Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 14 March 2023 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd.

The historical Treasury bond auctions conducted yesterday, where a total amount of Rs. 180 billion was on offer comprising of two maturities, saw only the 4-year maturity of 01.05.2027 been fully subscribed at a weighted average of 28.11%. The average was within its pre-auction rate of 27.50/28.1. The 4-year maturity will see a further amount of 20% on offer through its direct issuance window, until close of business of the day prior to settlement (i.e.,4.00 pm on 14.03.2023).

The historical Treasury bond auctions conducted yesterday, where a total amount of Rs. 180 billion was on offer comprising of two maturities, saw only the 4-year maturity of 01.05.2027 been fully subscribed at a weighted average of 28.11%. The average was within its pre-auction rate of 27.50/28.1. The 4-year maturity will see a further amount of 20% on offer through its direct issuance window, until close of business of the day prior to settlement (i.e.,4.00 pm on 14.03.2023).

However, the 1.5-year maturity of 15.11.2024 saw only an amount of Rs. 0.44 billion been taken up successfully against an offered amount of Rs. 70 billion at a weighted average of 29.99%, well below the expected rate and the 2-year pre-auction rate of 31.75/00.

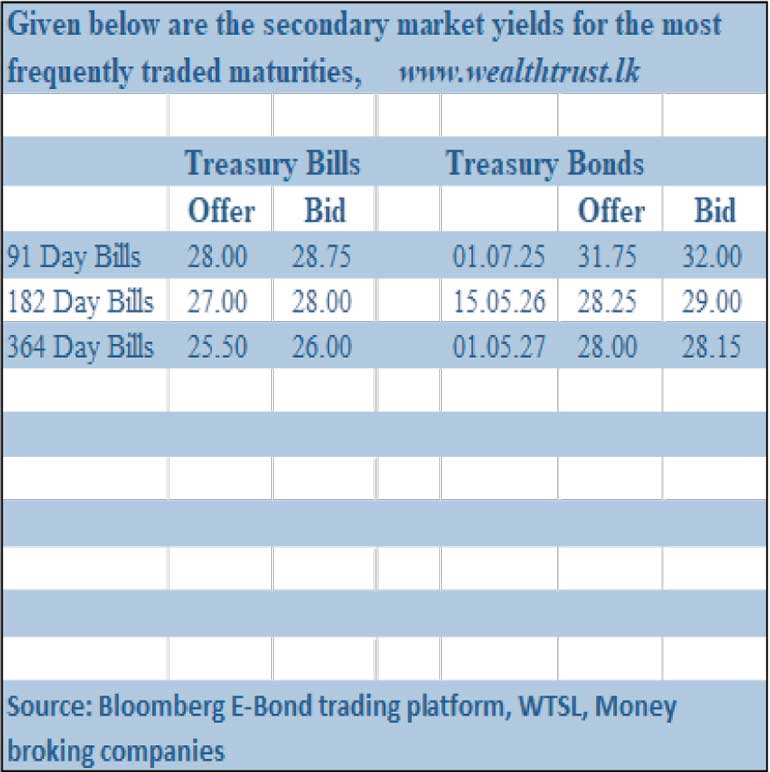

Meanwhile, the activity in the secondary bond market remained rather dull at the start of a new trading week yesterday. Limited trades were seen on the maturities of 01.07.25 and two 2027’s (i.e., 01.05.27 and 15.09.27) at levels of 31.50% to 32.00% and 28.00% to 28.05% respectively.

The total secondary market Treasury bond/bill transacted volume for 10 March 2023 was Rs. 17.66 billion.

In money markets, the weighted average rates on overnight call money and REPO stood at 16.49% and 16.50% respectively while an amount of Rs. 104.88 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 16.50%. The net liquidity deficit stood at Rs. 103.33 billion yesterday as an amount of Rs. 1.56 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 15.50%.

Forex Market

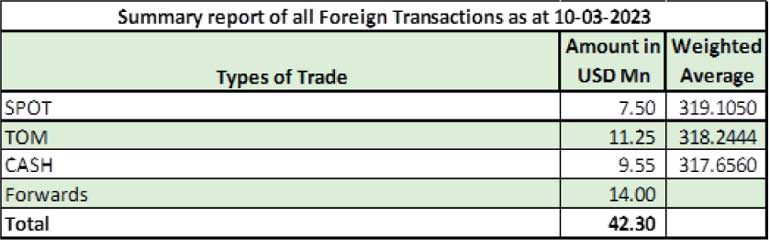

In the Forex market, the USD/LKR or rupee depreciated yesterday as its spot contracts were traded within the range of Rs. 323.00 to Rs. 325.00 yesterday against its previous days Rs. 319.00 to 321.00.

The total USD/LKR traded volume for 10 March was $ 42.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)