Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 12 December 2019 02:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

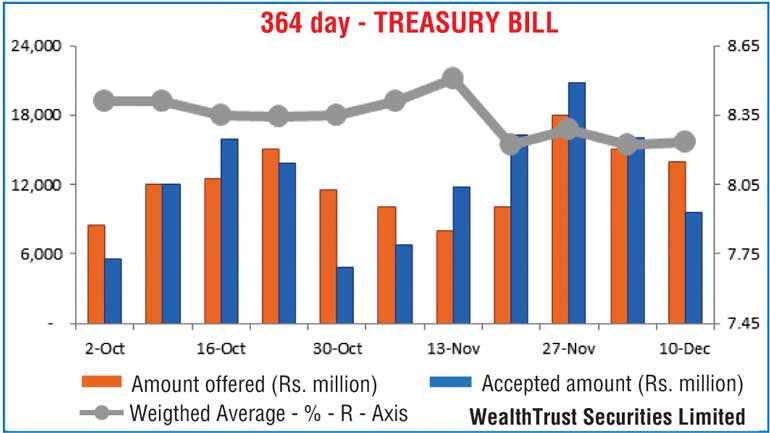

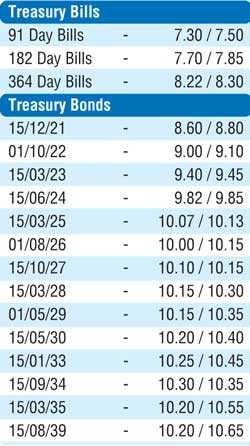

The market favourite 364 day bill weighted average yield increased at yesterday’s weekly auction reversing a dip witnessed the previous week. The 364 day maturity recorded an increase of 01 basis point to 8.23% with the weighted average yield of the 182 day maturity increasing by 05 basis points to 7.65%. However, the yield of the 91 day bill remained unchanged at 7.45%.

The total offered amount of Rs. 27 billion was successfully accepted at the auction as the bid to offer ratio stood at 1.96:1.

In the secondary bill market, March and September to November maturities were seen trading at levels between 7.42% to 7.50% and 8.15% to 8.31% respectively while in the bond market moderate activity was witnessed consisting of the 15.3.2023, 15.06.2024, 15.09.2024 and 15.03.2025 maturities at levels of 9.40%, 9.80% to 9.84% and 10.08% to 10.15% respectively. The long tenure maturity of 15.09.2034 traded at 10.30%. Today’s bond auction will have on offer a total amount of Rs. 25 billion, consisting of Rs. 15 billion of the 4year and 9 month maturity 15.09.2024 and Rs. 10 billion of the 10year and 5month maturity 15.05.2030.

The total secondary market Treasury bond transacted volume for 9 December was Rs. 8.59 billion.

In money markets, the Open Market Operations (OMO) Department of the Central Bank conducted an overnight Reverse Repo auction and injected Rs. 8.70 billion at a weighted average rate of 7.53% with the overnight net liquidity surplus in the system standing at Rs. 19.58 billion. The overnight call money and repo rates averaged 7.51% and 7.54% respectively.

Rupee appreciates

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating yesterday to close the day at Rs. 181.10/15 against its previous day’s closing levels of Rs. 181.20/30, subsequent to trading at a high of Rs. 180.30 and a low of Rs. 181.05.

The total USD/LKR traded volume for 9 December was $ 38.80 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 181.50/70; 3 months - 182.40/60 and 6 months - 184.20/50.