Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 14 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

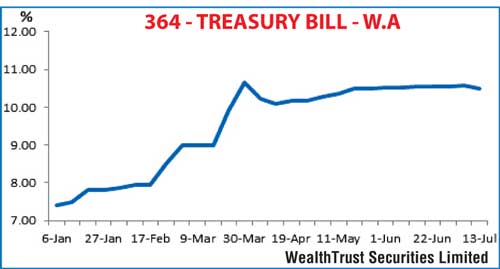

Reversing an upward or stagnant trend, the 364-day bill weighted average was seen decreasing for the first time in 13 weeks yesterday while all bids received for the 91-day and 182-day bills were rejected. The dip was 7 basis points to 10.49% as an amount of Rs. 7.49 billion was accepted against an offered amount of Rs. 6 billion.

In the secondary bond market, activity continued to remain high mainly on the 01.09.23, 01.01.24 and 01.06.26 maturities within daily lows of 12.00%, 12.05% and 12.18% respectively to highs of 12.03%, 12.10% and 12.26%.

In addition, the yield on the 15.09.19 maturity was seen dipping to an intraday low of 11.42% against an opening high of 11.50% while 2018 maturities continued to change hands at levels of 11.05% to 11.10%.

This was ahead of today’s Treasury bond auctions where a total amount of Rs. 23 billion will be on offer consisting of Rs. 9 billion on a 2.03-year maturity of 15.10.2018, Rs. 8 billion on a 4.08-year maturity of 01.03.2021 and Rs. 6 billion on a 9.01 year maturity of 01.08.2025.

Meanwhile, in money markets yesterday, the call money and repo rates remained steady to average at 8.21% and 8.02% respectively as the OMO Department of the Central Bank was seen injecting an amount of Rs. 46.49 billion on an overnight basis by way of a reverse repo auction at a weighted average rate of 7.97%. The net liquidity shortfall was seen decreasing to Rs. 42.27 billion against Rs. 51.51 recorded the previous day.

Rupee appreciates marginally

In Forex markets yesterday, the USD/LKR rate on the active one week forward contract was seen appreciating marginally to close the day at Rs. 146.10/25 against its previous day’s closing levels of 146.25/40. The total USD/LKR traded volume for 12 July 2016 was $ 58.60 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 146.70/00; three months - 148.30/50 and six months - 150.70/90.