Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 21 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The continued increase in the weekly Treasury bill weighted averages, money market liquidity turning negative towards the latter part of the week coupled with the increase in the foreign outflow from rupee bonds for a third consecutive week reflected bearishly on the trading activities in the secondary bond market during the week ending 18 May 2018.

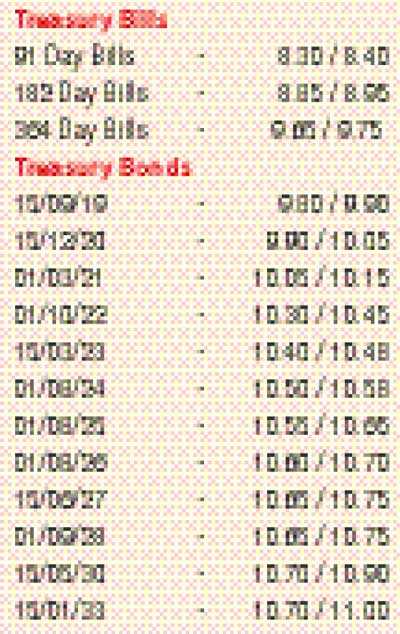

The limited activity during the week centered on the maturities of 01.03.21, the two 2023’s (i.e. 15.03.23 and 15.05.23), 01.08.24 and 01.09.28 within the ranges of 10.04% to 10.18%, 10.35% to 10.50%, 10.50% to 10.55% and 10.65% to 10.70% respectively and closed the week broadly steady against its previous week’s closings.

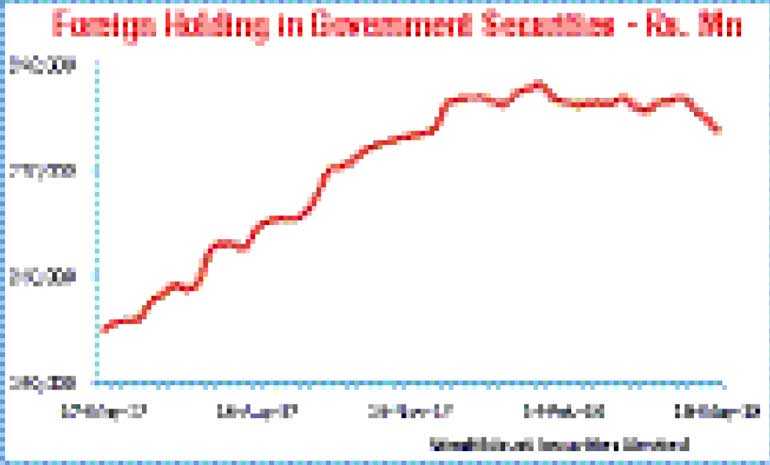

The foreign outflow from rupee bonds increased to Rs. 5.97 billion during the week ending 16 May 2018, recording an amalgamated outflow of Rs. 15.49 billion over the past three weeks.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 7.06 billion.

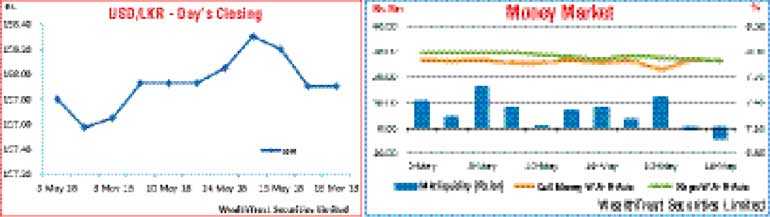

In money markets, liquidity was seen turning negative from Thursday, 17 May, reversing its surplus position witnessed since 16 April 2018. An average net surplus of Rs. 7.58 billion was witnessed during the first three days of the week and an average net short of Rs 2.18 billion was witnessed over the last two days of the week. However, call money and Repo remained broadly steady to average 7.87% and 7.92% respectively.

Rupee closes the week steady

The USD/LKR rate on spot contracts was seen closing the week steady at Rs. 157.80/00 against its previous weeks closing subsequent to dipping to an intraday week low of around Rs. 158.65.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 54.24 million.

Some of the forward dollar rates that prevailed in the market were one month - 158.60/90; three months - 160.20/50 and six months - 162.50/80.