Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 23 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

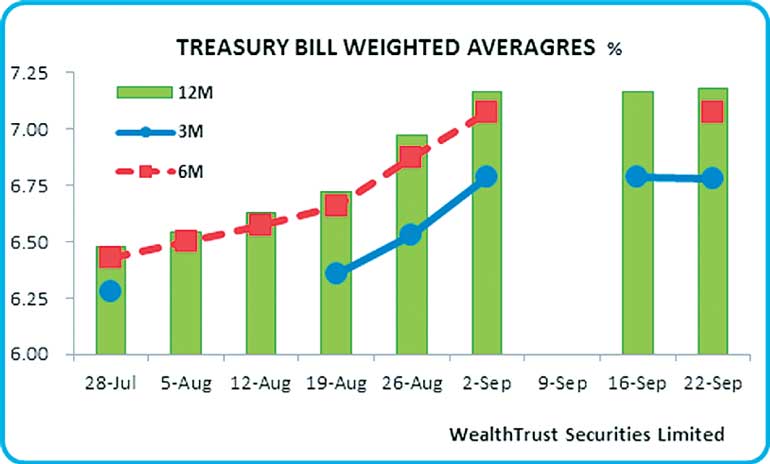

At the weekly Treasury bill auction conducted yesterday, the weighted average (W. Avg) on the 91-day bill dipped for the first time in 17 weeks, reflecting a drop of 01 basis point (bp) to 6.78% while the W. Avg on the 182-day bill remained unchanged.

However, the W. Avg on the 364-day bill increased by 01 bp to 7.18% as the total accepted amount exceeded the total offered for the first time in six weeks as well. Considerable demand for the 91-day bill saw it represent 79.57% of the total accepted amount which was Rs. 6.33 billion above the initial total offered amount of Rs. 22 billion.

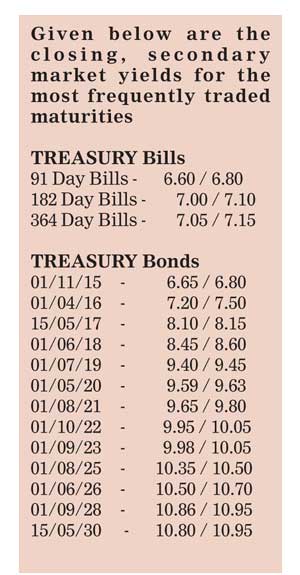

Meanwhile, activity in secondary market bonds increased yesterday reflecting mixed fortunes during the day as yields on the shorter tenure maturities were seen increasing while longer tenure yields were seen closing the day marginally lower in comparison to its previous day’s closing levels. Yields on the maturities of 15.05.17 and 01.07.19 were seen closing the day higher at levels of 8.10/15 and 9.40/45 respectively in comparison to its previous day’s closing levels of 7.90/10 and 9.15/25.

However, yields on the maturities of 01.05.20 and 01.09.23 were seen closing the day marginally lower at levels of 9.59/63 and 9.98/05 respectively subsequent to hitting intraday highs of 9.65% and 10.05%. Meanwhile, in secondary market bills, demand for shorter tenure maturities continued as the March and August 2016 durations were seen closing the day at levels of 7.00/05 and 7.00/15 respectively.

In money markets yesterday, surplus liquidity increased to Rs.78.36 billion as overnight call money and repo rates remained mostly unchanged to average 6.35% and 6.44% respectively.

Downward trend on rupee continues

In forex markets, the rupee was seen dipping further to hit its all-time low level of Rs. 140.98 yesterday against its previous day’s closing of Rs. 140.80/90 on the back of importer demand. The total USD/LKR traded volume for 21 September 2015 was $ 29.25 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 141.55/65; three months - 142.85/00 and six months - 144.50/75.