Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 31 October 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

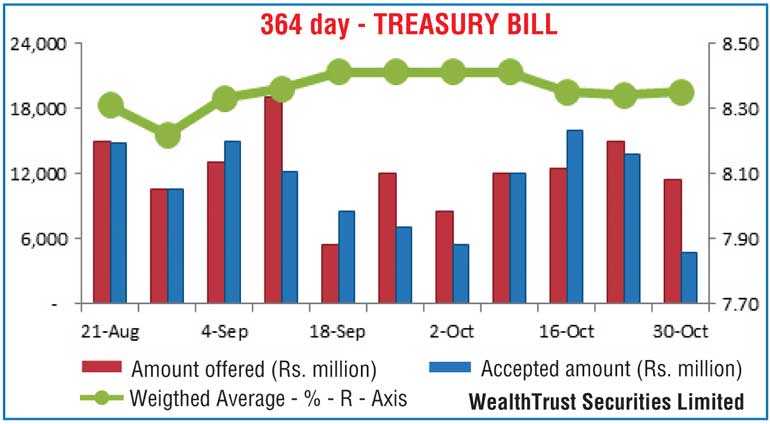

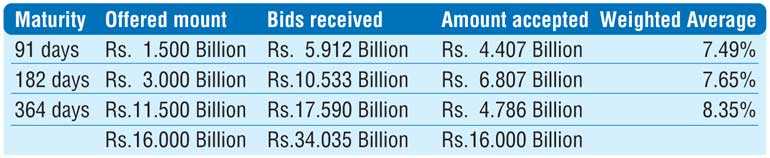

The 364 day bill weighted average at yesterday’s Treasury bill auction increased for the first time in six weeks, nudging up by 01 basis point to 8.35% with only an amount of Rs. 4.78 billion been accepted on it against its offered amount of Rs. 11.5 billion. Nevertheless, the total offered amount of Rs. 16 billion was successfully met at the auction as demand for the 91 day and 182 day maturities continued. Both these maturities decreased by 01 basis point each to 7.49% and 7.65% respectively, continuing its downward movement for a fifth and third consecutive week.

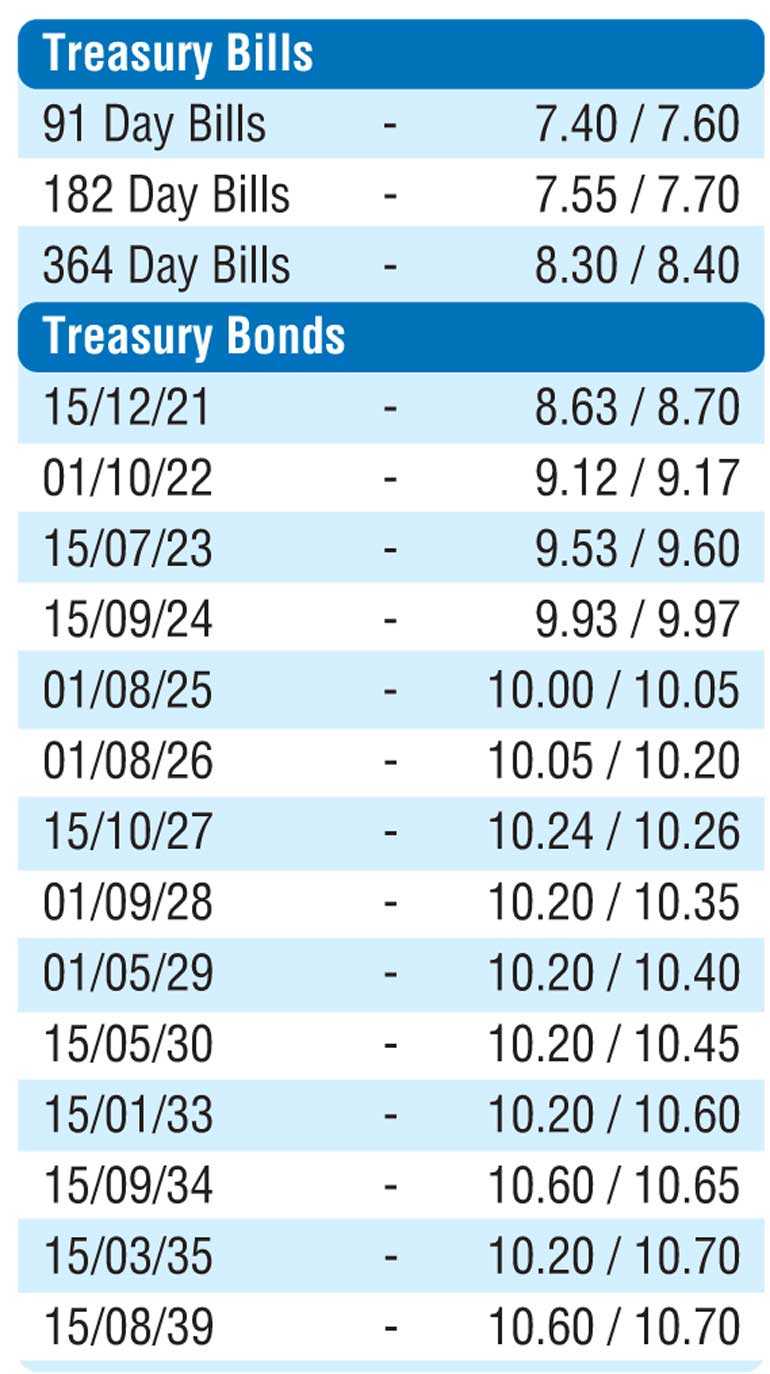

Meanwhile in the secondary bond market yesterday, activity moderated as most market participants were seen on the sidelines. Limited trades were seen on the maturities of 15.12.21, two 2022’s (i.e. 01.07.22 & 01.10.22) and 15.10.27 within the range of 8.65% to 8.70%, 9.10% to 9.15% and 10.25% to 10.27% respectively. In the secondary bill market, the 16 October 2020 maturity traded at a level of 8.30% to 8.34%.

The total secondary market Treasury bond/bill transacted volume for 29 October was Rs. 26.57 billion.

In money markets, the overnight call money and repo rates averaged at 7.43% and 7.49% respectively as the overnight net liquidity surplus in the system stood at Rs. 23.56 billion yesterday.

In the Forex market, the downward movement on the rupee continued for a fourth consecutive day as spot contracts were seen closing the day at Rs. 181.58/62 against its previous day’s closing level of Rs. 181.55/60 on the back of continued buying interest by banks.

The total USD/LKR traded volume for 29 October was $ 50.30 million.

Some forward USD/LKR rates that prevailed in the market are: one month – 182.15/30; three months – 183.35/50; six months – 184.15/35.