Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 12 September 2024 02:54 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury bill auction conducted yesterday, saw 91% of the bids received on the 91-day tenor accepted, as an amount of Rs.105.75 million was raised against bids received amounting to Rs. 115.89 billion. However, the auction overall only managed to raise 91.54% or Rs. 164.77 billion in total out of the Rs. 180.00 billion total offered amount. This marks the first instance that a T-Bill auction has gone undersubscribed since 07 August.

The Treasury bill auction conducted yesterday, saw 91% of the bids received on the 91-day tenor accepted, as an amount of Rs.105.75 million was raised against bids received amounting to Rs. 115.89 billion. However, the auction overall only managed to raise 91.54% or Rs. 164.77 billion in total out of the Rs. 180.00 billion total offered amount. This marks the first instance that a T-Bill auction has gone undersubscribed since 07 August.

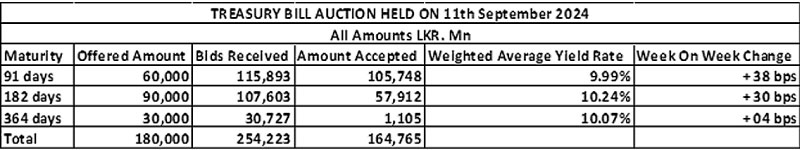

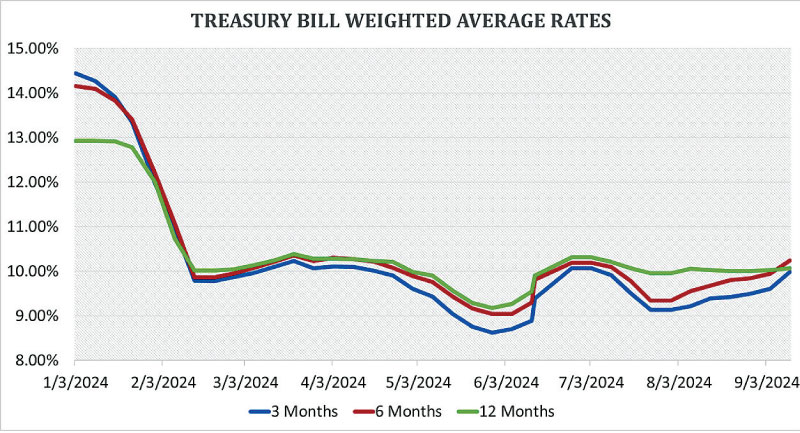

The weighted average (W.A) rates continued on an upward trajectory, with yields on the shorter tenor securities increasing for the sixth straight week. Accordingly, the rate on the 91-day tenor rose steeply by 38 basis points to 9.91% and the 182-day tenor by 30 basis points to 10.24%. The 364-day tenor also saw its weighted average increase by 04 basis points to 10.07%, for the second consecutive week. Notably, the weighted average rate on the 182-day tenor was seen surpassing the 364- day tenor for the first time since early April this year. As such, rates overall (across all three maturities) rose for the second consecutive week.

The 2nd phase of the auction will be opened on the 182-day and 364-day tenors at the weighted average rates until close of business of the day prior to settlement (i.e., 4.00 p.m. on 13.09.2024).

Given below are the details of the auction;

The secondary bond market yesterday saw moderate activity; however, yields experienced a marginal uptick. This was against the backdrop of the uncertainty stemming from the upcoming Presidential Election due in just 10 days and the Rs. 290 b T-bond auction due for today.

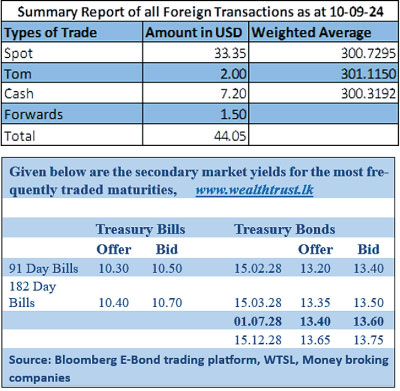

Accordingly, limited trades were observed on selected tenors. The 15.02.28, 15.03.28 and the 15.12.28 maturities saw yields increase from 13.20% to 13.30%, 13.40% and 13.50% to 13.75% respectively.

Today, the CBSL is scheduled to conduct a Rs. 290.00 billion round of Treasury bond auctions scheduled (12 September 2024). The auction will comprise of Rs. 100.00 billion from a 15 February 2028 maturity bearing a coupon of 10.75%, Rs. 150.00 billion from 15 June 2029 maturing bond bearing a coupon of 11.75% and Rs. 40.00 billion from 15September 2034 maturity bearing a coupon of 10.25%.

For context, at the last Treasury bond auctions conducted on 13 August the 15.06.2029 bond was issued at a weighted average yield of 12.98% and the 01.10.2032 bond was issued at a weighted average yield of 13.25%. In conclusion, the previous round of auctions successfully raised the total Rs 60 billion on offer in its entirety, with the total bids received to the total offered amount ratio standing at 1.72:1.

The total secondary market Treasury bond/bill transacted volume for 10 September was Rs. 5.82 billion.

In money markets, the weighted average rates on overnight call money and were 8.57% and 8.65%, respectively.

The net liquidity surplus stood at Rs. 94.66 billion yesterday as an amount of Rs. 105.82 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25%. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 11.16 billion at the weighted average rate of 8.51%.

Forex Market

In the Forex market, the USD/LKR on spot contracts closed the day depreciating marginally to Rs. 301.00/301.30 against its previous day’s closing level of Rs. 300.60/300.75.

The total USD/LKR traded volume for 10 September was $ 44.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)