Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 26 December 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bond market slowed down during the week ending 22 December, as a result of the upcoming monetary policy decision and Treasury bond auctions.

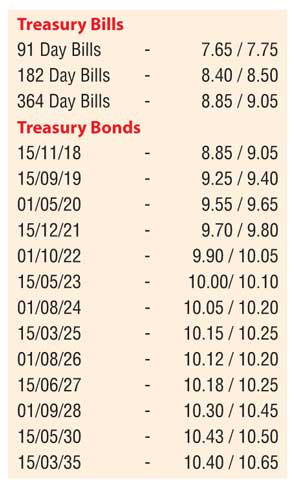

The last monetary policy announcement for 2017 is due on 28 December, with the final Primary bond auction too scheduled for the same day. A total amount of Rs. 30 billion will be on offer consisting of Rs. 8 billion of a 2.11 bond maturing on 15.12.2020 and Rs. 22 billion of a 8.05 year bond maturing on 1.6.2026.

In the secondary bond market, selling interest generated mainly by local investors resulted in the liquid maturities of 1.3.21, 1.5.21 and 15.6.27 increasing to weekly highs of 9.75%, 9.77% and 10.25% respectively, during the early part of the week amidst of moderate volumes. However, yields were seen decreasing once again on limited trades, to hit lows of 9.68%, 9.70% and 10.20% respectively. This was subsequent to the weekly Treasury bill auction, where the weighted average yields decreased for a fifth consecutive week. In the secondary bill market, the April, July, September and November 2018 maturities were traded at highs of 8.13%, 8.70%, 8.85% and 9.00% respectively, during the latter part of the week.

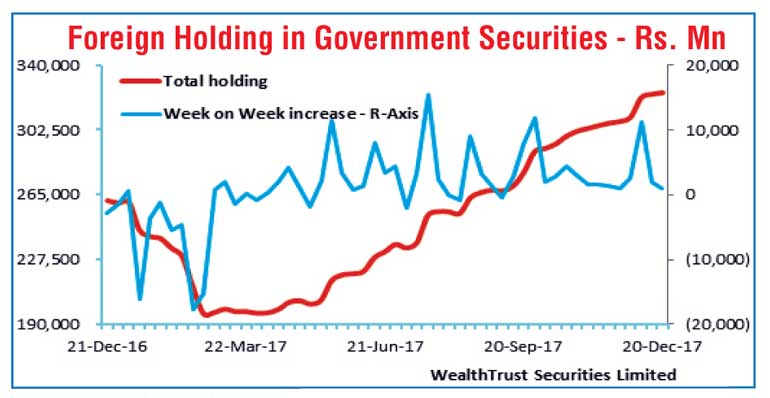

The foreign holding in rupee bonds increased further with an inflow of Rs. 0.93 billion for the week ending 20 December 2017.

The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 2.64 billion.

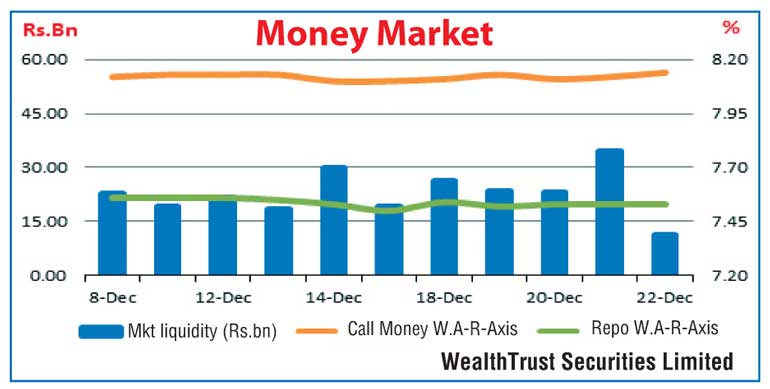

In money markets, the overnight call money and repo rates remained mostly unchanged during the week to average 8.12% and 7.53% respectively as the average net surplus liquidity in the system stood at Rs. 23.86 billion. The Open Market Operations (OMO) Department drained out liquidity throughout the week on an overnight basis at a weighted average of 7.25%.

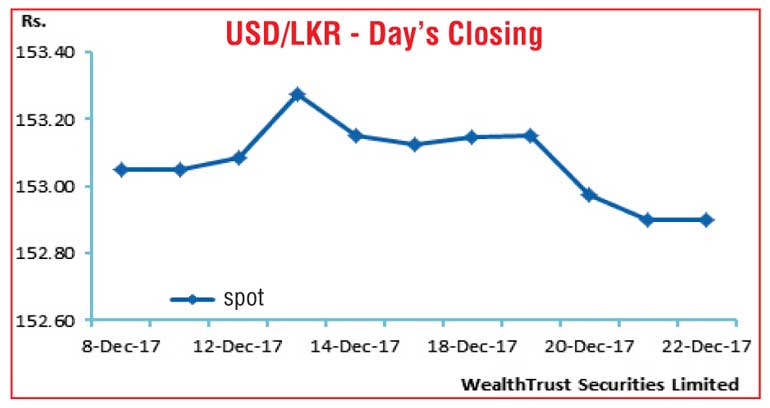

Rupee appreciates during the week

Exporter dollar conversion coupled with seasonal inward remittances saw the USD/LKR rate appreciate to Rs. 152.85/95 during the week on spot contracts when compared against the previous week’s closing levels of Rs. 153.10/20.

The daily USD/LKR average traded volume for the three days of the week stood at $ 64.24 million.

Some of the forward dollar rates that prevailed in the market were one month - 154.00/10; three months - 155.80/90 and six months - 158.35/50.