Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 13 February 2020 01:32 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

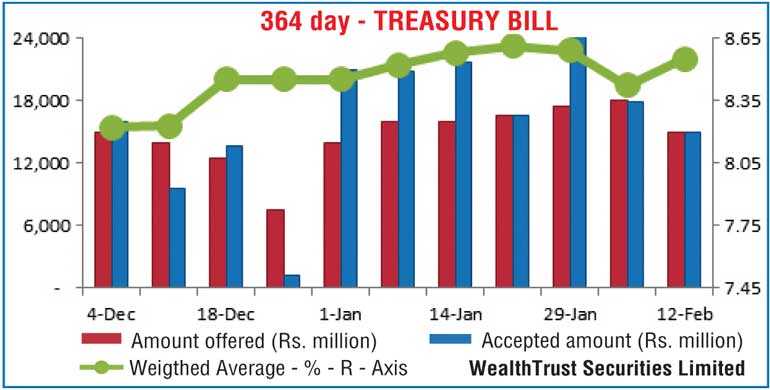

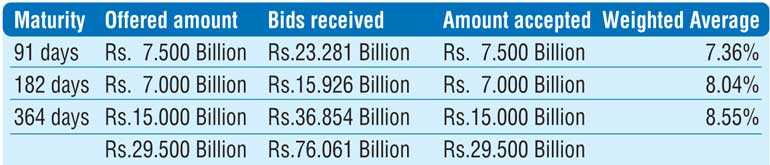

The market favourite 364-day bill weighted average yield at yesterday’s weekly Treasury bill auction was seen increasing once again recording a sharp jump of 13 basis points to 8.55% while the weighted average on the 182 day bill increased too by 05 basis points to 8.04%.

Nevertheless, weighted average yield on the 91-day bill decreased by 01 basis point to 7.36%. The total offered amount of Rs. 29.5 billion was fully met at the auction despite the bids to offer ratio dipping to a three weeks low of 2.58:1.

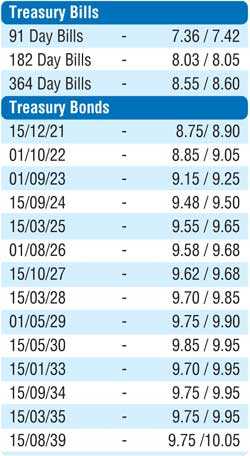

Meanwhile, secondary bond market yields increased marginally yesterday with the liquid maturities of 15.03.23, two 2024s (i.e. 15.06.24 and 15.09.24) and 15.10.27 hitting highs of 9.15%, 9.49%, 9.51% and 9.65% respectively against its previous day’s closing levels of 9.10/15, 9.45/48 each and 9.60/65.

In addition, longer end maturities of 15.05.30 and 15.09.34 were traded at highs of 9.91% each as well. Furthermore, in the secondary bill market, July 2020 and January 2021 maturities traded at levels of 7.92% and 8.49% to 8.51% respectively, pre-auction.

The total secondary market Treasury bond/bill transacted volume for 11 February was Rs. 6.85 billion.

Meanwhile in money markets, the overnight call money and Repo rates averaged 6.95% and 7.02% respectively as the overnight liquidity surplus increased to Rs. 19.19 billion yesterday.

Rupee fluctuates within a narrow range

In the Forex market, the USD/LKR rate on spot contracts were seen changing hands within the range of Rs. 181.40 to Rs. 181.51 before closing the day at level of Rs. 181.42/47 against its previous day’s closing level of Rs. 181.45/55.

The total USD/LKR traded volume for 11 February was $ 68.40 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 181.95/05; three months – 182.95/10; six months – 184.45/65.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies.)