Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 15 October 2024 02:36 - - {{hitsCtrl.values.hits}}

Acuity Partners forecasts potential upside to listed commercial banks from the restructuring of International Sovereign Bonds (ISBs).

This assessment is contained in a special report developed by Acuity.

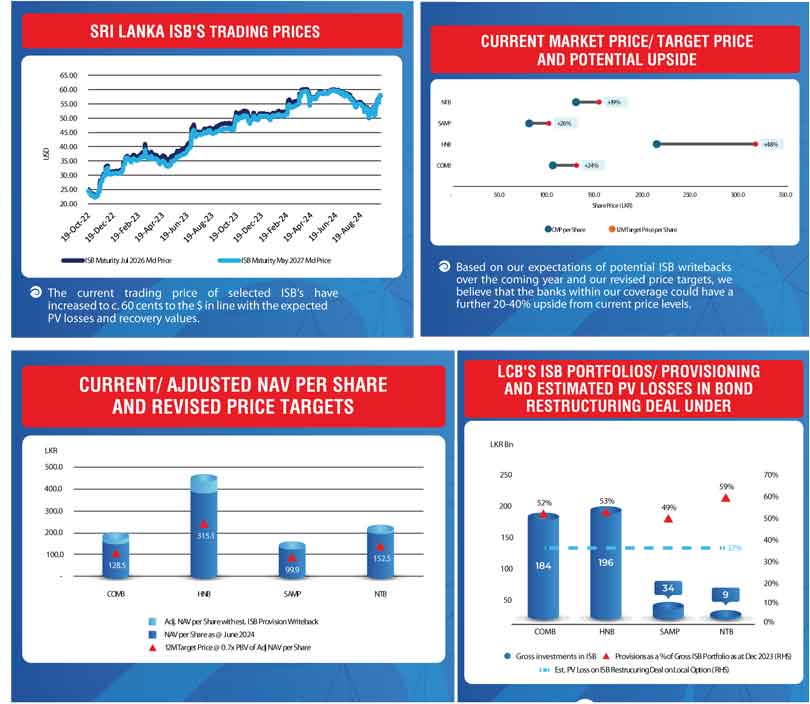

“Based on our expectations of potential ISB writebacks over the coming year and our revised price targets, we believe that the banks within our coverage could have a further 20-40% upside from current price levels,” Acuity said.

The report analyses Commercial Bank PLC, Hatton National Bank PLC, Sampath Bank PLC and Nations Trust Bank PLC.

The Government of Sri Lanka (GOSL) has announced that the agreement in principle reached with international and local holders of International Sovereign Bonds (ISBs) has met with the approval of the IMF and the official creditors in terms of both debt sustainability/program parameters of the IMF EFF and comparability of treatment for restructuring of the external debt.

The GOSL has accordingly confirmed their endorsement of the agreement in principle and expressed intention to conclude the bond exchange as envisaged in the agreement in principle announced on the 19 September, with an international bank likely to be appointed shortly to manage the transaction. The timeframe to conclude the transaction is expected to be around two to three months.

“Whilst shares of listed commercial banks have rallied since the news, we believe there is still more upside to the banks in our coverage based on potential writebacks of provisions on ISB’s and slightly higher rerating of valuation multiples closer to historical averages,” Acuity said.

It also said listed banks in its coverage have indicated provisions of >50% on their ISB holdings. “We expect that if the local banks opt primarily for the “local option” in the envisaged bond exchange as outlined in the agreement in principle, the present value loss arising from the ISB restructuring would be c. 37%.

Even if LCB’s opt for part of the bond exchange under the alternative option, whilst the initial PV loss may be higher at c. 40%, it’s likely that the actual PV loss would be lower over time on the macro linked bonds as Sri Lanka is likely to outperform the IMF’s baseline GDP estimates in 2024 through 2027 which would trigger step up payments on the initial haircuts and coupons.

“Therefore, we believe that provision writebacks of 12-15% over a period of time would be possible for most banks on the value of their ISB holdings,” Acuity said.

It noted the current trading price of selected ISB’s have increased to c. 60 cents to the $ in line with the expected PV losses and recovery values.

Whilst all banks in Acuity’s universe will see some potential writeback of provisions, HNB and COMB are the largest beneficiaries on account of their significantly larger ISB holdings. The estimated writebacks for HNB and COMB may equate to an increase in NAV per share of c. Rs. 50 and c. Rs. 20 respectively for the two banks.

“Based on the potential increase in NAV from the ISB writebacks and our expectations that PBV multiples could expand to c. 0.7x in-line with historical levels, we believe that there is still further upside for the banks in our coverage over the next 12 months. Beyond the impact from the ISB restructuring, further upside will be provided by continued strong growth in retained earnings over the next year, supported by the economic recovery and pickup in private sector credit,” Acuity said.

It pointed out that the main risk factors for the banking sector in the short to medium term include the suspension of parate execution, which could hinder debt recovery/credit growth and any deviation from fiscal consolidation, which would keep market interest rates at elevated levels.