Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 3 August 2021 02:50 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

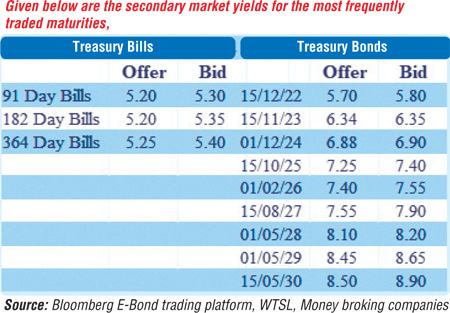

The start of a new trading week saw activity in the secondary bond market shift back to the 2023 maturities yesterday as the liquid maturity of 15.11.23 hit an intraday low of 6.35% against its previous day’s closing level of 6.35/40, while 15.01.23, 15.03.23, 15.07.23 and 01.09.23 maturities changed hands at level of 5.75%, 5.95%, 6.05% to 6.10% and 6.17% to 6.20% respectively as well. In addition, the 15.12.24 maturity traded at a level of 6.90%.

The start of a new trading week saw activity in the secondary bond market shift back to the 2023 maturities yesterday as the liquid maturity of 15.11.23 hit an intraday low of 6.35% against its previous day’s closing level of 6.35/40, while 15.01.23, 15.03.23, 15.07.23 and 01.09.23 maturities changed hands at level of 5.75%, 5.95%, 6.05% to 6.10% and 6.17% to 6.20% respectively as well. In addition, the 15.12.24 maturity traded at a level of 6.90%.

Amounts of Rs. 3 billion and Rs. 0.5 billion were issued through the Direct Issuance Window on the 01.12.24 and 15.03.31 maturities respectively at their weighted averages.

The total secondary market Treasury bond/bill transacted volume for 30 July was Rs. 2.40 billion.

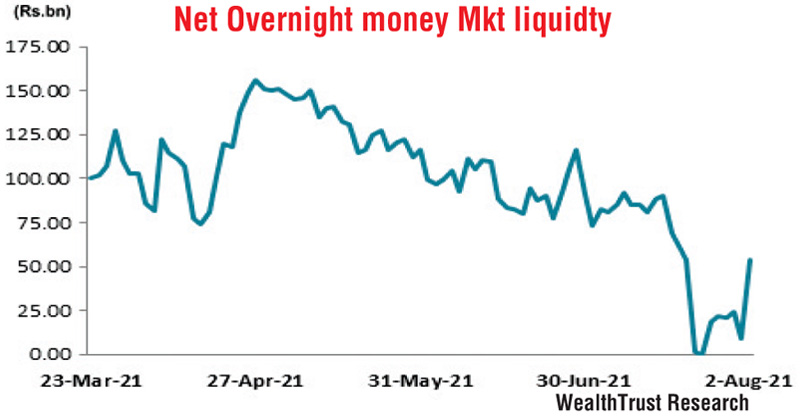

In money markets, the overnight net liquidity surplus was seen increasing yesterday to a nine-day high of Rs. 53.62 billion as an amount of Rs. 144.98 billion was deposited at Central Banks SLDR of 4.50% against an amount of Rs. 91.35 billion withdrawn from Central Banks SLFR of 5.50%. The weighted average rates on overnight call money and repo was registered at 5.10% and 5.16% respectively. The CBSL’s holding of Gov. Securities increased to Rs. 1,194.95 billion against its previous days of Rs. 1,141.05 billion.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 30 July was $ 30.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)