Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 5 May 2020 01:26 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

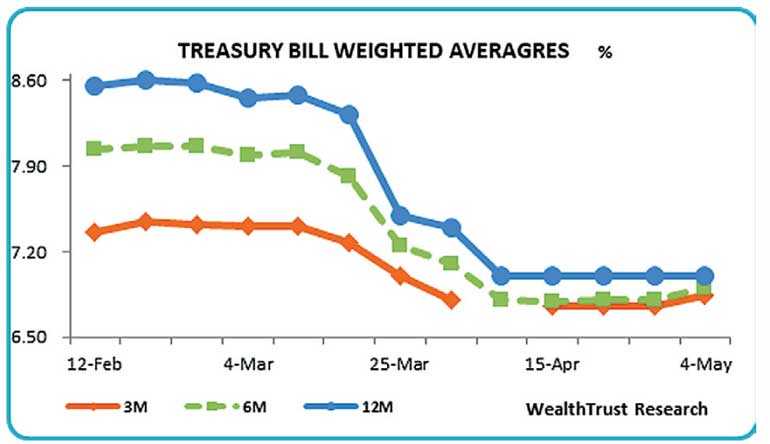

The 364-day bill weighted average rate was seen holding steady at 7% for a fifth consecutive week at its weekly Treasury bill auction conducted yesterday. However, weighted average rates on the 91-day and 182-day bills recorded increases of 9 and 10 basis points, respectively, to 6.84% and 6.90%.

The total accepted amount was seen falling short of the total offered amount for a seventh consecutive week, with Rs. 19.26 billion been accepted against a total offered amount of Rs. 30 billion. The total bids to offer ratio increased to 1.49:1.

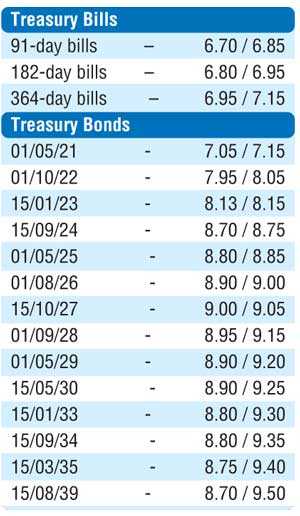

In the secondary bond market yesterday, buying interest on the three year maturity of 15.01.23 saw its yield dipped to an intraday low of 8.14% yesterday from its opening high of 8.17/20 while selling interest on the maturities of 2024’s (i.e. 15.06.24 and 15.09.24) and 15.10.27 saw its yields edge up to 8.70%, 8.75% and 9.02%, respectively. In addition, the maturities of 2021’s (i.e. 01.03.21, 01.05.21 and 01.08.21), 01.10.22 and 01.05.25 were seen changing hands at levels of 7.10% to 7.24%, 8.00% and 8.80% to 8.83%, respectively.

In secondary bills, June to July, October to November, and January 2021 maturities traded at levels of 6.70% to 6.85%, 6.90% to 6.96%, and 7.10%, respectively.

In money markets, the weighted average rates on overnight call money and repo stood at 6.41% and 6.56%, respectively, as the overnight net liquidity surplus in the system stood at Rs. 137.56 billion yesterday. The DOD (Domestic Operations Department) of Central Bank injected an amount of Rs. 3 billion by way of a seven-day reverse repo auction at a weighted average rate of 6.50%, subsequent to offering Rs. 25 billion. It further injected an amount of Rs. 5 billion for Standalone Primary Dealers by way of a seven-day reverse repo auction at a weighted average rate of 6.93%.

Rupee appreciates

In the Forex market, the USD/LKR rate on spot contracts appreciated to trade within the range of Rs. 188 to Rs. 191 yesterday against its previous days of Rs. 192 on the back of selling interest by banks.

The total USD/LKR traded volume for 30 April was $ 53.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)