Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 3 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

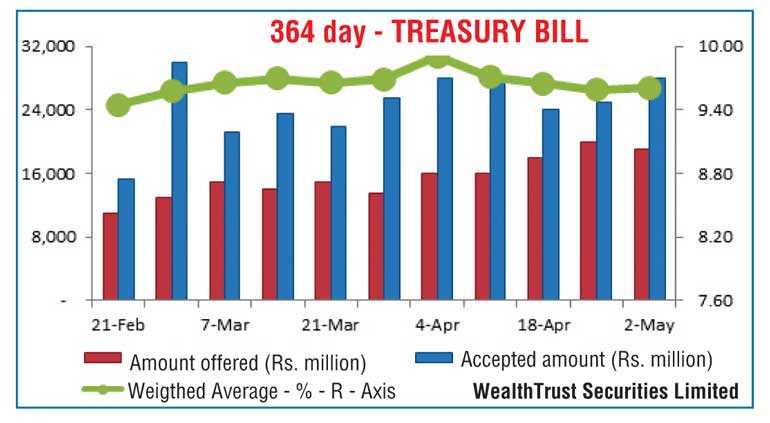

The 364 day bill weighted average was seen increasing once again at its weekly Treasury bill auction held yesterday, reversing its downward trend witnessed over the previous three weeks.

The total offered amount of Rs. 28 billion was accepted only on the 364 day maturity, recording an increase of two basis points on its weighted average to 9.61% while all bids for the 91 day and 182 day maturities were rejected. The bids to offer ratio decreased to a five-week low of 2.75:1. Given below are the details of the auction.

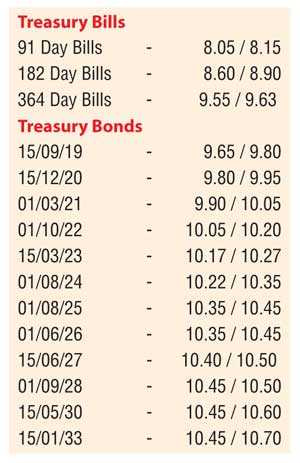

In the secondary bond market, selling interest on the maturities of 15.12.20, the two 2021s (i.e. 01.03.21 and 15.12.21), 01.08.25, 01.08.26, 15.06.27 and 01.09.28 resulted in its yields hitting intraday highs of 9.85%, 10.05%, 10.10%, 10.40%, 10.38%, 10.44% and 10.45% respectively on the back of thin volumes changing hands.

The total secondary market Treasury bond transacted volume for 1 May was Rs. 1.95 billion.

Meanwhile, in money markets, the overnight call money and repo rates increased marginally to average 7.89% and 7.99% respectively as the net surplus liquidity decreased to Rs. 1.47 Billion yesterday. The Open Market Operations (OMO) Department of the Central Bank drained out an amount of Rs. 10 billion on an overnight basis at a weighted average of 7.54%.

Rupee remains steady

The USD/LKR rate on spot contracts remained mostly unchanged for a second consecutive day to close the day at Rs. 157.75/90 as markets were at equilibrium.

The total USD/LKR traded volume for 1 May was $ 53.69 million.