Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 15 March 2018 01:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

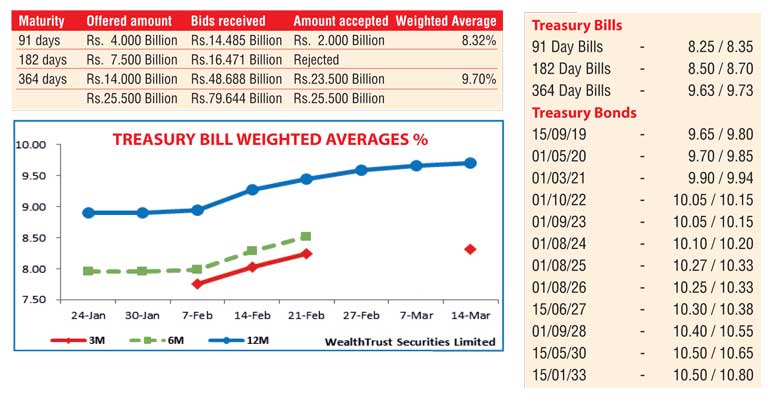

The weighted average on the 364 day bill continued its upward trend, albeit at a slower pace in comparison to its previous weeks, at its auction conducted on 13 March. The 04 basis point increase saw the 364 day bill fetch a weighted average of 9.70% while the 91 day bill recorded a weighted average of 8.32% as it was accepted after a lapse of two weeks. The 182 day bill was rejected for a third consecutive week. The total offered amount of Rs. 25.50 billion was fully accepted as the bids to offer ratio increased to 3.12:1.

In the secondary bond market yesterday, yields continued to decrease on thin volumes once again. The three 2021 (i.e. 01.03.21, 01.05.21 and 01.08.21) maturities hit intraday lows of 9.90% and 9.95% each respectively while the 01.08.25 changed hands at 10.30%. In the secondary bill market, August 2018 maturities were seen changing hands at levels of 8.70%.

The total secondary market Treasury bond/bill transacted volumes for 13 March was Rs. 5.9 billion.In money markets, the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 43.7 billion by way of two repo auctions at weighted averages of 7.26% and 7.36% respectively for periods of 1 and 7 days as the net surplus liquidity in the system increased to Rs. 54.48 billion yesterday. The overnight call money and repo rates averaged at 8.13% and 7.64% respectively.

Rupee loses

The USD/LKR rate on spot contracts depreciated yesterday to close the day at levels of Rs. 155.85/95 against its previous day’s closing levels of Rs. 155.65/70 on the back of importer demand.

The total USD/LKR traded volume for 13 March was $ 65.15 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 156.65/75; 3 Months - 158.35/50 and 6 Months - 160.85/95.

Reuters: Sri Lankan shares fell yesterday (14 March) from their highest close in nearly two weeks hit in the previous session, as selling by foreign investors weighed on sentiment, brokers said.

Foreign investors sold a net Rs. 183.3 million ($1.18 million) worth of shares, but they have been net buyers of Rs. 7.1 billion worth of equities so far this year.

The Colombo stock index ended 0.54% weaker at 6,519.48.

Falls in large cap Ceylon Tobacco Co PLC dragged down the overall index, said First Capital Holdings research head Dimantha Mathew. “The market came down on small quantity of CTC trade and some banks also came down as investors think the earnings could be hit on some tough regulatory compliance,” he added.

Turnover was Rs. 1.6 billion, more than this year’s daily average of around Rs. 973.3 million.

Shares in Ceylon Tobacco ended 4.8% weaker, Ceylinco Insurance PLC fell 7.6% and Commercial Bank of Ceylon PLC slipped 0.22%.