Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 15 May 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

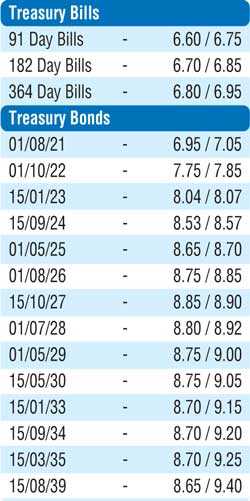

Activity in the secondary bond market moderated yesterday with limited volumes of the 2023s (i.e. 15.01.23, 15.03.23 & 15.05.23) and 2024s (i.e. 15.03.24 & 15.09.24) changing hands at levels of 8.05%, 8.09%, 8.14%, 8.50% and 8.55% respectively. In the secondary bill market June 2020 and May 2021  bills were traded at levels of 6.55% and 6.90% respectively.

bills were traded at levels of 6.55% and 6.90% respectively.

The total secondary market Treasury bond/bill transacted volume for 13 May was Rs. 24.21 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 5.91% and 6.01% respectively as the overnight net liquidity surplus in the system stood at Rs. 126.36 billion yesterday. The DOD (Domestic Operations Department) of Central Bank injected an amount of Rs. 4 billion by way of a 7 day reverse repo auction at a weighted average rate of 6.08%, subsequent to offering Rs. 15 billion. It further injected an amount of Rs. 5.00 billion for Standalone Primary Dealers by way of a 7 day reverse repo auction at a weighted average rate of 6.41%.

Rupee appreciates marginally

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 187.95 to Rs. 188.35 yesterday before closing the day at levels of Rs. 187.85/15 against its previous day’s closing levels of Rs. 188.00/30.

The total USD/LKR traded volume for 13 April was $ 35.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)