Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 19 June 2018 00:00 - - {{hitsCtrl.values.hits}}

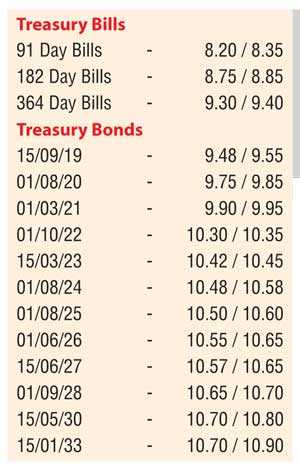

Activity in the secondary bond market moderated yesterday with limited trades seen on the 01.07.19, 15.12.21, 01.07.22, 15.03.23 and 15.06.27 maturities at levels of 9.43%, 10.05%, 10.20%, 10.42% and 10.62% respectively.

Activity in the secondary bond market moderated yesterday with limited trades seen on the 01.07.19, 15.12.21, 01.07.22, 15.03.23 and 15.06.27 maturities at levels of 9.43%, 10.05%, 10.20%, 10.42% and 10.62% respectively.

In money markets, the OMO Department of the Central Bank of Sri Lanka infused an amount of Rs.15.00 billion at a weighted average yield of 8.50%, by way of an overnight reverse repo auction as the net deficit in the system increased to Rs.18.57 billion yesterday. The overnight call money and repo rates averaged 8.41% and 8.44% respectively.

Rupee losses further

The USD/LKR rate on spot contracts depreciated yesterday, to close the day at Rs.159.90/95 against the previous day’s closing levels of Rs.159.60/70 on the back of renewed importer dollar demand. The total USD/LKR traded volume for 14 June was $ 65.50 million. Given are some forward USD/LKR rates that prevailed in the market: one month – 160.70/85; three months – 162.25/50; six months – 164.50/70.