Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 27 October 2021 00:00 - - {{hitsCtrl.values.hits}}

The activity in the secondary bond market remained moderated yesterday with only the 15.01.27 maturity changing hands once again at levels of 11.38% to 11.40%.

The activity in the secondary bond market remained moderated yesterday with only the 15.01.27 maturity changing hands once again at levels of 11.38% to 11.40%.

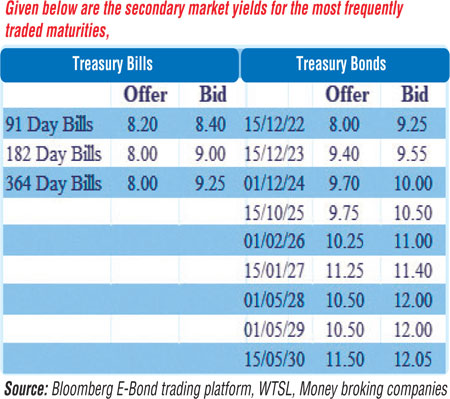

This is ahead of today’s bill auction, where in total an amount of Rs. 56.5 billion will be on offer, consisting of Rs. 15 billion on the 91-day, Rs. 17.5 billion on the 182-day and Rs. 24 billion on the 364-day maturities. At last week’s auction, weighted average rates on all three maturities increased to 8.39%, 8.16% and 8.17% respectively.

The total secondary market Treasury bond/bill transacted volume for 25 October was Rs. 0.32 billion.

In money markets, the weighted average rates on overnight call money and repo remained steady at 5.90% and 5.93% respectively, while the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out amounts of Rs.14.49 billion and Rs. 8 billion by way of overnight and seven-day repo auctions respectively at weighted average rates of 5.99% each. The net liquidity deficit increased to Rs. 156.18 billion yesterday as an amount of Rs. 84.07 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 5% against an amount of Rs. 262.73 billion withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6%.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at level of Rs. 202.99 to Rs. 203 yesterday.

The total USD/LKR traded volume for 25 October was $ 17.25 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)