Monday Mar 02, 2026

Monday Mar 02, 2026

Thursday, 21 April 2022 03:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

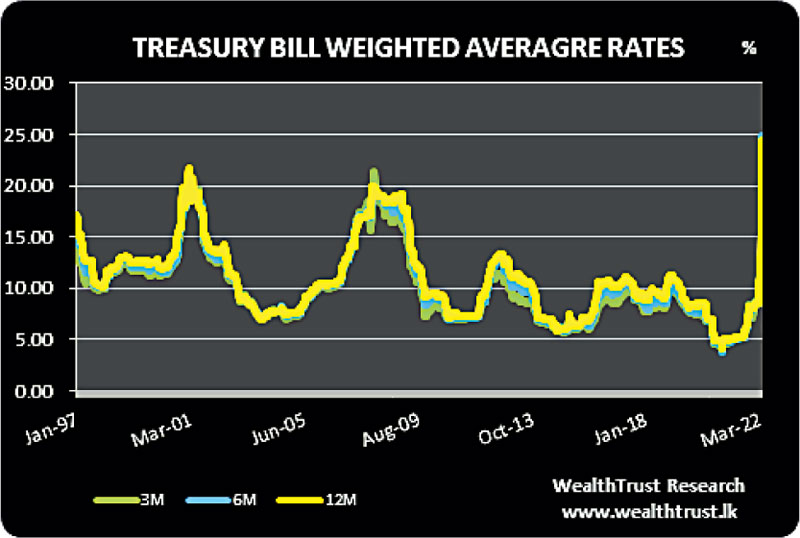

The increasing trend in the weekly Treasury bill weighted average rates continued at its auctions held yesterday, with the 91 day bill increasing above 23.00% for the first time in over 25 years.

The increasing trend in the weekly Treasury bill weighted average rates continued at its auctions held yesterday, with the 91 day bill increasing above 23.00% for the first time in over 25 years.

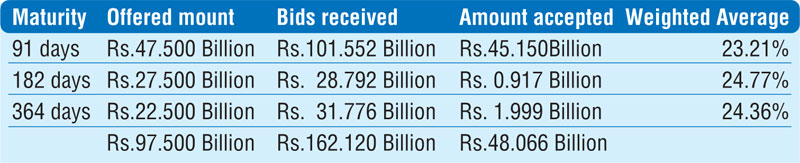

The 91 day bill recorded a considerable increase of 350 basis points to 23.21% closely followed by 182 day and 364 day maturities by 204 and 100 basis points to 24.77% and 24.36% respectively.

The total accepted amount decreased to a 32 week low of 49.30% of its total offered amount as only an amount of Rs. 48.07 billion was successfully taken up against a total offered amount of Rs. 97.50 billion with the 91 day bill representing 93.93% of this volume.

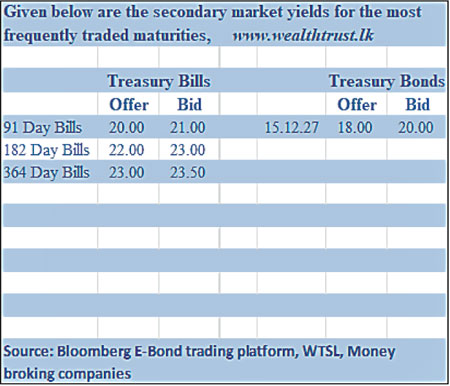

The secondary bond market remained at a standstill yesterday. In secondary bills, April 2023 maturities changed hands at a level of 23.00%, post auction.

The total secondary market Treasury bond/bill transacted volume for 19 April was Rs. 1.52 billion.

In money markets, the net liquidity deficit stood at Rs. 622.27 billion yesterday as an amount of Rs. 124.88 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 747.14 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Call money and Repo stood at 14.50% each.

Forex Market

In forex market, limited trades on the USD/LKR tom and spot contracts were seen at levels of Rs. 335 to Rs. 339 yesterday while overall activity remained moderate.

The total USD/LKR traded volume for 19 April was $ 41.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)