Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 8 September 2021 00:00 - - {{hitsCtrl.values.hits}}

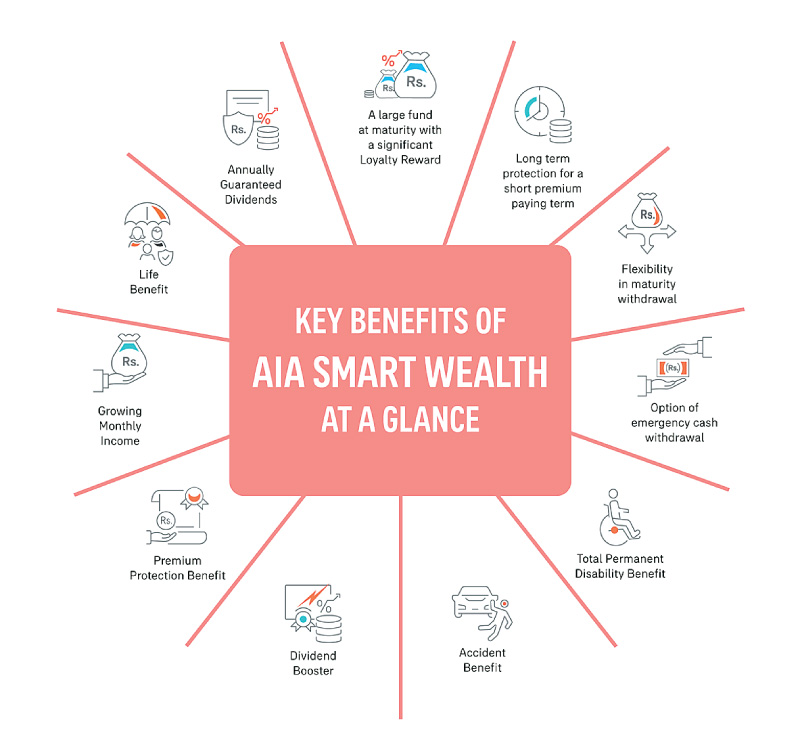

Following in-depth research and with a view to addressing current market conditions, AIA Insurance recently redesigned and launched its flagship savings product, AIA Smart Wealth, enhancing its value and proposition to Sri Lankans. The newly designed, Smart Wealth enables you to create, manage and protect your wealth. It combines the best of savings with life insurance while providing a significant amount of flexibility to customers.

Backed by the professional and prudent investment management capabilities of AIA, Smart Wealth invests in a portfolio of high-quality corporate bonds/fixed income investments and government securities which are invested for the long term. The investment strategy is designed to provide customers a solid return on their long-term savings. AIA Insurance’s track record of providing superior returns (declared dividend for 2020 was 9.18%) is further backed by an annual guarantee which is currently at 8% for 2021.

The redesigned saving solution offers customers the choice of customising the amount of life insurance protection they need. Smart Wealth comes standard with a life insurance cover of 5 times the Annualised Premium, but customers may choose to add more life insurance – up to 50 times the Annualised Premium, along with an Accident Insurance Cover.

In the unfortunate event of death or Total Permanent Disability, AIA will immediately pay the insurance benefits to your loved ones AND will continue to pay your premium on your behalf so that your loved ones will receive the maturity as you intended. This is a unique feature where customers get the benefit of protection and maturity in case the life assured passes away.

Unlike traditional life insurance products, which require long-term premium paying commitments, AIA Smart Wealth suits customers who are saving for the long term (up to 20 years) but only want to make payments for 4 or 6 years. The new product also offers, for the first time, a 15-year policy term version (6 years of premium payments for 15 years of protection), providing greater choice to our customers.

AIA Smart Wealth has a special loyalty reward of up to 450% of the Annualised Basic Premium depending on the Policy Term and Premium Paying Term which is added to the savings fund on the 15th and 20th year for 20-year Policy Terms and at maturity for 10- and 15-year Policy Terms. This Loyalty Reward enhances your savings and allows you to build a solid investment for your needs.

The choice and flexibility continue even after maturity. Not all of us want our funds as a lumpsum, so AIA Smart Wealth, after maturity, allows you to receive your savings as a growing monthly income for a period of 5 to 30 years. This monthly option is ideal for people looking for a retirement solution or to provide a monthly income to a loved one. This monthly income is further increased by AIA’s unique Dividend Booster feature which pays 30% more of the Annual Dividend Rate.

These are just a few of the many benefits offered by this product, not to forget the annually guaranteed dividend payment that AIA customers receive, with a track record of consistently being above the promised amount. AIA Smart Wealth is brought to you by AIA Sri Lanka, a leader in life insurance, providing health, pensions and savings solutions and the Best Life Insurance Company in Sri Lanka for 2019 and 2020 (according to Global Banking and Finance Review). Call 011 2310310 for further details.