Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 27 June 2019 01:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

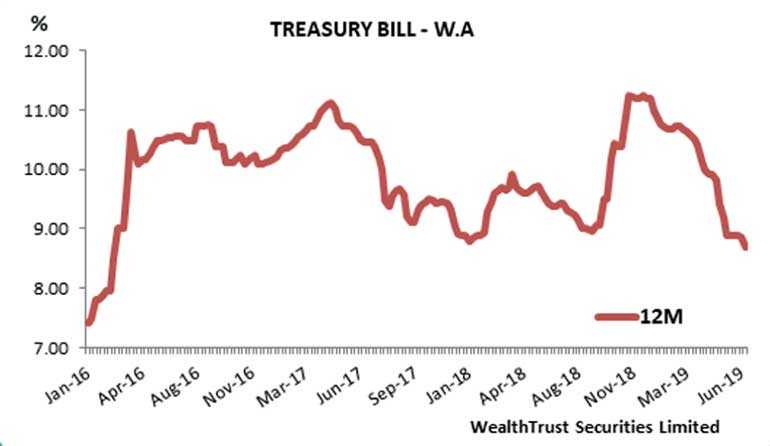

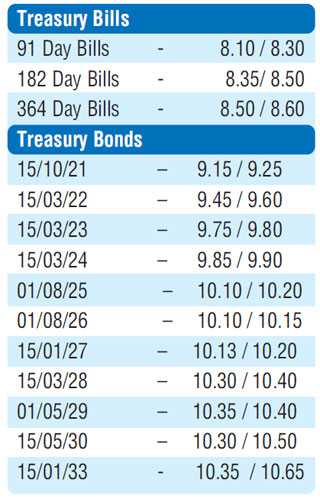

The weighted average on the benchmark 364-day bill was seen declining by 16 basis points to over a three year low of 8.70%, a level last seen in February 2016. The 91-day and 182-day bills followed through recording dips of 14 and 11 basis points respectively to 8.24% and 8.49%. The total offered volume of Rs. 16 billion was successfully subscribed as the bids to offer ratio stood at 4.88:1.

In the secondary bond market, activity increased pre-auction with yields decreasing across the yield curve. Local buying interest on the maturities of 2021’s (i.e. 01.03.21, 01.05.21, 01.08.21, 15.10.21 & 15.12.21), two 2022’s (i.e. 15.03.22 and 01.10.22), 2023’s (i.e. 15.03.23 15.05.23, 15.07.23 and 15.12.23), 15.03.24, 01.08.26, 15.01.27 and 01.05.29 saw its yields decrease to lows of 9.00%, 9.20%, 9.20%, 9.20%, 9.20%, 9.65%, 9.60%, 9.80%, 9.83%, 9.85%, 9.80%, 9.90%, 10.17%, 10.16% and 10.38% respectively. In addition, the 01.05.20 bond was seen changing hands at levels of 8.55% as well.

Today’s Treasury bond auctions, in lieu of a Treasury bond maturity of Rs. 109.5 billion, will have in total an amount of Rs. 125 billion on offer, consisting of Rs. 75 billion on a new four-year and 11-month maturity of 15.06.2024 and Rs. 50 billion on a 15-year and eight-month maturity of 15.03.2035. The weighted average yields at the auctions conducted on 13 June for the maturities of 15.10.2021 and 15.03.2028 were recorded at 9.79% and 10.63% respectively.

The total secondary market Treasury bond/bill transacted volumes for 25 June was Rs. 17.50 billion.

In the money market, the overnight call money and repo rates averaged at 7.88% and 7.95% respectively as the OMO Department of the Central Bank of Sri Lanka drained out an amount of Rs. 29.80 billion by way of an overnight repo auction at a weighted average of 7.73%.

It further mopped up an amount of Rs. 10 billion by way of a five-day repo auction at a weighted average rate of 7.78% as the net liquidity surplus in the system increased to Rs. 49.59 billion yesterday.

Rupee remains mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged to close the day at Rs. 176.50/60 for a second consecutive day.

The total USD/LKR traded volume for 25 June was $ 114.83 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month – 177.20/40; 3 months – 178.70/90 and 6 months – 180.80/10.