 91-day bill were rejected.

Once again, the total accepted amount was seen dipping below the total offered amount, with only Rs. 13.90 billion being accepted against a total offered amount of Rs. 30 billion.

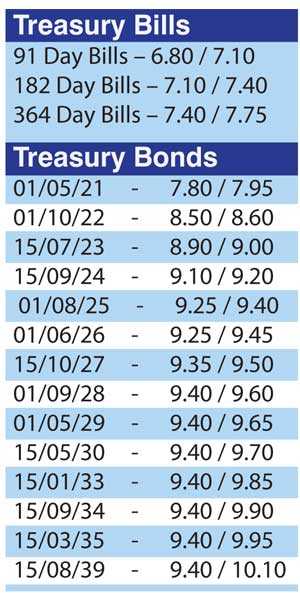

In the secondary bond market, following the monetary policy reduction and expectations on the outcome of the weekly bill auction; yields were seen dipping on the back of renewed buying interest. The market favourite maturities of 01.10.22, 2023s (i.e. 15.07.23, 01.09.23 and 15.12.23) and 2024s (i.e. 15.03.24, 01.08.24 and 15.09.24) saw its yields dip to intraday lows of 8.60%, 9.00%, 9.05%, 9.10%, 9.18%, 9.24% and 9.14% respectively against its previous day’s closing levels of 8.80/85, 9.15/20, 9.20/28, 9.30/35, 9.35/40, 9.45/50 and 9.33/40.

In addition, maturities of 01.05.21 and 15.10.27 changed hands at levels of 7.90% to 8.30% and 9.35% to 9.40% respectively as well. In secondary bills, January and March 2021 maturities changed hands at levels of 7.35% to 7.55%, pre-auction.

Today’s (7 April) Treasury bond auctions will have in total an amount of Rs. 40 billion on offer, consisting of Rs. 12.5 billion on a three year and five month maturity of 01.09.2023, Rs.10 billion on a four year and five month maturity of 15.09.2024 and a further Rs.17.5 billion on a seven year and six month maturity of 15.10.2027.

The weighted average yields at the auctions conducted on 12 March for the maturities of 01.10.2022, 15.09.24 and 15.10.2027 were recorded at 9.33%, 9.81% and 9.99% respectively.

In money markets on Monday, the weighted average rates on the overnight call money and repo decreased to 6.50% and 6.60% respectively as the overnight liquidity surplus stood at high of Rs. 111.81 billion.

The DOD (Domestic Operations Department) of Central Bank injected liquidity of Rs. 1 billion yesterday for a period of 89 days at a weighted average of 6.60% subsequent to offering Rs. 30 billion. The 14-day Reverse Repo auction of Rs.10 billion drew no bids.

Rupee trades on spot contracts

In the Forex market, the USD/LKR rate on spot contracts was traded at Rs. 199.50 yesterday. The total USD/LKR traded volume for 3 April was $ 109.10 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies.)