Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 6 May 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

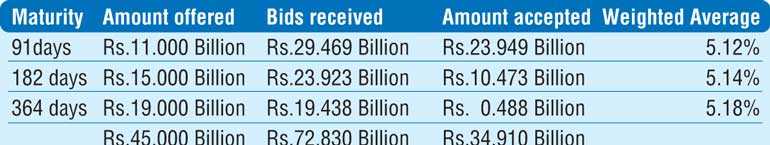

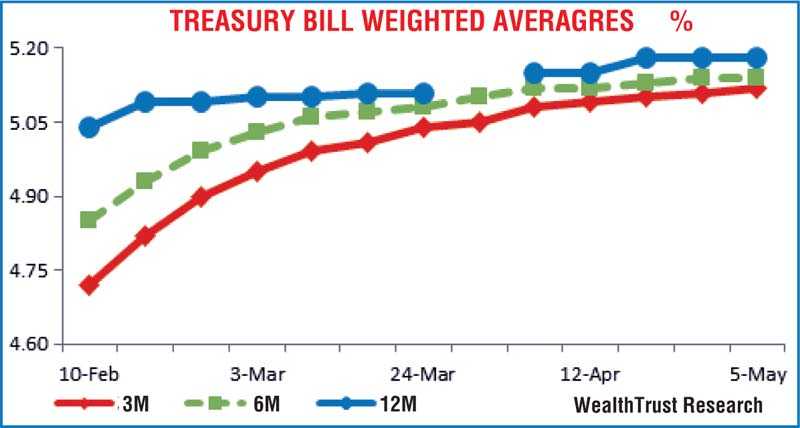

The total accepted amount at the weekly T-bill auction conducted yesterday was seen increasing once again, continuing to be dominated by the 91-day bill, while subscription for the 182-day bill increased as well. The 364-day bill continued to draw a low volume in successful bids. The weighted average rate of the 91-day maturity increased by one basis point to 5.12%, while the weighted average rates of the 182-day and 364-day maturities remained steady at 5.14% and 5.18% respectively. The bids-to-offer ratio increased to 1.62:1.

The total accepted amount at the weekly T-bill auction conducted yesterday was seen increasing once again, continuing to be dominated by the 91-day bill, while subscription for the 182-day bill increased as well. The 364-day bill continued to draw a low volume in successful bids. The weighted average rate of the 91-day maturity increased by one basis point to 5.12%, while the weighted average rates of the 182-day and 364-day maturities remained steady at 5.14% and 5.18% respectively. The bids-to-offer ratio increased to 1.62:1.

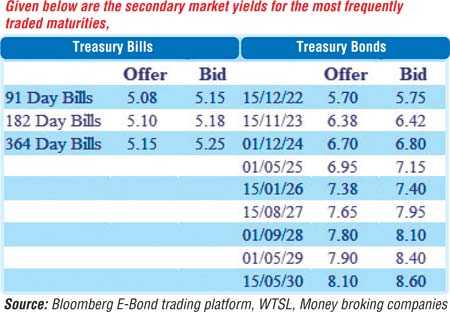

In the meantime, the secondary bond market continued to remain positive yesterday, with yields of the 01.10.22, 15.12.22 and 15.11.23 maturities decreasing further to intraday lows of 5.70%, 5.73% and 6.38% respectively, against its previous day’s closing level of 5.75/80, 5.75/85 and 6.42/48. Furthermore, 2026 maturities (i.e. 15.01.26 and 01.08.26) were also seen changing hands at levels of 7.38% and 7.73% to 7.75% respectively as well.

The total secondary market Treasury bond/bill transacted volume for 4 May was Rs. 5.83 billion.

In the money market, net overnight surplus liquidity was recorded at Rs. 145.93 billion yesterday, while call money and repo averaged 4.66% and 4.69% respectively.

USD/LKR

In Forex markets, the USD/LKR on spot contract was traded at levels of Rs. 199.90 to Rs. 200.99 yesterday while the one-month contract was quoted at Rs. 199.90/209.00.

The total USD/LKR traded volume for 4 May was $ 51.97 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)