Sunday Mar 08, 2026

Sunday Mar 08, 2026

Monday, 21 December 2020 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bill and bond market slowed down during the week ending 18 December with market participants continuing to be on the side lines.

Activity in the secondary bill and bond market slowed down during the week ending 18 December with market participants continuing to be on the side lines.

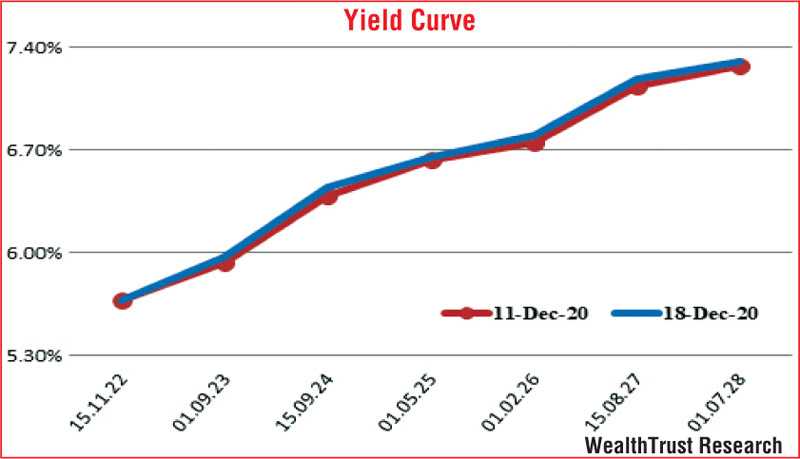

Limited activity was witnessed consisting of the 15.12.22, 01.09.23, 01.12.24, 15.10.27, 01.07.28 and 15.05.30 maturities at levels of 5.70% to 5.75%, 5.98%, 6.45%, 7.20% to 7.22%, 7.26% to 7.28% and 7.78% to 7.80% respectively, in comparison to the previous weeks closing levels of 5.67/75, 5.90/95, 6.37/44, 7.10/20, 7.25/28 and 7.55/75.

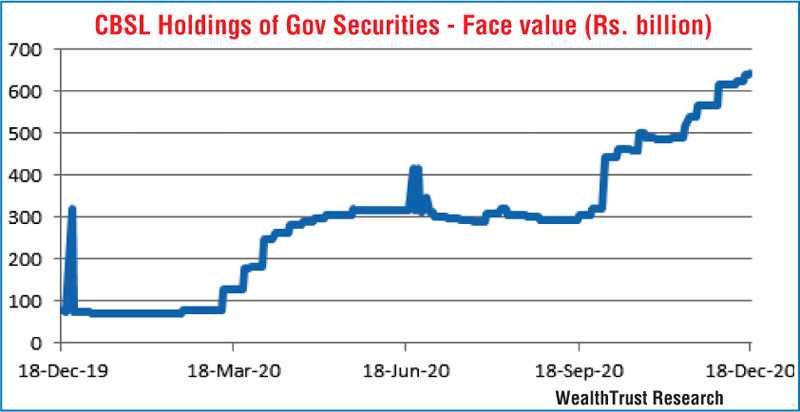

Furthermore, the 15.03.23, 2024s (i.e. 01.01.24, 15.03.24 and 01.08.24) and 01.08.26 traded at levels of 5.75% to 5.80%, 6.15%, 6.47%, 6.45% to 6.50% and 7.00% respectively. Bills maturing in March, June, July and October and the shorter bond maturities of August and December 2021 also traded at levels of 4.65% to 4.70%, 4.76%, 4.74% to 4.80%, 4.86% to 4.94% and 4.79% to 4.85% and 5% respectively. Meanwhile, at the weekly bill auction, the accepted amount fell short of the total offered amount, once again. However, the weighted average rates of the 91, 182 and 364 day maturities were in line with the stipulated cut off rates of 4.67%, 4.78% and 5.01%, while the foreign holding in Rupee bonds decreased further, recording an outflow of Rs. 0.75 billion for the week ending 16 December.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 8.35 billion.

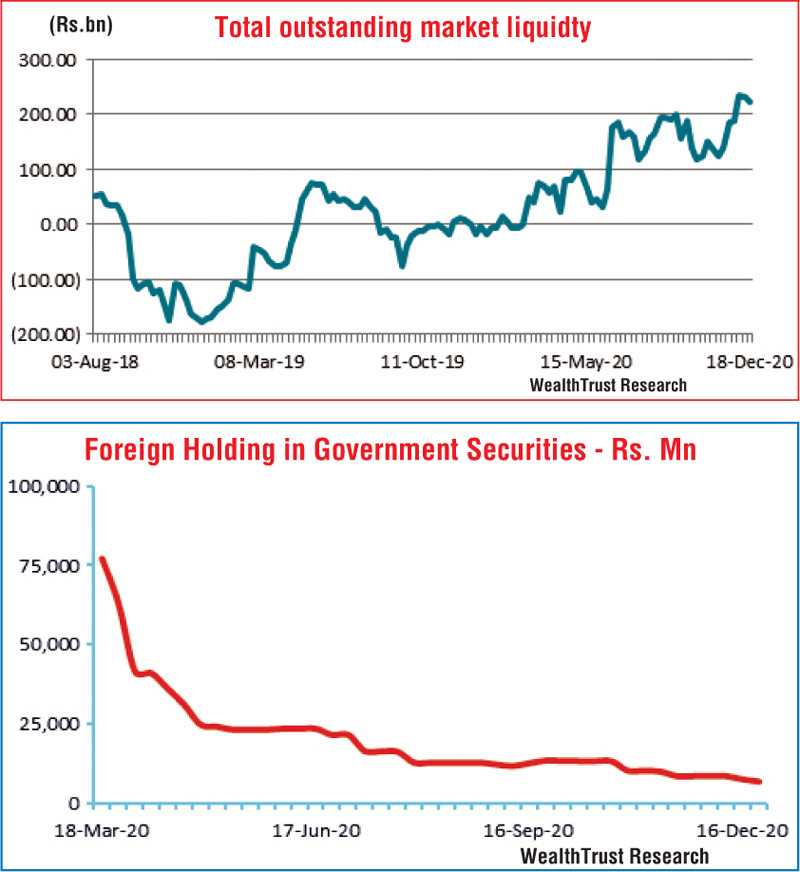

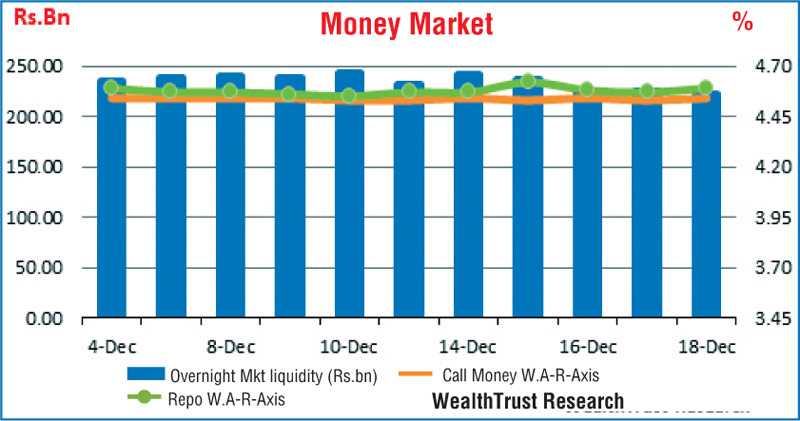

In the money market, the total outstanding market liquidity stood at a surplus of Rs. 222.78 billion when compared against the previous week’s amount of Rs. 232.77 billion. The weighted average rates on overnight call money and repos remained mostly unchanged at 4.54% and 4.59% respectively while the CBSL’s holding of Gov. Security’s increased to Rs. 644.67 billion.

Rupee depreciates further

In Forex markets, in the absence of spot contracts been quoted, spot next contracts were seen depreciating further to close the week at Rs. 188.10/30 in comparison to its previous weeks closing levels of Rs.186.70/20.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 56.15 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)