Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 29 May 2024 01:53 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

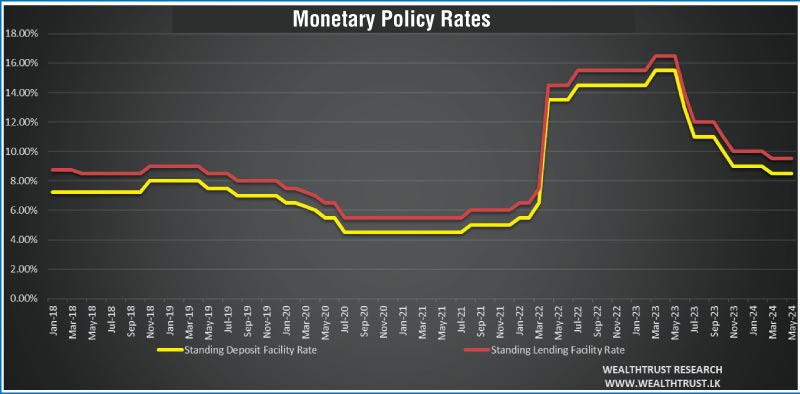

The secondary bond market yields were seen increasing yesterday following the 3rd monetary policy announcement, at which policy rates were kept unchanged at 8.50% and 9.5% on the Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR) respectively. The Statutory Reserve Ratio (SRR) also remained steady at 2.00%. The official press release stated the Board decided to maintain the current policy interest rates after evaluating the macroeconomic conditions and risks. Expressing that the goal is to keep inflation at the 5% target over the medium term while supporting economic growth.

The secondary bond market yields were seen increasing yesterday following the 3rd monetary policy announcement, at which policy rates were kept unchanged at 8.50% and 9.5% on the Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR) respectively. The Statutory Reserve Ratio (SRR) also remained steady at 2.00%. The official press release stated the Board decided to maintain the current policy interest rates after evaluating the macroeconomic conditions and risks. Expressing that the goal is to keep inflation at the 5% target over the medium term while supporting economic growth.

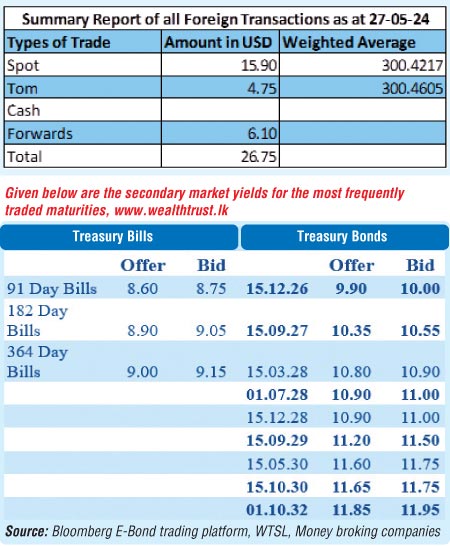

In the morning hours of trading, selling interest on the 15.12.26 and 2028’s (i.e. 15.03.28, 01.07.28 & 15.12.28) maturities saw its yields increase to intraday highs of 10.00%, 10.95% and 11.00% each respectively against its previous day’s closing levels of 9.90/00, 10.55/75, 10.80/90 and 10.85/90. Nevertheless, buying interest at these levels saw yields pull back once again as it dipped to 9.95%, 10.85%, 10.90% and 10.95% respectively. In addition, the other liquid 2026 tenors (i.e. 01.02.26, 15.05.26 and 01.08.26) and the 15.09.27 maturity were seen changing hands at levels of 9.60%, 9.87%, 9.95% and 10.40% to 10.50% respectively. The Treasury bill auction due today will see a total volume of only Rs. 160 billion on offer. This will consist of Rs. 30 billion on the 91-day maturity and Rs. 50 billion on the 182-day maturity and Rs. 80 billion on the 364-day maturity.

At last week’s auction, the weighted average yields declined across all three maturities for a seventh consecutive week, reaching its lowest levels in over two years. Last week’s decline was notably steep, with the 91-day maturity falling by 28 basis points to 8.76%, the 182-day maturity by 26 basis points to 9.17% and the 364-day maturity by 28 basis points to 9.29%. The auction went fully subscribed with the entire offered amount of Rs. 160.00 billion accepted at the 1st phase.

The total secondary market Treasury bond/bill transacted volume for 27 March was

Rs. 6.15 billion.

In money markets, the weighted average rates on overnight call money were 8.65% and 8.72%, respectively.

The net liquidity surplus stood at Rs. 190.68 billion yesterday as an amount of Rs. 1.64 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 192.32 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts continued to weaken as it was seen closing the day up at Rs. 301.70/302.30 against its previous day’s closing level of Rs. 300.50/300.70.

The total USD/LKR traded volume for 27 March was US $ 26.75 million.

References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform,

Money broking companies.